As a seasoned crypto investor, I’ve witnessed my fair share of market ups and downs. The recent bullish analysis by Crypto Con and Henrik Zeberg on Bitcoin’s potential price targets has piqued my interest. While past performance is not always indicative of future results, historical patterns can provide valuable insights into the market.

As a researcher examining the cryptocurrency market, I’ve come across some intriguing insights from renowned crypto analyst and advocate, Crypto Con. He presents a bullish perspective on Bitcoin based on historical price trends, suggesting that BTC could potentially reach a price of $123,832 in the near future.

As a seasoned crypto investor, I’ve been closely monitoring Bitcoin’s historical price movements and trends. My analysis indicates that there are several key indicators pointing towards Bitcoin’s capability to surpass its past record-highs and touch new heights never seen before.

Most Accurate Bitcoin Price Bands

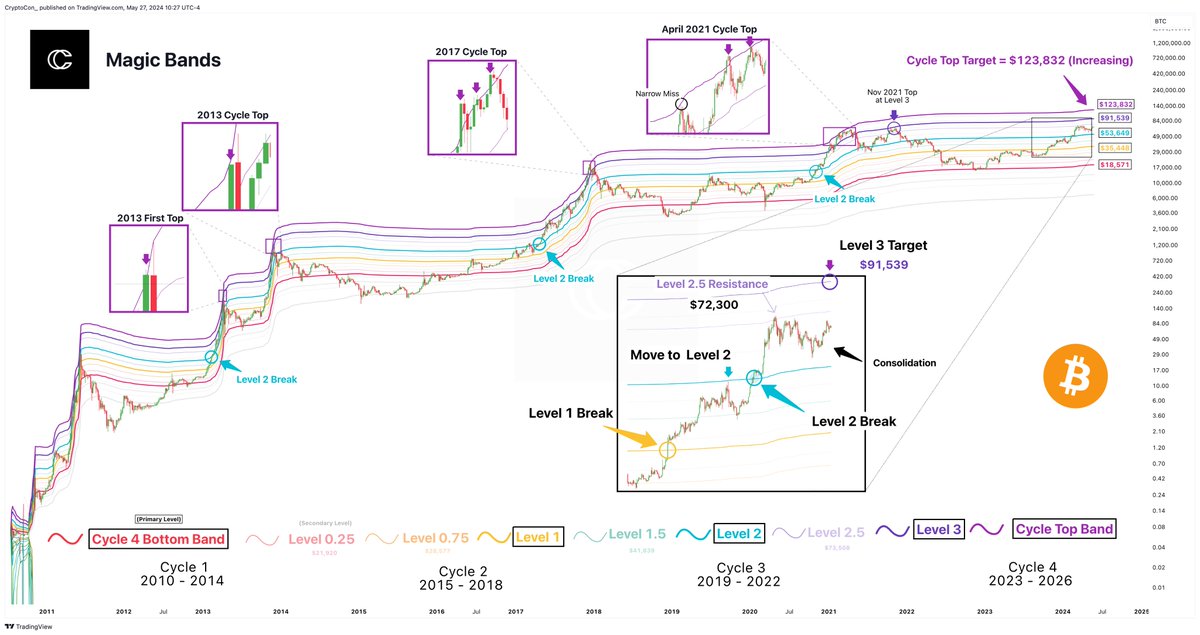

Crypto analyst Con’s examination focuses on Bitcoin’s present trends using its key price thresholds, specifically three distinct levels, as demonstrated in his graphic. According to this assessment, the third level currently offers a highly accurate representation of Bitcoin’s value, which is priced at approximately $91,539. Despite consolidation taking place at level 2.5, the consequences of this situation are already starting to unfold. Consequently, Bitcoin aims to attain the third price band as its primary objective.

Related Reading: Bitcoin Price Aims Higher: Bullish Trend Signals New Peaks Ahead

In addition, he emphasized that during every Bitcoin cycle, the peak price level of $123,832, which is the top band, has always been reached and touched. This trend is currently experiencing an uptick. Consequently, when the Bitcoin price surge reaches its climax, or the Bitcoin parabola concludes, the top band will have seen the most significant expansion.

As a cryptocurrency analyst, I’ve closely examined Bitcoin’s (BTC) market cycles and have successfully identified the past two accurate cycle tops using fundamental indicators. Specifically, the bottom of the initial early top, marked by a yellow dot on my chart, can be traced back to the Green Year.

As a researcher studying Bitcoin trends, I’ve observed that the lowest points in the cycle that have been tested repeatedly are significant for identifying pattern formations. However, an issue arises as Bitcoin has recently touched the cycle line at $74,000 – a level that could potentially disrupt this trend analysis.

When Bitcoin hit a fresh record high a year earlier than anticipated, it generated an unexpected clash with the established trend. As a result, the expert opines that the previous cycle’s trajectory, which was based on Bitcoin’s swift price movements, may not accurately predict the current peak.

As a cryptocurrency investor, I’ve noticed the predictions made by Crypto Con about imminent and unprecedented price movements that could potentially lead to cycle tops being broken. However, it’s essential to keep an eye on historical trends to better understand Bitcoin’s price behavior.

BTC Poised For 6-Figure Price Target

Macro strategist Henrik Zeberg anticipates Bitcoin’s price to reach six figures in the near future as the cryptocurrency shows robustness. According to Zeberg, Bitcoin has started an uptrend since May 20th.

Based on current trends, Zeberg projects a significant leap in revenue by the end of Q3, reaching approximately $112,500 to $117,500. The expert explains that this growth can be attributed to the recurring pattern of market highs and lows.

Read More

- Odin Valhalla Rising Codes (April 2025)

- Gold Rate Forecast

- King God Castle Unit Tier List (November 2024)

- POPCAT PREDICTION. POPCAT cryptocurrency

- Weak Hero Class 2 Ending: Baek-Jin’s Fate and Shocking Death Explained

- Jurassic World Rebirth Trailer’s Titanosaur Dinosaur Explained

- The Boy and the Heron Max Release Date Set for Streaming Debut

- Who Is Carrie Preston’s Husband? Michael Emerson’s Job & Relationship History

- Oblivion Remastered Spellmaking: The ULTIMATE Guide!

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

2024-05-28 17:46