Ah, the world’s biggest financial whale, BlackRock, has been up to some shenanigans! They’ve gobbled up over 5% of the newly-dubbed “Strategy” Inc., previously known as MicroStrategy. With nearly 11.2 million shares in their pockets, they’ve made quite the splash in the Bitcoin pool!

Over the last quarter of 2024, BlackRock’s been secretly adding to their stash, boosting their stake by 0.91%. By the end of September 2024, they’d already snagged 4.09% of MicroStrategy. But now, they’ve upped the ante, crossing the 5% threshold.

Why all the fuss over Strategy, you ask? Well, it’s become a cozy little nest for institutional birds to dabble in Bitcoin without getting their feathers wet. And let me tell ya, Strategy’s been a real money-maker! Over the past year, it’s raked in 540% gains, more than triple what Bitcoin’s brought home!

Not one to be left behind, BlackRock’s also launched its own regulated Bitcoin product, the iShares Bitcoin Trust (IBIT). With net inflows surpassing $40 billion since its debut in January 2024, it’s been quite the success story!

BlackRock’s News Sends Strategy Soaring 5%!

Strategy recently rebranded and launched its convertible preferred stock, Strike (STRK), which started trading on the Nasdaq last week. The stock closed 2% higher on its first day, with over 650,000 shares traded. And guess what? It’s climbed another 5% in pre-market trading!

Source: TradingView

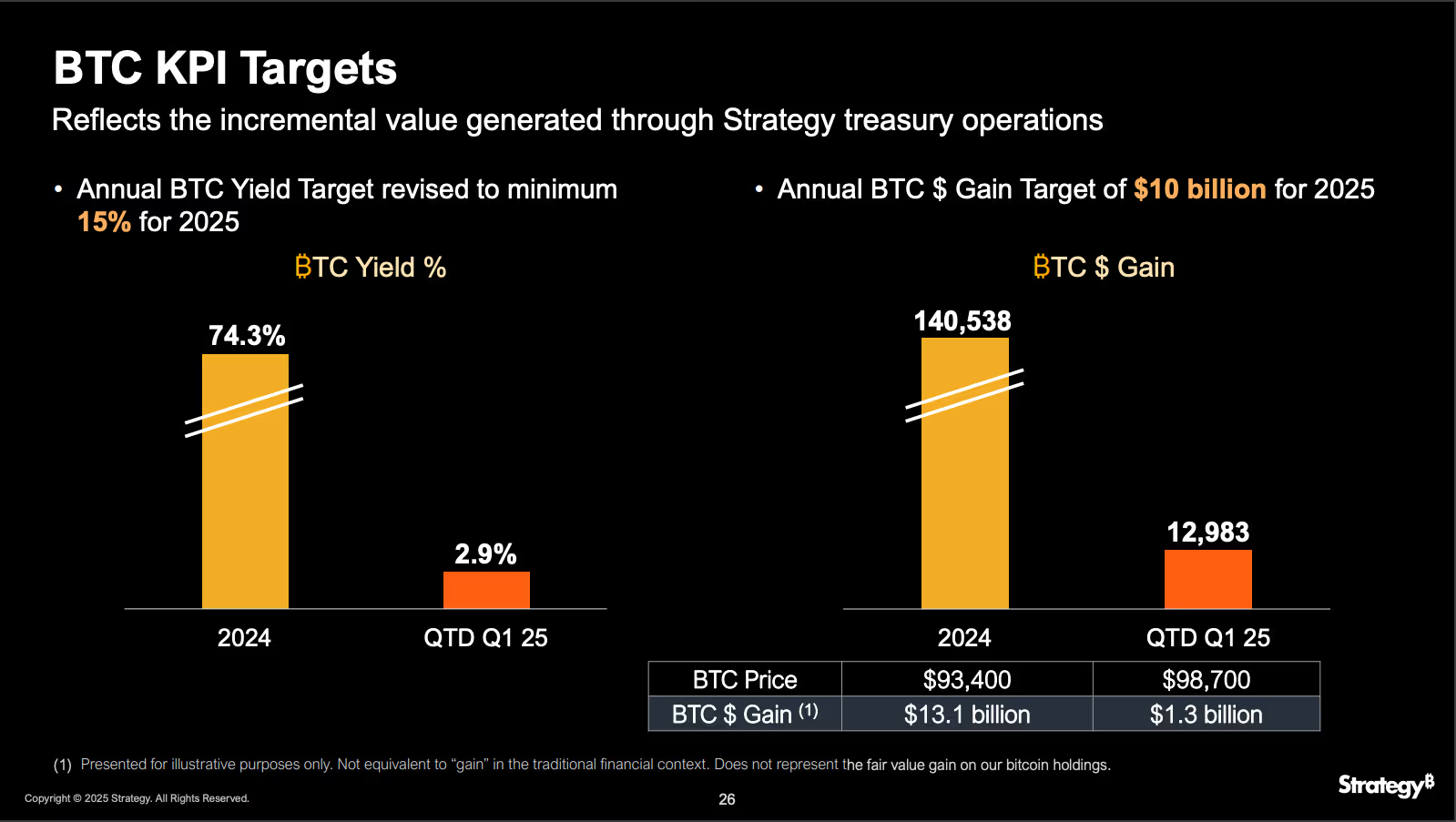

Strategy’s Q4 earnings report revealed new performance metrics, including a target of $10 billion in Bitcoin gains for 2025. They’ve already achieved $1.24 billion this year, with a Bitcoin yield goal of 15%. So far, they’ve managed 2.9% this year.

Source: Strategy

With Strategy paving the way, other corporate critters have followed suit, adding Bitcoin to their balance sheets. Metaplanet and Semler Scientific, for instance, have seen their stock prices soar after embracing Bitcoin.

Read More

- Oblivion Remastered Spellmaking: The ULTIMATE Guide!

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Oblivion Remastered: Complete Spellmaking Guide | Elder Scrolls IV

- Gold Rate Forecast

- Weak Hero Class 2 Ending: Baek-Jin’s Fate and Shocking Death Explained

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- POPCAT PREDICTION. POPCAT cryptocurrency

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- Who Is Tyler Herro’s Girlfriend? Katya Elise Henry’s Instagram & Relationship History

2025-02-07 17:53