Guess who’s ready to take over Europe with their Bitcoin charm? 🎉 It’s BlackRock, the big daddy of asset management, planning to list a Bitcoin ETP in Europe. After the smashing success of their $58 billion US-based Bitcoin ETF, the iShares Bitcoin Trust (IBIT), they’re taking their crypto game to the next level. 🤑

Looks like BlackRock is about to drop a Bitcoin bomb in Europe, or so says Bloomberg’s Emily Nicolle. Rumor has it they’ll play the same tune as in Canada, where the ETF is basically a fancy wrapper for IBIT. 🎁

— James Seyffart (@JSeyff) February 5, 2025

Bloomberg whispers that Switzerland might be the lucky country to host this new fund. BlackRock’s keeping mum, but we hear they’re ready to start marketing it this month. Shhh, it’s a secret! 😜

With $4.4 trillion in ETF assets under their watchful eye, BlackRock’s been cozying up to crypto. Europe’s had crypto ETPs for ages, but this will be BlackRock’s first baby outside the US and Canada. It’s a crypto milestone, folks! 🏁

Bitcoin ETFs: The New Gold Rush 🥇

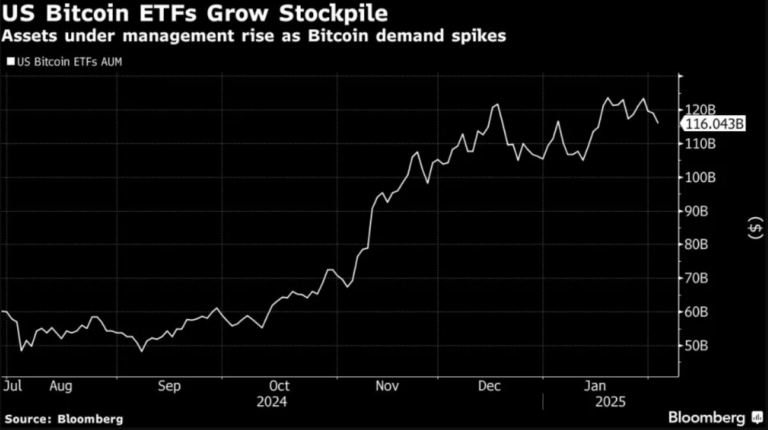

Bitcoin ETFs are all the rage since they debuted in the US last year. They’ve gathered a whopping $116 billion in assets, and IBIT is the star of the show, setting records left and right. It’s the best-performing ETF launch ever! 🌟

Source: Bloomberg

BlackRock’s been on a roll, launching a Bitcoin ETF in Canada in January. Canadian investors can now get their hands on the US Bitcoin goodness. It’s an international crypto takeover! 🌍

US Bitcoin ETFs saw $35 billion in net inflows last year, with an average of $144 million in fresh funds every trading day. Analysts predict another $48 billion in net inflows for 2025. It’s raining money in the crypto world! 💰

BlackRock takes the gold in Ethereum too, followed closely by Fidelity. Bitwise gets the bronze. 1. Blackrock 🥇 $3.5bn 2. Fidelity 🥈 $1.5bn 3. Bitwise 🥉 $0.4bn

— Farside Investors (@FarsideUK) December 31, 2024

Europe’s Crypto ETP Market: Playing Catch-Up 🏃♂️

Europe’s crypto ETP market is still playing catch-up with the US. With over 160 crypto ETPs tracking Bitcoin, Ether, and other digital darlings, they only hold $17.3 billion. It’s a small pond compared to the US lake. 🐟

But BlackRock sees the writing on the wall. “The ETP wrapper makes Bitcoin exposure irresistible,” say Samara Cohen and Jay Jacobs. BlackRock’s CEO, Larry Fink, is all-in on Bitcoin, calling it a hedge against currency debasement. He’s a true believer! 🙏

Bitcoin’s Soaring Highs and the Trump Bump 📈

Bitcoin’s price has gone bananas since Trump’s re-election. It hit an all-time high of $109,114 in January. Trump’s pro-crypto vibes are giving Bitcoin a boost, and clearer regulations are expected to lure more big players into the crypto scene. 🎯

Europe’s new crypto rules, rolled out in December, could give BlackRock’s European Bitcoin ETP a helping hand. It’s a win-win for institutional adoption. Get ready for crypto domination, Europe! 🇪🇺

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2025-02-06 01:59