As a seasoned analyst with years of experience in the crypto market, I see the BNB price as currently consolidating, attempting to break above the $635 resistance level. My analysis suggests that BNB has been on a rollercoaster ride lately, struggling to keep up with its peers like Ethereum and Bitcoin, but it’s holding strong above the crucial support at $600.

The BNB price found it difficult to surpass the barrier at $665. Currently, it’s holding steady, potentially preparing for another upward push beyond the $635 mark.

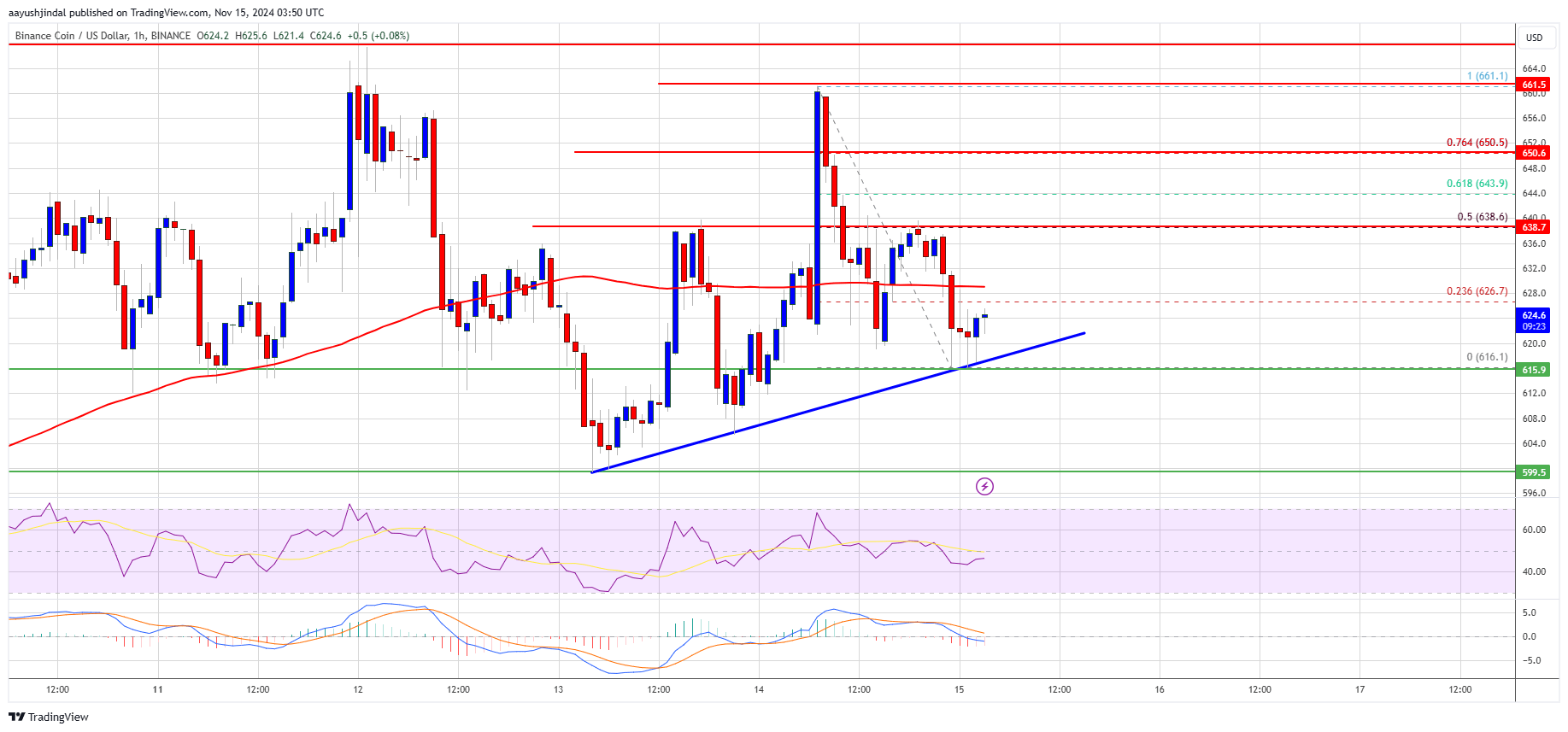

- BNB price started a downside correction from the $665 resistance zone.

- The price is now trading below $640 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $620 on the hourly chart of the BNB/USD pair (data source from Binance).

- The pair must stay above the $600 level to start another increase in the near term.

BNB Price Holds Support

Following a rise above the $620 mark, the BNB price continued to climb higher. Yet, growth was restricted beyond $660, with the price reaching a ceiling that other cryptocurrencies like Ethereum and Bitcoin did not experience.

Initially, the price dipped below both $632 and $620, but it’s currently maintaining its growth above $600. The lowest point was reached at $616, and now the price is stabilizing close to the 23.6% Fibonacci retracement level of the decline that started from the peak of $661 down to the trough of $616.

Currently, the price for this pair is dipping under $620 and aligning below its 100-hour moving average. Additionally, a potential upward trend line is being formed on the hourly chart of the BNB/USD pair, offering support at $620.

As a crypto investor, if I notice a fresh surge in the price, I’d anticipate potential resistance around the $626 mark. The next significant hurdle might be near the $638 level or the 50% Fibonacci retracement level of the downward swing from the $661 high to the $616 low. A decisive break above the $638 zone could potentially propel the price upward.

In this particular situation, the BNB price may reach around $650. If it manages to break through the current resistance at $650, it could pave the way for a larger advance, potentially targeting the next resistance at $665. Any further increases might prompt a challenge of the $680 mark in the short term.

More Losses?

If BNB doesn’t manage to surpass the $638 barrier, there may be a renewed drop. Should this happen, initial support might be found around $620, including the trendline. A more substantial support could be at approximately $615.

If the price falls below the $600 level serving as our primary support, it might lead to a further decrease in value, potentially dropping to the next support at $585. Further declines beyond that could trigger a more significant drop towards the $565 region.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently below the 50 level.

Major Support Levels – $620 and $615.

Major Resistance Levels – $638 and $650.

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- The Babadook Theatrical Rerelease Date Set in New Trailer

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2024-11-15 08:10