As a seasoned crypto investor with a keen interest in Dogecoin, I find Ali Martinez’s analysis intriguing and thought-provoking. The historical patterns he has identified, specifically the consistent occurrence of descending triangles followed by significant bull runs, resonate with my own observations of Dogecoin’s price movements over the years.

In a recent examination posted on X, cryptocurrency analyst Ali Martinez explained the persistent price declines of Dogecoin (DOGE). He proposed that these corrections frequently precede significant market rallies, referencing past trends to predict upcoming price fluctuations.

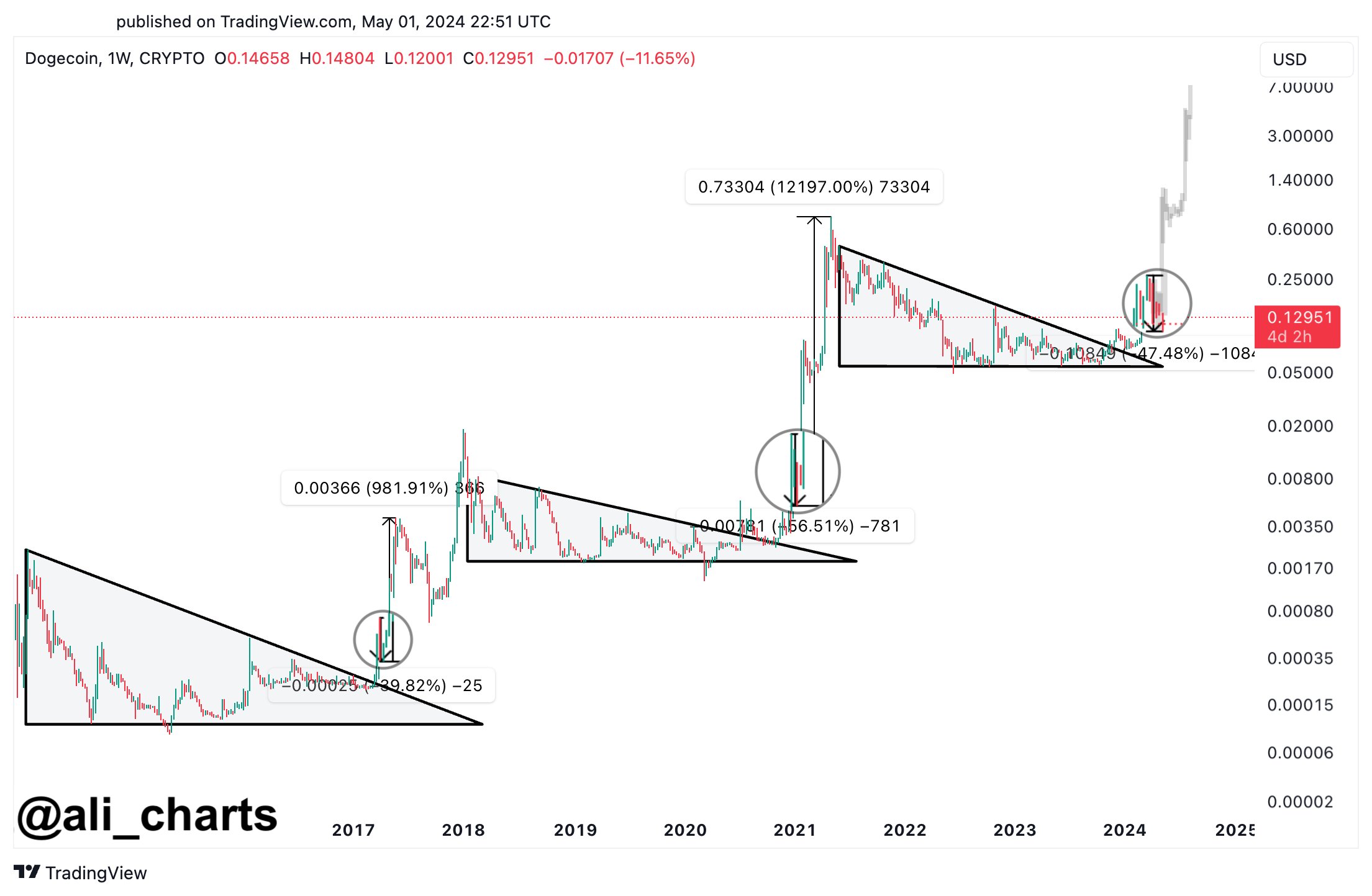

In his analysis, Martinez focuses on the chart pattern referred to as the “descending triangle.” This is a bearish configuration where the price moves in a downtrend while following a horizontal support line. Normally, this pattern signals an extension of the downward trend. However, according to Martinez’s perspective on Dogecoin, it may instead foreshadow substantial bullish breakouts.

“During the current adjustment in Dogecoin’s price, Martinez pointed out, is typical preceding significant rallies. He elaborated on this pattern’s past relevance in Dogecoin’s market trends: In 2017, DOGE emerged from a descending triangle and subsequently experienced a 40% decline before embarking on an impressive 982% price surge.”

Martinez delved deeper into recent trends to strengthen his findings, stating, “In 2021, DOGE escaped from a descending triangle pattern once more. After that, DOGE retreated by approximately 56%, only to surge by an astonishing 12,197% later!” According to Martinez’s analysis, these pullbacks are not arbitrary occurrences but rather reflective of Dogecoin’s historical market behavior, paving the way for substantial price increases.

The analyst pointed out striking similarities between the present market trends and past occurrences of DOGE: “In 2024, DOGE has once more shattered the boundaries of a descending triangle! At present, it is experiencing a 47% price adjustment, much like earlier patterns, which could trigger the next surge in DOGE’s value!” This observation implies that the ongoing market slump might present an excellent buying opportunity for potential profits.

