As a seasoned researcher with over two decades of experience in the crypto market, I have seen my fair share of bullish and bearish predictions. The current state of Render (RNDR) has piqued my interest due to its divergent outlooks from analysts Crypto Patel and Crypto Alex.

In a market where predictions vary greatly, the Render token is gaining traction among analysts and crypto enthusiasts. Currently priced at around $4.80, cryptocurrency expert Crypto Patel forecasts that Render could surge by an astonishing 990% or more, potentially reaching as high as $50. This optimistic outlook comes even after the token’s significant drop of 75% from its highest point.

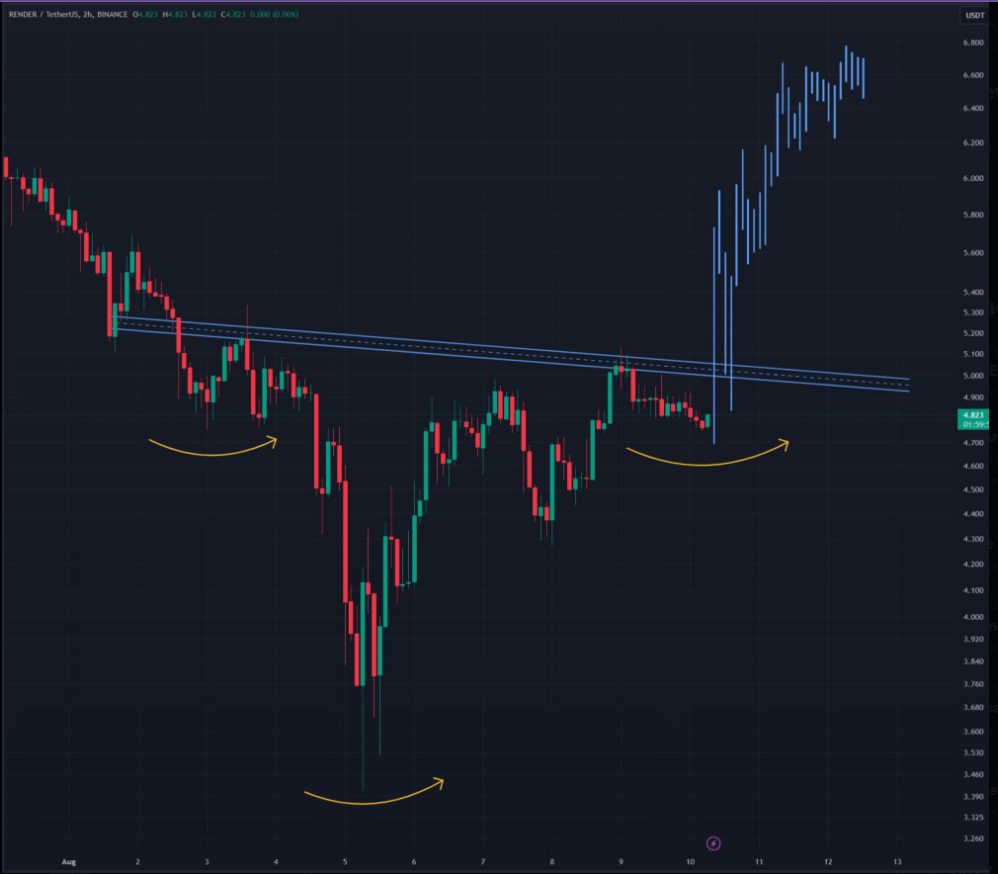

Instead, Crypto Alex identified a bullish inverse head-and-shoulders pattern within the Render charts, suggesting a potential surge when selling pressure subsides. This conflicting perspective places Render at a critical crossroads, adding intrigue to its upcoming trajectory.

Key Support And Buy Zones

Additionally, it’s important to note that Patel’s analysis doesn’t solely rely on his optimistic price target. Instead, he has pinpointed strategic buying zones for investors. According to him, potential growth areas for the token could be around $4-$3.5 and $2-$1.7.

A Bullish Outlook on RNDR/USDT: While RNDR has experienced a 75% decline from its highest point, it’s currently trading at approximately $4.58 and is showing signs of a robust rebound following its hold at the $3 support.

Key Buying Zones:

Entry 1: $4 – $3.5

Entry 2: $2 – $1.7

Target: $50

If RNDR can hold…

— Crypto Patel (@CryptoPatel) August 13, 2024

Instead, Patel noted that the $3 level carries significant importance. If the token can hold above this mark, it suggests a robust upward trend. Conversely, if the token falls below, potential buying opportunities might lie at $4.

Render: Bearish Signs

As a crypto investor, I’ve been keeping a close eye on RNDR, and here’s what I’ve observed: While there might be potential in this cryptocurrency, it’s crucial to approach with caution. Technical indicators suggest a bearish trend when looking at the 1-day chart. The Keltner Channels indicator shows that Render’s price consistently hovers below the middle line, indicating a possible negative momentum. Furthermore, the price often touches or lingers near the bottom band, which is a strong signal of heavy selling pressure. So, tread carefully if considering an investment in RNDR.

Currently, the RSI reading of 34.16 is relatively low and falls below the neutral threshold of 50, which suggests potential cause for concern. When the RSI goes below 30, it signals that bearish momentum may persist; however, if we reach oversold conditions, a rebound might occur. The Chaikin Money Flow stands at -0.05, indicating minimal outflow of capital, signifying that while sellers hold a slight advantage, the situation is not excessively extreme.

Bullish Pattern

As an analyst, I’ve observed a potential bullish inverted head-and-shoulders pattern emerging in the data, which has been identified by Crypto Alex. This pattern, initially appearing in early August, might signal a shift in trend direction. The left shoulder forms the base, followed by the ‘head’ or lowest point, and finally, the right shoulder – all these points are higher compared to the head, forming an inverted head-and-shoulders configuration.

$RENDER bottom is in

A breakout above $5.2 and RENDER will moon

— AMCrypto (@AMCryptoAlex) August 10, 2024

1. This pattern’s neckline is located around $5.2 and holds significance. A decisive surge above this resistance point could potentially drive prices upwards. Previously, Render has failed to surpass this level, but the formation of higher bottoms hints at growing buying interest. If the token manages to breach the $5.2 resistance, it might continue climbing and reach Patel’s ambitious target.

In a fascinating turn of events, Render Token is facing diverse predictions from analysts. While Crypto Patel envisions a dramatic surge towards $50, disregarding recent declines and highlighting strategic buying areas, Crypto Alex sees potential for an optimistic inverse head-and-shoulders pattern that might indicate a bullish trend.

Regarding this point, he mentioned that if RNDR surpasses $5.2, a significant jump might occur. Given the differing opinions of analysts, it’s crucial to keep an eye on RNDR’s future actions as they could shape its direction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-14 18:54