As a seasoned analyst with years of experience tracking the cryptocurrency market, I find myself optimistic about Binance Coin (BNB) at this juncture. The current consolidation near the $725 zone seems to be a temporary pause before BNB aims for a move above the $740 resistance.

The BNB price appears to be stabilizing around the $725 region. It looks like it’s preparing to break through the $740 barrier, indicating potential growth ahead.

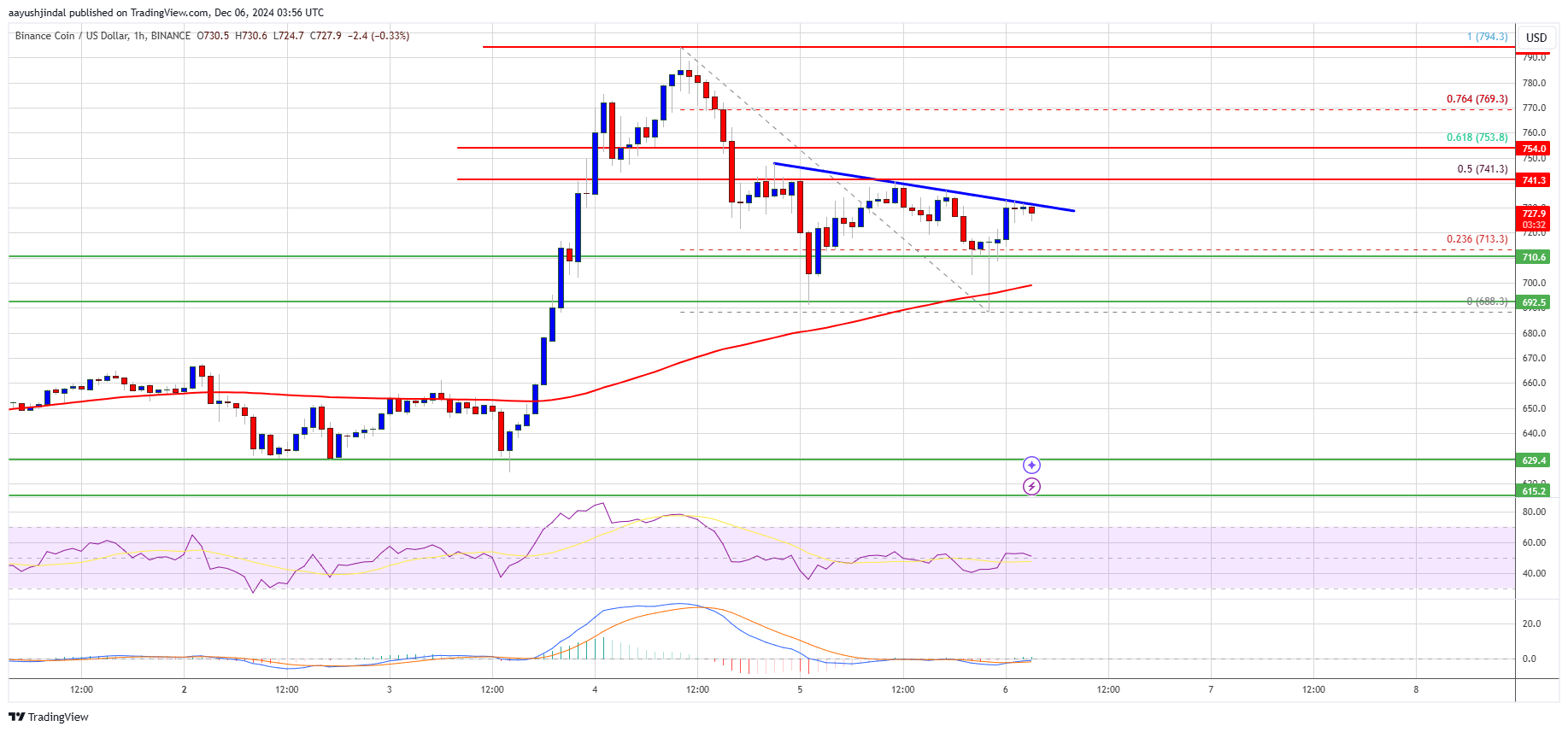

- BNB price started a downside correction from the $800 resistance zone.

- The price is now trading above $700 and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $725 on the hourly chart of the BNB/USD pair (data source from Binance).

- The pair must stay above the $715 level to start another increase in the near term.

BNB Price Holds Support

Following a breakthrough above the $700 mark, the BNB price continued to climb, mirroring the upward trend of both Ethereum and Bitcoin. The buying pressure, or bulls, managed to push the price beyond the $720 and $750 levels which previously served as resistance points.

Ultimately, the cost reached the $800 mark, peaking at $794 before a drop occurred. It fell below the $750 and $740 points, but now it’s holding steady above $700. A low of $688 was set, followed by consolidation above the 23.6% Fibonacci retracement level from the high at $795 to the low at $688.

Currently, the price has moved beyond $700 and is above its 100-hour moving average. If there’s further growth, it might encounter resistance around the $725 region. Moreover, a significant bearish trend line is developing on the hourly chart of BNB/USD pair with resistance at $725.

The next resistance sits near the $740 level. It is near the 50% Fib retracement level of the downward move from the $795 swing high to the $688 low. A clear move above the $740 zone could send the price higher.

In this scenario, the Binance Coin (BNB) price may reach around $750. If it manages to break through the current resistance at $750, it could signal a bigger push towards the next resistance at $785. Further increases might lead to a challenge of the $800 level in the short term.

Another Dip?

As an analyst, if BNB does not manage to surpass the $725 resistance, it might trigger another drop in price. Should this occur, initial support for BNB can be found around the $715 mark. Further down, a significant level of support lies near the $700 level.

Should the main support at $685 be breached on the downside, the price might fall towards the next support at $665. Further declines could trigger a larger drop that may extend to the $650 region.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major Support Levels – $715 and $700.

Major Resistance Levels – $740 and $750.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-12-06 08:10