As a researcher with a background in cryptocurrency and exchange markets, I find Bybit’s meteoric rise to the second-largest crypto exchange by trading volume quite intriguing. The strategic targeting of former FTX users and the unique margin trading service have significantly contributed to their growth. The ongoing recovery of the crypto market and the regulatory landscape have also played a role in their success.

Based in Dubai, Bybit is now the second-largest cryptocurrency exchange globally in terms of trading volume. This significant expansion occurred following the downfall of the fraudulent FTX exchange, as reported by Bloomberg. The remarkable surge indicates not only the resilience of the crypto market but also the evolving regulatory environment.

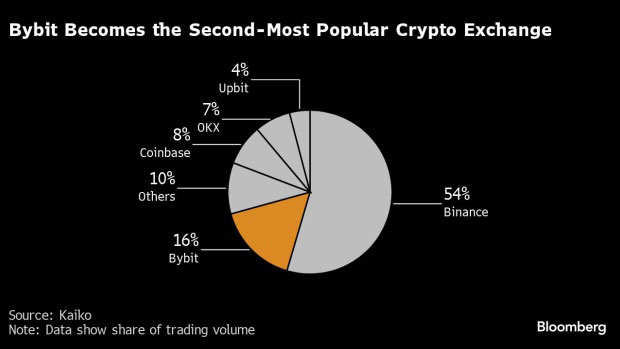

Photo: Kaiko

After strategically courting users who previously relied on FTX, as well as expanding its user base in Europe and Russia, Bybit seized an opportunity following FTX’s collapse. Bybit’s co-founder and CEO Ben Zhou expressed this by referencing the unexpected downfall of Sam Bankman-Fried’s formerly powerful exchange.

The distinctive margin trading feature at this exchange, enabling over 160 tokens as collateral, has significantly fueled its expansion. As Zhou emphasized, “this was unmatched by others.” Since October, Bybit’s market share has more than doubled to reach 16%, surpassing Coinbase in March based on Kaiko data. Currently, Bybit ranks second to Binance for both spot and derivatives transactions.

Bybit’s Fortunes Rebound

The recent thriving performance of Bybit is indicative of the broader revival in the cryptocurrency market. Over the past year, Bitcoin‘s price has more than doubled, fueled by the launch of US-backed exchange-traded funds (ETFs) for Bitcoin. This resurgence signifies a substantial bounce back from the 2022 bear market and the ensuing controversies, such as the FTX collapse.

As a researcher examining the crypto exchange landscape, I’ve observed that some platforms have capitalized on the market upturn by introducing groundbreaking features. For instance, these exchanges offer cross-margin trading accounts which enable users to utilize unrealized gains as collateral for fresh positions. This option caters to traders seeking a competitive edge in the reviving market.

Europe continues to be Bybit’s most significant market, making up approximately 30-35% of its total trading volume. The Commonwealth of Independent States (CIS), with a focus on Russia, accounts for roughly 20%. Nevertheless, Bybit encounters hurdles in Russia due to the close scrutiny of cryptocurrency usage and the potential risks of sanctions violations arising from the ongoing Ukraine conflict.

Bybit meticulously filters transactions for Russian clients, adhering rigorously to sanction regulations. To strengthen its commitment to compliance, the company is establishing an office and pursuing a digital-asset license in nearby Georgia, building on the permit acquired in Kazakhstan the previous year.

Bybit’s Strategic Market Shift

The surge in Bybit’s development parallels the recent $4.3 billion penalty imposed on Binance by US authorities for alleged sanctions and anti-money laundering (AML) infringements. This substantial fine and imprisonment of Binance’s co-founder, Changpeng Zhao, underscore the intensifying regulatory scrutiny in the digital asset sector.

Bybit, formerly recognized as a platform catering primarily to non-domestic clients, is adapting in response to regulatory evolutions. According to Zhou, the implementation of Europe’s Markets in Crypto-Assets Regulation (MiCAR) restricts certain offerings, causing Bybit to explore expanding markets such as Brazil, Turkey, and Africa.

I’m focusing on the significance of our partnerships with prime brokers in the context of the crypto market, which facilitate the connection between institutional traders and exchanges. In May, we initiated a “compliance review” of these interactions. Essentially, I need to identify who the prime brokers are that we’re dealing with.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-06-27 17:21