As an analyst, I’ve noticed that Martinez’s assessment highlights the recurring pattern in Dogecoin’s price fluctuations. This pattern seems to consist of significant drops followed by strong rebounds. In other words, Dogecoin’s history shows a distinct cyclical behavior. To put it simply, based on past trends, Dogecoin’s price movements have typically experienced sharp declines, only to be followed by impressive recoveries. The takeaway from this observation is that patience is crucial for those invested in Dogecoin, as these cycles may repeat themselves over the years.

Short-Term Dogecoin Price Analysis

With a bullish outlook, the Dogecoin value finds itself in a vulnerable position in the immediate future. Since the middle of April, Dogecoin has encountered notable technical obstacles. Specifically, the Dogecoin price has repeatedly been denied at the 50-day Exponential Moving Average (EMA), suggesting considerable selling pressure above certain price points.

During a wider market decline, Dogecoin’s price falling below its 100-day moving average (EMA) significantly worsened the trend. Traders frequently monitor this level for indications of the market’s medium-term direction. Previously, it had provided support. The breakthrough implies deteriorating market sentiment and potentially prolonged losses.

At the moment of publication, Dogecoin’s price was close to $0.1259. It had managed to stay above its 200-day moving average the previous day, which is an important psychological and technical threshold. This moving average now plays a crucial role for Dogecoin; if it breaks down on the daily chart, this could lead to a notable shift in market dynamics, possibly causing a decline towards the $0.1005 support level.

As a researcher studying the market trends, I’ve noticed that the Relative Strength Index (RSI) for DOGE is currently at 31.63. This number is approaching the oversold territory, which typically signals that a security is being sold heavily and may be due for a rebound. However, it hasn’t quite reached that threshold yet. The market is getting close to oversold conditions, but the selling pressure isn’t completely exhausted just yet. It’s possible that we could see one more leg down in order for DOGE to officially enter oversold territory and potentially mark a local bottom.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-05-02 10:16