As a seasoned crypto investor with a knack for deciphering market trends and a portfolio that has weathered multiple bull and bear cycles, I find myself cautiously optimistic about Cardano (ADA) at this juncture. The recent sharp drop of over 18% in the ADA price amidst the broader market crash is concerning, but it’s not uncharted territory for us crypto veterans.

On the weekly chart, the price of Cardano (ADA) stands at $0.87 with a 24-hour volatility of 1.7%. Despite this relatively stable price action, the coin has experienced a significant drop of over 18% due to the recent broader crypto market downturn. Additionally, on-chain indicators suggest potential worry as overall network activity has been decreasing.

After reaching $1.30 during early December and then moving sideways with significant corrections, the current price of Cardano’s ADA token stands at $0.88 due to heavy sell-offs. Although some Cardano holders may anticipate a potential recovery, analysis from the In/Out of Money Around Price (IOMAP) indicator indicates potential obstacles ahead.

According to IntoTheBlock’s data, there appears to be substantial resistance for Cardano (ADA) at around $0.92. This level is notable because approximately 58,470 Cardano holders collectively possess nearly 951.02 million tokens here, which exceeds the number of tokens in profit within the range of $0.74 to $0.88. Consequently, if buying pressure remains subdued, it may be challenging for the price of Cardano to make a notable upward move.

Source: IntoTheBlock

Cardano Network Activity Sees a Drop

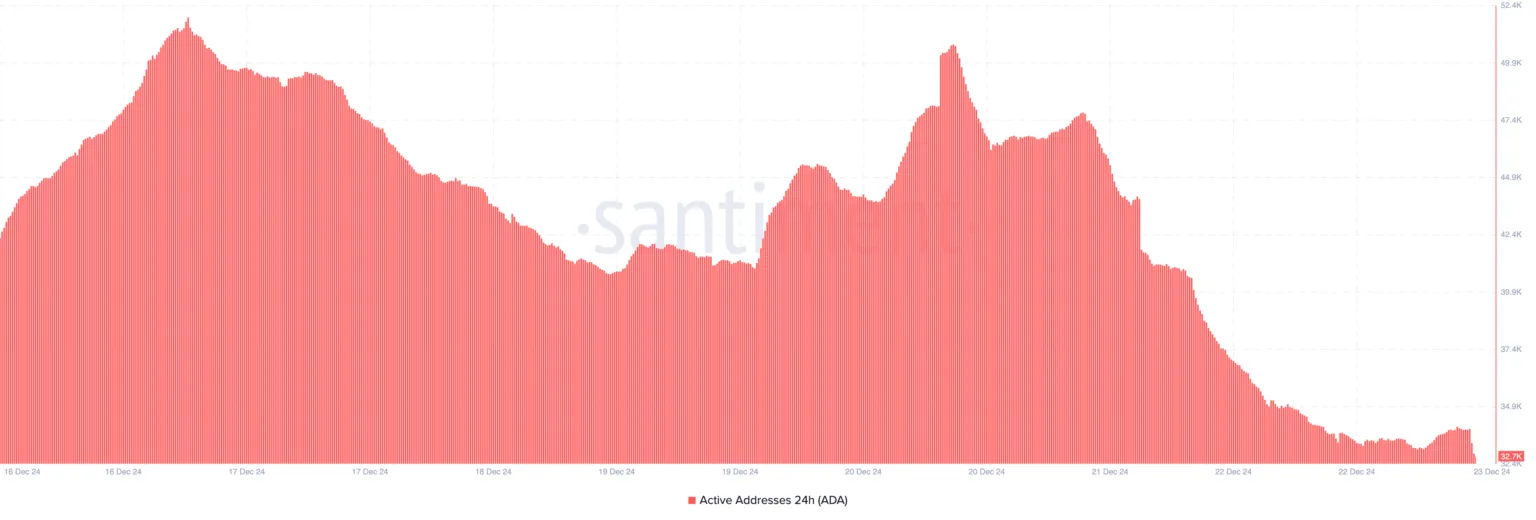

According to Santiment, a company that analyzes blockchain data, the activity on the Cardano network has decreased, indicating a potential negative outlook for ADA. On December 16th, the number of active addresses surpassed 51,000, but it has since declined to around 32,700.

In simpler terms, active addresses refer to wallets involved in transactions that were completed successfully, either by sending or receiving, within a certain time period. A rise in active addresses usually indicates growing user interaction, which tends to coincide with positive price trends. However, the current decrease suggests less involvement, supporting the bearish sentiment towards Cardano (ADA).

Source: Santiment

As an analyst, I’ve noticed that my daily analysis of ADA shows its price has dipped beneath the 20-day Exponential Moving Average (EMA). This dip suggests a potential bearish trend for the token. Moreover, it seems to be lingering close to the 50-day EMA, which indicates a vital support level that could influence its future trajectory.

This arrangement implies that the value of Cardano could potentially fall below its current support at $0.88. If this support gives way, the price might drop even more to around $0.77. In a pessimistic outlook for bears, the cryptocurrency may plummet as far down as $0.55. On the other hand, if Cardano recovers from its current position at $0.88, it could trigger a subsequent price increase.

Source: TradingView

A Bullish Take on ADA

crypto analyst Ali Martinez has pointed out noticeable parallels between Cardano’s (ADA) current price trend and its past market pattern. As per Martinez, the present downturn seems to resemble a crucial incident from 2020, when ADA underwent its initial substantial dip following an extended bull run.

Source: Ali Charts

The analyst pointed out that the price movement of Cardano’s $ADA token is mirroring its past pattern, as the initial significant downturn following the bullish trend in 2020 occurred around the same time as the current correction we are witnessing.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

2024-12-23 17:57