As a seasoned analyst with over a decade of experience in the crypto market, I find the Q2 performance of the BNB Smart Chain to be a fascinating study in the ebb and flow of this dynamic industry. The decline in revenue, network activity, and TVL is undeniably concerning, but the resilience shown by BSC in maintaining its position as the third-highest DEX trading volume is commendable.

During the second quarter of the year, the BNB Smart Chain (BSC) demonstrated a blend of results as the overall cryptocurrency market started to lose momentum following a significant price increase in March. Even though the value of BNB, the native token of the BSC, remained relatively steady with a 5% decrease compared to the previous quarter, the network’s essential statistics presented a mix of positive and negative developments.

Binance Smart Chain Revenue Plunges

As per a recent analysis by Messari, the chain’s quarterly revenue (the total fees earned by the network) decreased by 28% compared to the previous quarter, amounting to approximately $48.1 million during Q2. However, this represents a decrease of only 8% compared to the same quarter in 2023, with earnings of $52.4 million.

The report indicates that the main factor contributing to this drop was a decrease in the value of BNB, resulting in a 51% decline in revenue when compared to the previous period. This shift saw the network’s native token revenue decrease from 165,100 BNB to 81,300 BNB.

As an analyst, I’ve noticed a significant downturn in network activity, with daily transactions dipping by 10% quarter-over-quarter to approximately 3.7 million, and the number of active addresses declining by 18% QoQ to around 1.1 million on the BSC. This pattern isn’t exclusive to the BSC, as on-chain activity has generally decreased across most smart contract platforms during Q2, following a robust Q1.

Although there was a general drop, the report highlighted some changes in user tendencies within the BSC environment. Notably, Uniswap, a decentralized exchange, witnessed a substantial surge in daily transactions, rising by an impressive 630% quarter-over-quarter. On the other hand, PancakeSwap, which was previously dominating, experienced a decline of 46% in its daily transactions during the same period.

Staking Surges 30%, TVL Drops

Messari noted that the amount of BNB tokens staked rose by 30% compared to the previous quarter, reaching a total of 30.4 million BNB. The total value of these staked funds also grew by 24%, amounting to $17.7 billion. This places the Binance Smart Chain as the third-largest Proof-of-Stake (PoS) network in terms of staked value, although it trails behind Solana by a substantial $38.4 billion.

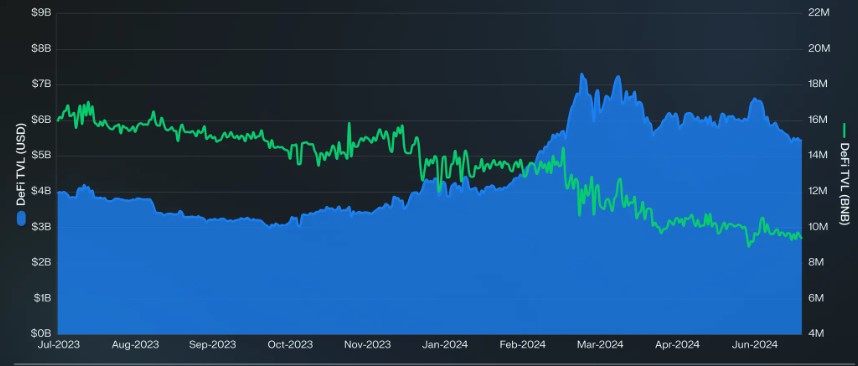

In contrast to its usual trend, the Decentralized Finance (DeFi) system within the BSC experienced a decline in the total value locked (TVL), falling by approximately 24% from one quarter to the next, landing at $5.5 billion. The main reason for this decrease was a substantial drop of around 41% in borrowing on the DeFi platform Venus Finance during the same period.

Based on my years of experience in the crypto market, I’ve learned that token prices can be quite volatile and unpredictable. In this specific case, it seems that the decrease in value locked within the company was partly due to a drop in the BNB token’s value, which fell from an all-time high of $722 in March down to $567 by the end of the quarter. This is not an unusual occurrence in the crypto world, and I’ve seen similar situations many times before. It’s important for investors to stay informed and adaptable when it comes to digital assets, as their value can change rapidly due to various factors such as market conditions, regulatory updates, or project-specific developments.

Regardless of the ups and downs, Messari noted that Binance Smart Chain consistently ranked third among decentralized exchanges (DEX) in terms of trading volume during Q2 this year. The total volume reached a substantial $66 billion, just below Ethereum (ETH) and Solana.

BNB Price Analysis

While penning this, I noticed that the BNB token was being traded at approximately $586, marking a 2% increase over the past 24 hours. Yet, the trading volume during the same period saw a minor dip of 3%, settling at around $830 million, as per the data provided by CoinGeko.

Over the past few days, the token has been holding steady within a range of $570 and its current trading value, mirroring the behavior of major cryptocurrencies. On Monday, it failed to breach its immediate resistance at $590, which is the last barrier standing before reaching the $600 milestone.

As a BNB investor, I’m keeping a close eye on the 200-day exponential moving average (EMA) highlighted in the daily BNB/USDT chart below. This yellow line sits just beneath the current price, and it could serve as a crucial support for the token. If BNB holds above this line, it might prevent any additional drops.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-01 06:05