The Hong Kong Securities and Futures Commission (SFC) has given its green light to several Bitcoin and Ethereum exchange-traded funds (ETFs) from well-known fund managers such as China Asset Management, Bosera Capital, HashKey Capital Limited, and Harvest Global Investments. This approval is a major step forward for the growing crypto market in the region.

Hong Kong’s SFC Approves Bitcoin And ETH ETFs

China Asset Management’s Hong Kong branch has been given the green light from the Securities and Futures Commission (SFC) to introduce Bitcoin and Ethereum spot ETFs. This move is a joint effort between China Asset Management, OSL Digital Securities Limited, and BOCI International. Their objective is to offer retail investors an opportunity to invest directly in cryptocurrencies through asset management services.

In a similar vein, Bosera Asset Management and HashKey Capital have been given provisional green lights from the SFC for launching their own Bitcoin and Ethereum spot ETFs. The Bosera HashKey Bitcoin ETF and Bosera HashKey Ether ETF enable investors to purchase ETF shares by using Bitcoin and Ethereum directly, according to their official announcements.

Harvest Global Investments has received preliminary approval from the Securities and Futures Commission (SFC) for two major digital asset spot Exchange-Traded Funds (ETFs). This was announced in a press release, with Tongli Han, CEO and CIO of Harvest Global Investations, commenting: “Receiving this preliminary approval for our digital asset ETFs from the SFC highlights Hong Kong’s leadership position in the digital asset sector. It also showcases our commitment to driving innovation in the industry and catering to a wide range of investor preferences.”

Through a collaboration with OSL Digital Securities, the first regulated and insured digital asset platform approved by the SFC, these ETFs will be introduced. This marks an important advancement in tackling typical market issues like high margin demands and inflated prices.

A Bosera and HashKey press release announces that launching virtual asset spot ETFs will bring fresh investment possibilities and strengthen Hong Kong’s position as an international finance hub and a significant digital asset center. This action aligns with the city’s efforts to become a pioneer in financial innovation, particularly within the digital asset industry.

Hong Kong’s regulatory framework is moving forward with digital assets, as shown by the approvals. This framework intends to incorporate digital assets into its financial system in a secure and safe manner. The creation of these ETFs will offer a regulated investment opportunity for both individual and institutional investors in the region, introducing innovation while minimizing risk. Although there is less excitement surrounding Hong Kong’s ETFs compared to those in the US, some experts predict similar significant consequences.

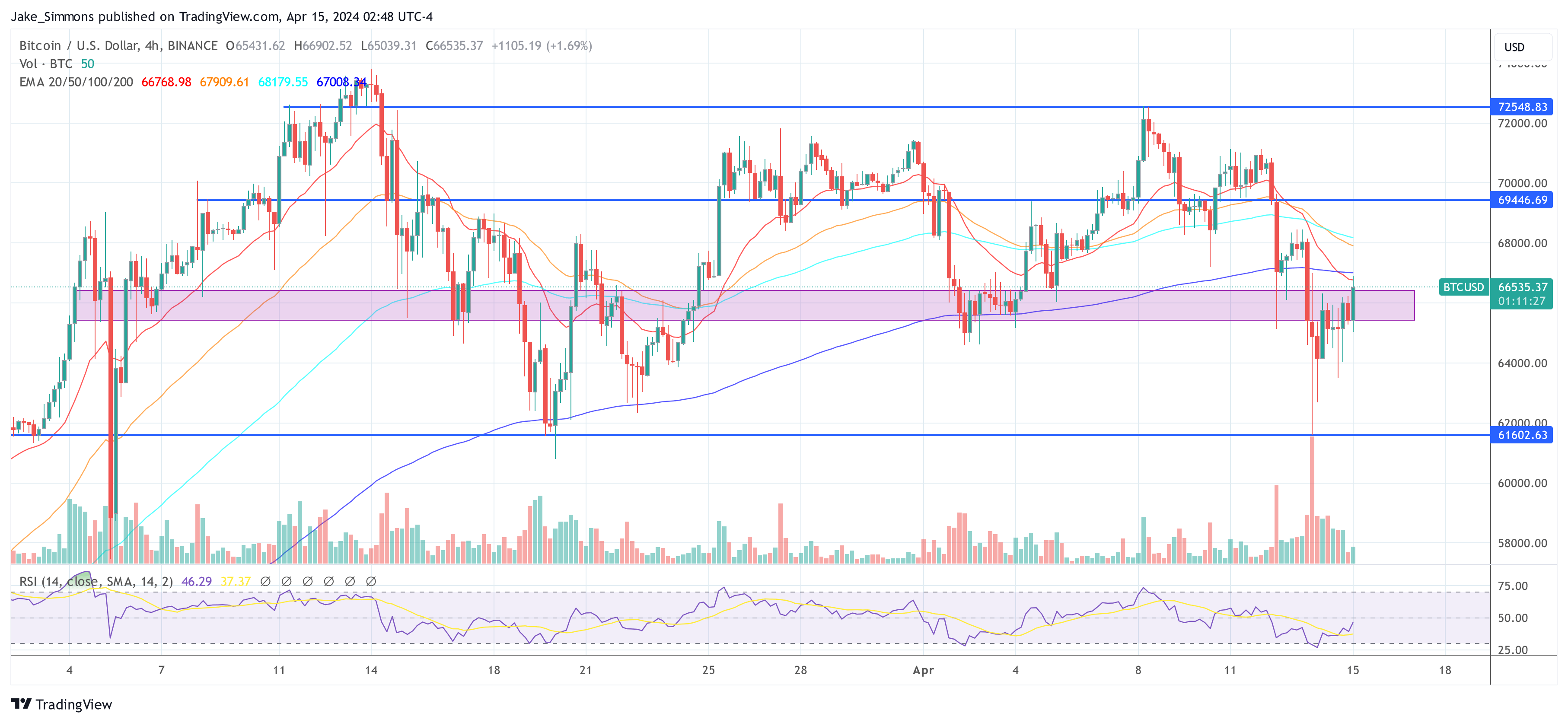

After rumors surfaced last Friday regarding the possible approval of Bitcoin and Ethereum ETFs, there was a lot of excitement in the market. People were discussing and debating the possibilities, and today’s confirmation has given a significant push to both Bitcoin and Ethereum prices. Bitcoin has risen by 2.2% since the announcement, surpassing $66,000. The ETFs are expected to be launched towards the end of April.

At press time, BTC traded at $66,535.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-04-15 10:16