As a seasoned financial analyst with extensive experience in the crypto market, I find Arthur Hayes’ analysis in his May 2, 2024 essay thought-provoking and insightful. His interpretation of recent market volatility and the underlying macroeconomic trends is well-articulated and offers valuable insights for investors.

In a publication dated May 2, 2024, Arthur Hayes, the founder of BitMEX exchange, discussed the turbulent crypto market and the broader economic indicators influencing future trends in an essay titled “Mayday.” The crypto market has seen substantial volatility since mid-April, and Hayes directly addressed this issue in his writing.

Stealth Money Printing Is Commencing

Hayes initiates by acknowledging the visible unease in the cryptocurrency markets. He identifies several reasons behind this turbulence: the conclusion of the US tax season, apprehensions about upcoming Federal Reserve actions, the approaching Bitcoin halving, and sluggish expansion in the Bitcoin ETFs’ assets under management in the United States.

In simpler terms, he views these elements as a necessary purging of excessive speculation. He declares, “Tourists may wait out the upcoming phase on the beach, provided they have the means. The rest of us will hold on and even increase our investments in preferred cryptocurrencies such as Bitcoin, Ether, Solana, Dog Whistle Hat, and Dogecoin (the original meme coin).”

One major aspect of Hayes’ examination is dedicated to the Federal Reserve’s latest modification in its Quantitative Tightening (QT) plan. Initially, the Fed was reducing assets by $95 billion monthly, but more recently, they have decreased this amount to $60 billion per month.

Hayes considers this a hidden version of quantitative easing, adding $35 billion every month to the dollar liquidity pool. He elaborates, “The decrease in Quantitative Tightening (QT), combined with Interest on Reserve Balances, RRP payments, and interest income from U.S. Treasury bonds, amplifies the stimulus offered to global financial markets each month.”

As an analyst, I delve into the actions taken by the US Treasury, with a focus on Secretary Janet Yellen’s tenure. I examine in detail the Quarterly Refunding Announcement (QRA), which provides insights into the anticipated borrowing needs and cash balances for upcoming quarters. For Q2 2024, the Treasury projects a need to borrow $243 billion. Notably, this figure represents a significant increase of $41 billion compared to earlier projections, primarily attributed to lower-than-expected tax revenues.

I believe an increase in the supply of Treasuries could result in higher long-term interest rates. In response, former Federal Reserve Chair Janet Yellen might implement yield curve control measures to prevent this trend. Such a situation could potentially spark a substantial rally in the prices of Bitcoin and cryptocurrencies.

In his analysis, Hayes brings up the collapse of Republic First Bank and underscores the role of monetary authorities in responding as a sign of potential system instability. He voices concerns over the federal safety net, which ensures all depositors are compensated, arguing that it conceals underlying weaknesses within the US banking sector. This, according to Hayes, results in a covert form of monetary expansion, with uninsured deposits implicitly backed by the government. This misalignment, he warns, could eventually trigger substantial inflationary pressures.

Buy Crypto In May, Go Away

Hayes is candid about his investment strategies in the current environment. He advocates buying now. “I’m buying Solana and doggie coins for momentum trading positions. For longer-term shitcoin positions, I’m upping my allocations in Pendle and will identify other tokens that are ‘on sale.’ I will use the rest of May to increase my exposure. And then it’s time to set it, forget it, and wait for the market to appreciate the inflationary nature of the recent US monetary policy announcements.”

In simpler terms, The expert believes that the unstable crypto market will eventually stabilize due to the supportive liquidity measures implemented by US monetary and fiscal policies. He anticipates a gradual increase in crypto prices, despite initial resistance from inflationary pressures. Essentially, he is optimistic about the future of crypto, expecting prices to rebound after any potential downturns.

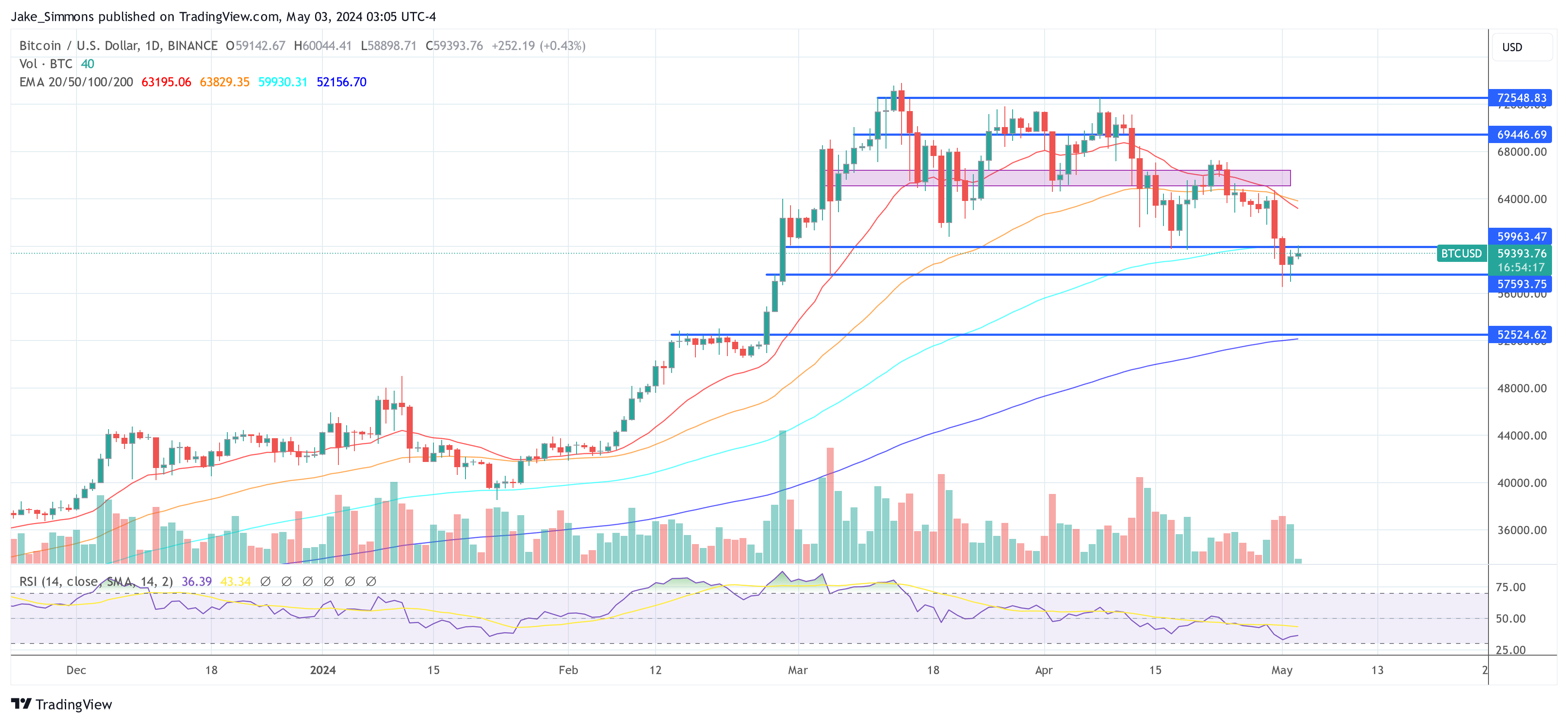

According to Hayes, Bitcoin is anticipated to regain the significant price point of $60,000 and subsequently trade within a band of $60,000 to $70,000 up until August due to the typical summer market sluggishness.

At press time, BTC traded at $59,393.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-03 10:34