As an analyst with over two decades of experience in the financial markets, I have witnessed numerous cycles and trends that have shaped the economic landscape. The current consolidation phase of Bitcoin, reminiscent of the $10,000 price range in 2019, presents a unique opportunity for observation and comparison.

As a researcher observing the Bitcoin market, I’ve noticed that we’re currently in a period of consolidation following the new all-time high of $73,777 reached in mid-March. Since then, Bitcoin’s daily closing prices have shown remarkable stability, neither breaking above $71,500 nor falling below $54,000 significantly. However, intraday lows have dipped as low as $49,000. This consolidation phase seems to be pushing the Fear and Greed Index towards a cautious “fear” score of 30, indicating a sense of apprehension among traders who are finding the volatile market dynamics challenging.

Is $60,000 The New $10,000 For Bitcoin Price?

Regardless of current market uncertainties, certain financial analysts view this moment as a possible chance to purchase, echoing similar market scenarios observed in 2019. In the words of Bloomberg ETF expert James Seyffart, expressed through X: “Bitcoin, currently around $50k-$70k over the past 6 months, somewhat resembles Bitcoin trading between $7k and $10k from mid 2019 to early-mid 2020.”

He acknowledges the complexities of comparing historical and current charts, emphasizing that while historical patterns should not dictate future outcomes, the comparative dynamics offer insightful parallels. “I obviously know not to equate historical charts with current charts. i know all the differences of the current price dynamics etc. $10k was way further off the $20k+ ATH that 60K is. But go ahead — make fun of me. I can take it,” Seyffart added.

James “Checkmate” Check, a prominent on-chain analyst and co-founder of Checkonchain, agreed with Seyffart’s observation. He found it peculiar and eerie how much the current market situation in 2024 resembles the chop-consolidation phase seen back in 2019.

In early 2019, the Bitcoin market saw a dramatic increase from $4,000 to $14,000 over just three months. This significant rise was largely due to the influence of the PlusToken Ponzi scheme in China, which accounted for roughly 2% of all Bitcoin in circulation at that time. Following this, there was a massive sell-off of these acquired Bitcoins on Huobi by Chinese authorities, leading to continued market volatility until the major crash in March 2020.

In a striking resemblance, it was observed that events mirrored in 2024 when the Bitcoin market surged from $40,000 to $73,777. This rise was driven significantly by increased demand from US spot ETFs, accounting for roughly 5% of the total Bitcoin supply. However, this was followed by extensive selling actions from both the U.S. and German governments, approximately disposing of 70,000 BTC. These sales led to continuous market volatility until the unwind of the 5-August Yen Carry Trade.

check pointed out an intriguing observation: these occurrences bear a striking resemblance, not only in their headlines but also in the details that lie beneath. He backed up his assertion by presenting various on-chain indicators that underscore their similarities.

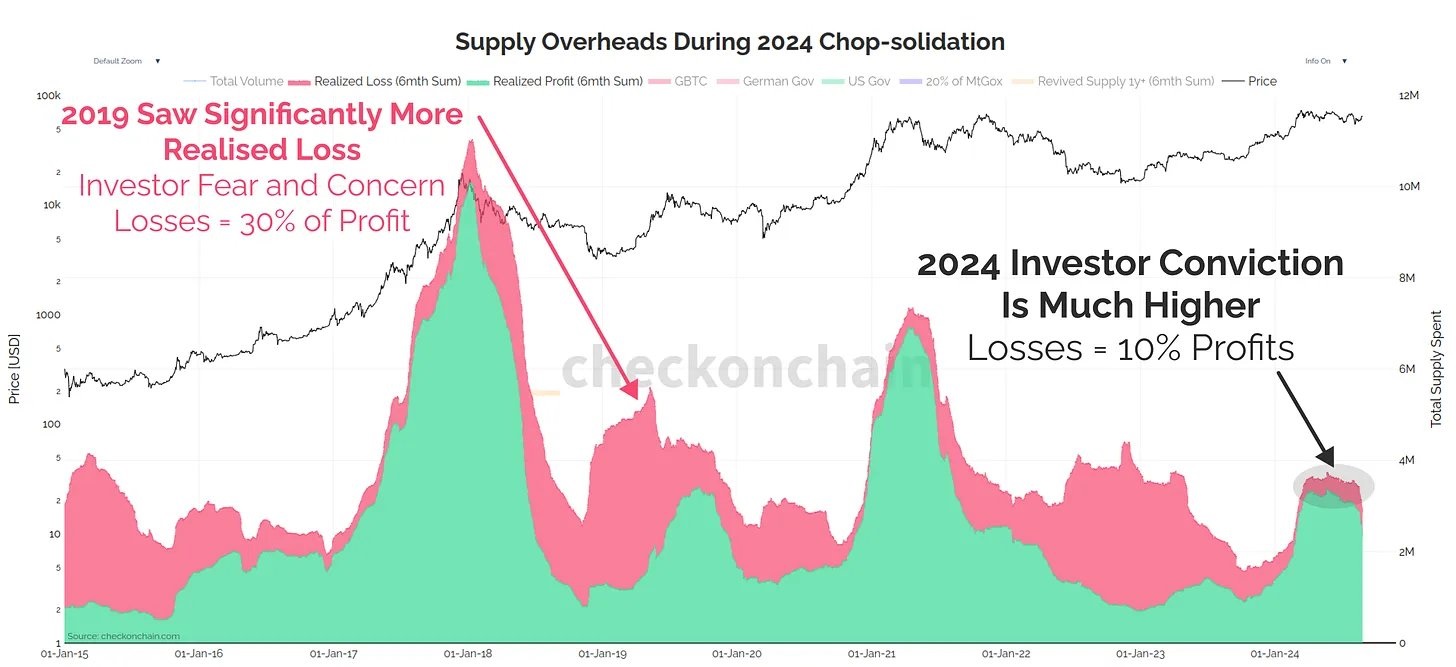

The chart labeled “Total Overheads in 2024 – Consolidation Period” demonstrated that the cumulative amount of Bitcoins that have been in circulation for more than a year and were recently moved, has followed a pattern similar to previous years. In 2019, this group transferred approximately 1.75 million BTC; as of today in 2024, around 1.9 million BTC have been activated. It’s important to note that large entities, such as the Grayscale Bitcoin Trust (GBTC), German Government, and the US government, were responsible for moving approximately 454,000 BTC during this time.

As a researcher delving into Bitcoin data, I uncovered some intriguing insights regarding the “Realized Profits” throughout specified periods. Specifically, during the span of six months in 2019, approximately 3.4 million Bitcoins were offloaded at a profit. Fast-forward to 2024, and that figure has slightly decreased to around 3.33 million BTC.

In contrast, a closer look at actual losses reveals a significant difference between the years 2019 and 2024. Back in 2019, losses amounted to three times the profits, suggesting an anxious market where investors were eager to sell even at a loss. On the other hand, in 2024, losses are just one tenth of the profits, implying that investors today seem more confident and less inclined towards panic selling compared to four years ago.

At press time, BTC traded at $59,689.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-28 14:46