As a researcher with extensive experience in the cryptocurrency and blockchain industry, I am thoroughly impressed by the impressive growth and performance of the Binance Smart Chain (BNB Chain) during the first quarter of 2024. The surge in market cap, revenue, average daily active addresses, decentralized finance (DeFi), total value locked (TVL), and average daily decentralized exchange (DEX) volume is a clear indication of its increasing importance in the blockchain ecosystem.

As a researcher studying the blockchain landscape in Q1 2024, I observed remarkable expansion and impressive performance for the Binance Smart Chain (BNB Chain). This innovative platform, spearheaded by the globally leading cryptocurrency exchange, Binance, by trading volume, showcased noteworthy progress during this period.

According to a recent analysis by Messari, Binance Smart Chain has experienced significant growth in various areas. Notably, its market capitalization, revenue, average number of daily active addresses, decentralized finance (DeFi) projects, total value locked in DeFi protocols, and the volume of transactions conducted on decentralized exchanges have all increased substantially.

BNB Outperforms Bitcoin In Q1 2024

In Q1 2024, BNB Smart Chain experienced significant market cap expansion, registering a 89% increase from the previous quarter (QoQ). This growth led to a market capitalization of approximately $92.5 billion for BNB, ranking it third among all tokens, excluding stablecoins. Ethereum (ETH) and Bitcoin (BTC) held the top two spots with greater market caps.

It’s intriguing to observe that BNB outperformed Bitcoin during this timeframe, with BNB’s market capitalization growing by a greater extent – expanding by more than Bitcoin’s 65% increase.

I’ve noticed a significant surge in revenue for the Binance Smart Chain in the first quarter. The network raked in approximately $66.8 million during this period, representing an impressive 70% rise compared to the previous quarter.

I’ve observed some intriguing insights from Messari’s analysis. The significant surge in our Q1 revenue can be attributed primarily to the rise in value of BNB. Remarkably, this quarter surpassed any previous revenue generation in the year 2023. DeFi transactions played a substantial role, contributing approximately 46% to the overall revenue through gas fees.

Though there was a modest dip in the daily average number of transactions, BNB Smart Chain registered a robust 27% expansion when compared to the previous year. This signifies continued vigor in network usage.

I’ve noticed a significant increase of approximately 26% quarter over quarter in the average daily active addresses on the BNB Smart Chain, which now numbers around 1.3 million. Notably, several protocols on this network have experienced heightened transaction volumes and higher levels of activity. Among them, Tether’s USDT stablecoin and decentralized exchange (DEX) PancakeSwap have been particularly noteworthy for their robust usage.

DEX Trading Volume Explodes

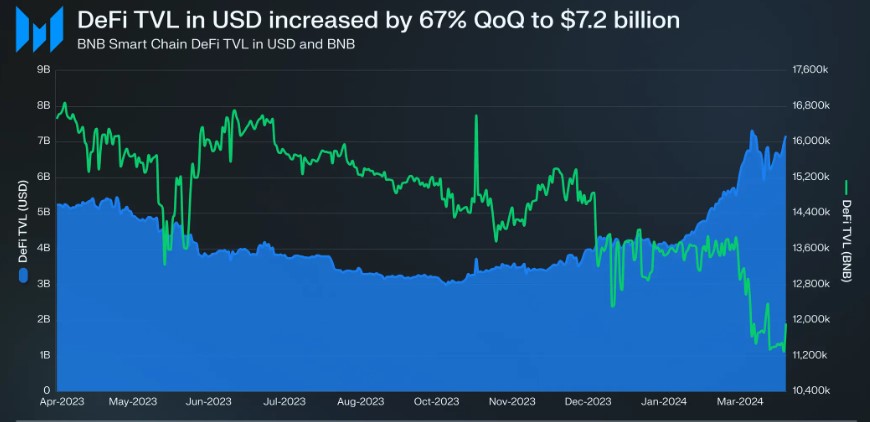

The total value locked in Decentralized Finance (DeFi) applications on BNB Smart Chain, expressed in US dollars, saw a significant increase of 67% quarter over quarter, amounting to $7.2 billion. As a result, Binance Smart Chain ranked third in terms of DeFi TVL, surpassed only by Ethereum and Binance Smart Chain.

As an analyst, I’ve noticed that when expressed in BNB terms, Total Value Locked (TVL) experienced a minor decline of approximately 12%. This observation implies that the significant increase in USD value was predominantly influenced by the rise in BNB price and new capital inflows.

In the past quarter, the decentralized exchanges operating on the Binance Smart Chain experienced a remarkable surge, recording an average daily trading volume that grew by 193% compared to the previous quarter. The combined trading volume for these exchanges during Q1 amounted to a significant $1.1 billion. Among these, PancakeSwap stood out as the leading decentralized exchange on the platform.

The volume of trades on PancakeSwap’s decentralized exchange (DEX) increased by an average of 140% every quarter compared to the previous one. This significant growth has put it ahead of its competitors and established PancakeSwap as the go-to DEX on the BNB Smart Chain.

As a researcher studying the blockchain landscape in the first quarter of 2024, I observed remarkable progress in Binance Smart Chain’s performance across multiple key indicators. This growth further solidified its role as a significant player in the blockchain ecosystem.

I’ve noticed that the native token of this exchange, Binance Coin, is presently priced at around $607. This represents a 2% rise in value over the last 24 hours and a noteworthy 10% surge during the past week.

The recent increase in price for this token is bringing it nearer to its peak value of $686, which was attained back in May 2021.

Read More

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-04-26 03:04