🤑 BlackRock’s ETH Obsession: Is This the Bull Run We’ve Been Waiting For? 🤑

Ah, Ethereum, that darling of the digital realm, has been behaving rather poorly of late, much like a spoiled child who’s been told to share his toys. 📉 Down 5.68% in the last week, it’s mirroring the general ennui plaguing the crypto market. One would almost think the crypto bull run had forgotten its date with destiny! But fear not, dear reader, for whispers of a grand revival are in the air, courtesy of our friends in the ivory towers of finance.

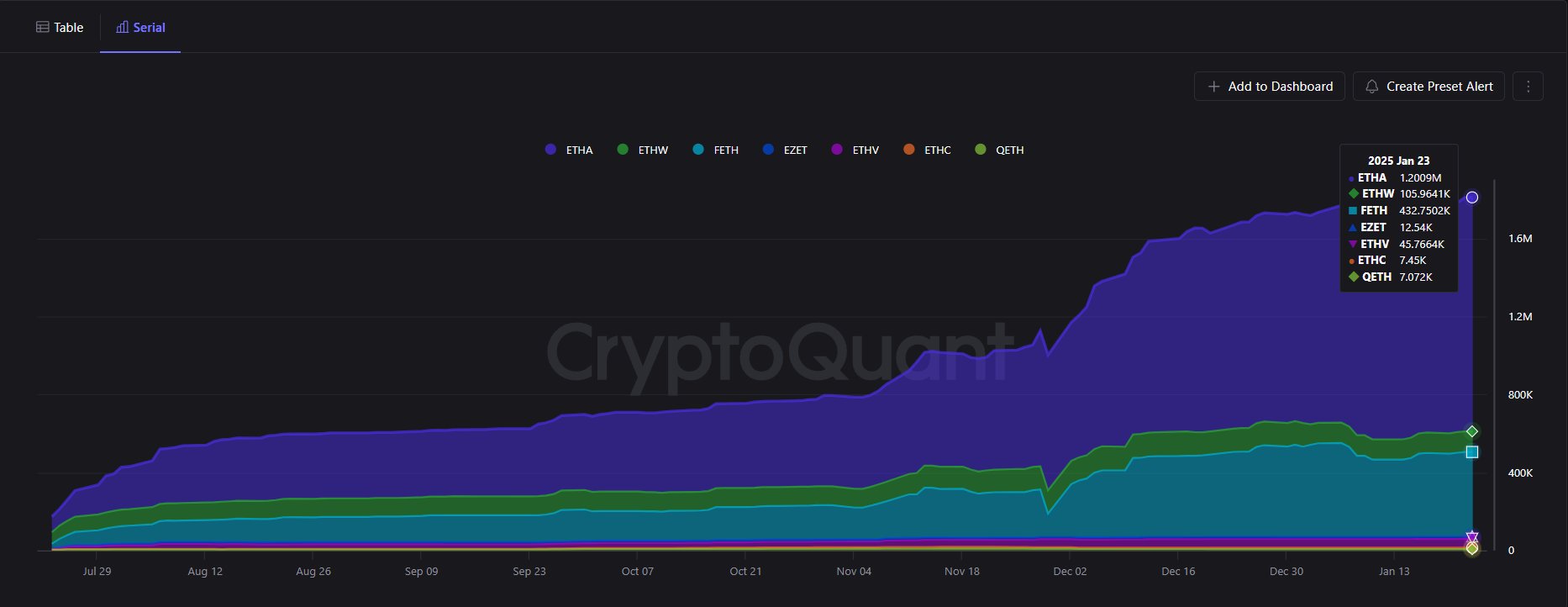

BlackRock’s ETHA: A Tale of Institutional Desire

Enter BlackRock, that titan of Wall Street, with its grandly titled ETHA (Ethereum Trust). It seems that this behemoth has amassed a staggering 1.2 million ETH, a veritable hoard of digital gold. 😲 This, my dear reader, is no mere trifle. It represents a whopping $3.19 billion in assets, and according to the esteemed Burak Kesmeci, it’s the single biggest driver of the burgeoning institutional adoption of Ethereum. Just imagine, dear reader, all those Wall Street suits clamoring for their piece of the crypto pie! 😄

Fidelity, that other stalwart of financial gravitas, isn’t far behind with its FETH, boasting a respectable 432,750 ETH. Bitwise and VanEck are also in the game, but they’re mere minnows compared to the behemoths. This, my dear reader, is a testament to the growing legitimacy of cryptocurrencies in the eyes of the establishment. Could this be the beginning of a beautiful friendship? 💍

Short-Sightedness in the Ethereum Market: A Bit of Gloom

However, dear reader, not all is rosy in the world of Ethereum. Apparently, a fair number of traders are betting against its future success. They see it as a sinking ship and are jumping ship, shorting it to the hilt. Poor Ethereum! 🤕 It seems the crypto world is full of fickle souls, always looking for the next quick buck, never appreciating the true beauty of a long-term investment. But perhaps this is just a passing phase, a mere hiccup on the road to Ethereum’s ultimate triumph. 😉

At present, Ethereum is holding steady, hovering around $3,297, but its trading volume has taken a dive. We’ll see if this short-term gloom can be dispelled by the bullish optimism of the institutional giants.

With a market cap of $396.85 billion, Ethereum remains the undisputed king of the altcoins, and its future remains full of potential. The question, dear reader, is will the institutional influx propel it to new heights or will it be brought down by the fickle winds of the market? Only time will tell. But one thing is certain, Ethereum’s journey will be fascinating to watch, a constant reminder that in the world of finance, anything is possible, even the unexpected embrace of a digital currency by the old guard.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2025-01-26 02:47