As a seasoned crypto investor with years of experience navigating the volatile Bitcoin market, I can confidently say that the recent surge in Bitcoin’s price and the decline in its exchange reserves to a five-year low is nothing short of exhilarating. The dwindling supply on exchanges, coupled with the growing demand from institutional players and long-term holders, paints a bullish picture for the future of Bitcoin.

In the last week, the price of Bitcoin has risen by 10%, surpassing $67,000 once more within the past few hours. The Coinmarketcap Fear and Greed Index, influenced by recent buying activity, has shifted to “greed” and indicates no signs of abating.

Over the last few days, the demand for Bitcoin has been incredibly high, causing a substantial reduction in the quantity of Bitcoin listed on cryptocurrency trading platforms. As per blockchain information, this decrease has brought the Bitcoin reserve on exchanges to an all-time low in the past five years.

BTC Exchange Reserve Drop to 5-Year Low

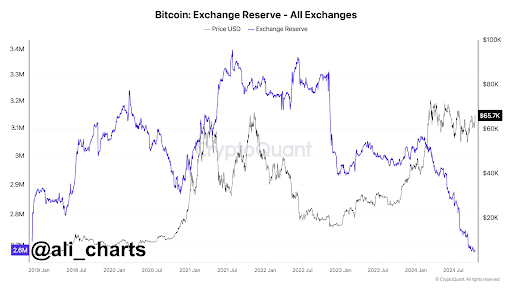

Recently, the interest for Bitcoin has surpassed its availability, resulting in a noticeable drop in the amount held in exchange reserves. As per data shared on social media by crypto expert Ali Martinez from CryptoQuant, currently, around 2.6 million Bitcoins are being stored in exchanges, which is the lowest level seen in the last five years.

The graph created by Martinez shows a fascinating pattern in the Bitcoin reserve levels over the course of the year. Initially, in January 2024, the reserve amounted to about 3.05 million Bitcoins. Since then, there’s been a significant decrease in this figure.

The decrease in the amount of Bitcoin available on exchanges can be explained by several main reasons. One major factor is the increasing demand from institutional investors, particularly after the approval and continuous growth of Spot Bitcoin ETFs. These ETFs have ignited considerable buying activity, leading US-based Spot Bitcoin ETFs to become the second-largest holders of BTC, only behind Satoshi Nakamoto.

Numerous long-term investors played a significant role in driving demand, persistently purchasing Bitcoin. During temporary fluctuations in price and selling by short-term investors, there was a noticeable shift in ownership towards long-term holders who are less inclined to sell, thus reinforcing the overall stability of Bitcoin.

Since January, approximately 450,000 Bitcoins have moved off of cryptocurrency exchanges, leaving a current reserve of around 2.6 million Bitcoins. This is the lowest level since January 2019, and such a significant decrease usually indicates a positive outlook for Bitcoin, as Martinez explained.

What Does This Mean For Bitcoin Price?

It seems like more and more market players are choosing to keep their Bitcoins rather than selling them, likely because they expect the value to rise further. This speculation stems from various predictions about Bitcoin’s potential price direction over the next few months.

When there’s less currency circulating on trading platforms, it usually signals decreased selling force. This can result in an upward price trend since the demand remains high and exceeds the supply.

Currently, Uptober is underway, and Bitcoin has surged by 6.3% this month. As of now, Bitcoin’s value stands at approximately $67,200. This significant price level suggests that Bitcoin could potentially break its previous all-time high of $73,737 before October concludes.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-10-18 00:04