As an analyst with extensive experience in the digital asset market, I find Matt Hougan’s analysis thought-provoking and insightful. His approach of breaking down the potential valuation of Bitcoin into two distinct factors—Bitcoin’s maturation as a store-of-value asset and global economic factors increasing demand for such assets—is both concise and compelling.

Matt Hougan, the Chief Investment Officer of Bitwise Asset Management, clarified a common question among investors: Is it necessary for the U.S. dollar to depreciate significantly for Bitcoin to reach a value of $200,000 per coin? According to Hougan’s analysis, Bitcoin reaching this price point doesn’t necessarily hinge on the weakening of the US dollar but instead relies on Bitcoin’s maturity as a valuable asset for long-term storage and growing global economic factors driving demand for such assets.

Bitcoin Can Reach $200,000 Without US Dollar Collapse

On the social media site X, Hougan shared a sequence of posts detailing a discussion with a financial consultant who raised a query during dinner. “Is it necessary for the US dollar to fail in order for Bitcoin to reach $200,000?” the consultant asked. Hougan responded, “Not necessarily.” Here’s the explanation behind this statement:

Hougan outlined that investing in Bitcoin essentially entails taking two separate wagers. Primarily, “Bitcoin will become a significant ‘store of value’ asset.” At present, Bitcoin’s market value is roughly 7% of gold’s $18 trillion total market valuation. He pointed out that if Bitcoin grows and becomes half the size of gold, each Bitcoin would be worth around $400,000.

“Subsequently, there’s a strong possibility that governments will mismanage fiat currencies, leading to an increased desire for ‘value-holding’ assets. If the market for these value-holding assets expands threefold due to such mismanagement, and Bitcoin continues to hold approximately 7% of the market share, each Bitcoin could be valued at over $200,000.

As a crypto investor, I wholeheartedly agree that these two factors – the maturity of Bitcoin and the potential doubling of the store of value market – are separate yet interrelated aspects. If Bitcoin indeed grows to its full potential as a store of value and the overall market for such assets expands, it’s not unreasonable to anticipate reaching seven-figure valuations. Personally, I find this scenario the most plausible in the long run.

Responding directly to the question, Hougan stated, “Actually, it’s not mandatory for the dollar to crash in order for Bitcoin to reach $200,000. All that’s needed is for Bitcoin to carry on its current trajectory of maturing into an institutional asset.” He further mentioned that both scenarios—the maturation of Bitcoin and potential misuse of fiat currency—are becoming more probable concurrently. “This is why Bitcoin is approaching new record highs,” he concluded.

The discussion continued with input from Kevin Brent Cook, a user on X, who added nuance to Hougan’s explanation. “Concise, clear, and simple,” Cook remarked. “I would only add that the reason a ‘collapse’ isn’t necessary is that under ‘abusing fiat’ comes the steady grind of deficit-driven dollar inflation (the US writes endless checks that never bounce), which naturally creates more currency chasing all assets.”

Hougan concurred with Cook’s assessment, responding with a succinct “Agreed.”

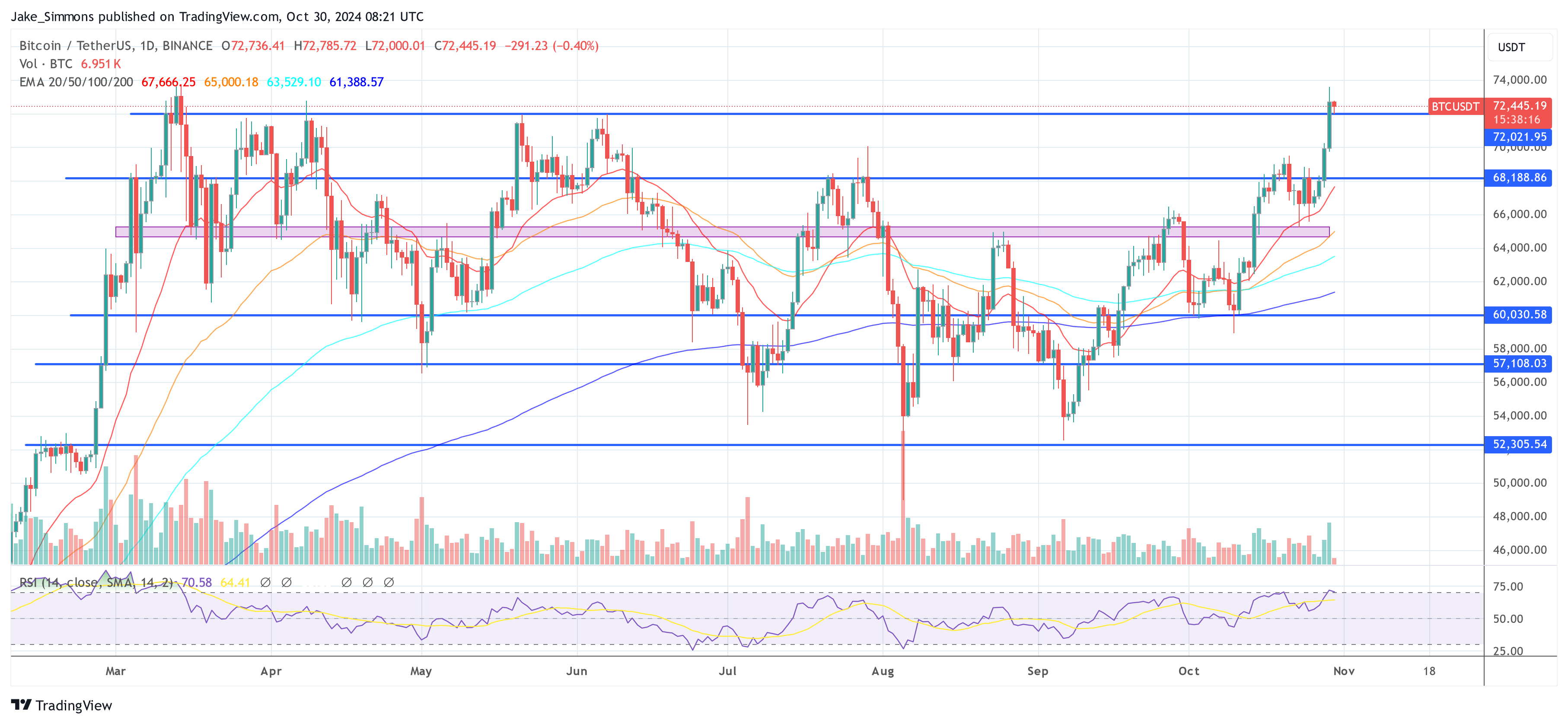

At press time, BTC traded at $72,445, up 23% in the last 20 days.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-10-30 20:10