As a seasoned investor with over two decades of experience in the financial markets, I’ve seen my fair share of market ebbs and flows. The recent outflow of $330 million from BlackRock’s iShares Bitcoin Trust (IBIT) has caught my attention, marking the largest single-day outflow since its launch last year. This trend suggests that institutions are taking profit after a massive run-up in 2024, but it’s essential to maintain a long-term perspective.

Having closely followed the crypto market for several years, I’ve learned that short-term volatility is par for the course. Despite the outflows, the BlackRock Bitcoin ETF still has a substantial $37.2 billion in inflows, which speaks volumes about the growing interest in digital assets among institutional investors.

It’s interesting to note that while IBIT saw significant outflows, other players like Bitwise’s BITB and Fidelity’s FBTC recorded net inflows during the same time. This underscores the diversity and resilience of the crypto market, where different assets can thrive simultaneously.

The fact that BlackRock’s Bitcoin ETF ranked among the top three ETF launches for 2024 in terms of net inflows is a testament to its growing popularity. However, whether the same institutional demand will continue depends on the BTC price action and the market sentiment.

I am optimistic about the future of crypto ETFs, especially given the new SEC administration’s likely approval of other crypto ETFs, such as Ethereum ETFs, combined spot BTC and Ether ETFs, and even a spot Solana ETF. I believe that 2025 could be an exciting year for crypto investors, with more opportunities to diversify our portfolios.

In the end, it’s essential to remember that investing in cryptocurrencies is like navigating a roller coaster ride – exhilarating, unpredictable, and full of ups and downs. But if you can stomach the volatility, the potential rewards could be substantial. As they say, “The best time to invest was yesterday, the second-best time is today.” So, buckle up and enjoy the ride!

As an analyst, I observed an unprecedented single-day outflow of approximately $330 million from BlackRock’s iShares Bitcoin Trust (IBIT) on January 2nd. This represents the largest such outflow above $300 million since its introduction in January 2024. However, it’s important to note that despite this significant withdrawal, the ETF still retains a substantial inflow of around $37.2 billion, managing assets valued at approximately $53.7 billion, given the current Bitcoin price. The 24-hour volatility stands at a modest 0.1%, while the market capitalization and 24-hour volume are currently at $1.91 trillion and $40.81 billion, respectively.

This week, the BlackRock Bitcoin ETF has seen three straight days of withdrawals, indicating that institutions may be taking profits following a significant annual increase. Over the past seven days, BlackRock’s IBIT has had outflows totaling $391 million.

Source: Apollo, Thomas Fahrer

On Thursday, IBIT experienced an outflow of $331 million, and Grayscale’s GBTC followed suit with a $23 million outflow. In contrast, other investment firms reported net inflows during the same period. For instance, Bitwise’s BITB recorded $48.3 million in inflows, Fidelity’s FBTC saw an inflow of $36 million, and Ark Invest’s ARKB took in $16.5 million.

BlackRock Bitcoin ETF Ranks among Top Three

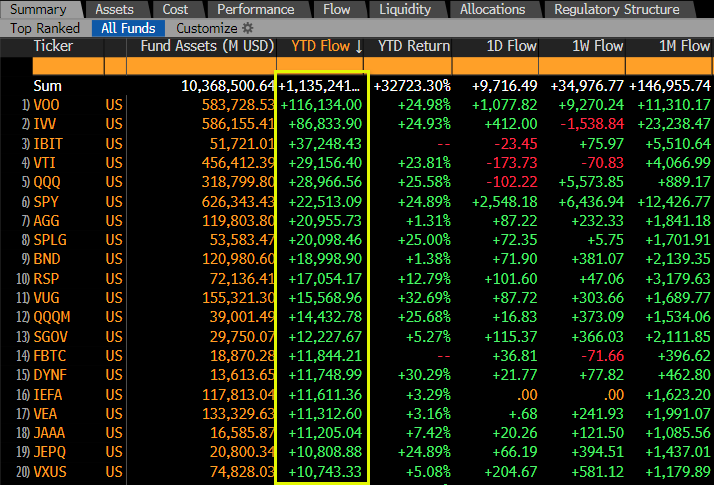

According to Bloomberg’s Senior ETF Strategist Eric Balchunas, the BlackRock Bitcoin ETF was one of the top three ETF launches in terms of net inflows for the year 2024. The Vanguard 500 Index Fund (VOO) took the lead with $116 billion in investments, while the iShares Core S&P 500 ETF (IVV) came in second with $89 billion in inflows.

Source: Bloomberg

In a discussion about advancements, Bitcoin core developer Adam Back commented: “Perhaps by the year 2025, Bitcoin Exchange-Traded Funds (ETFs) could become the leading choice due to increased investments and rising prices.

The persistence of institutional interest in IBIT by 2025 hinges on the behavior of BTC prices and public sentiment towards the asset. After reaching an all-time high of $108K, Bitcoin has been experiencing selling pressure and remains below the critical support level of $95,000.

Demand for Crypto ETFs on the Rise

As a seasoned investor with over two decades of experience in the financial markets, I have seen countless regulatory changes and shifts in market sentiment. The approval of Bitcoin and Ethereum ETFs by the SEC has been a significant milestone, opening up new avenues for institutional investors to enter the crypto market. With Paul Atkins now leading the SEC, there is a renewed sense of optimism that other crypto ETFs will follow suit. Given my personal experience in navigating regulatory hurdles and adapting to changing market conditions, I am confident that the new administration’s approach to crypto regulation will be more favorable, paving the way for further growth and innovation in this exciting space.

Nate Geraci, President of the ETF Store, recently disclosed some expectations for crypto ETFs by 2025. Among these predictions are:

1. The debut of combined Bitcoin and Ether ETFs.

2. Trading options for ETH spot ETFs.

3. In-kind creation and redemption for both Bitcoin and Ether spot ETFs.

4. Staking opportunities for spot Ether funds.

5. Approval for a Solana spot ETF.

According to Eric Balchunas from Bloomberg, it’s unlikely that more cryptocurrency ETFs will be approved prior to July, unless the Securities and Exchange Commission (SEC) chooses to expedite the process.

As a researcher, I’m excited to share that several altcoin ETF proposals are currently under consideration (in a certain country). I won’t express my personal views on the likelihood of their approval, but it’s important to note that there are no active 19b-4s for any at the moment. Historically, the process can take up to 240 days before an approval, which would extend beyond July. However, the Securities and Exchange Commission has shown the ability to expedite decisions, so we’ll have to wait and see.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2025-01-03 12:58