As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely observed and analyzed the impact of exchange-traded funds (ETFs) on the prices of Bitcoin and Ethereum. Based on my observations and understanding of the unique dynamics of each digital asset, I am confident that the upcoming launch of spot Ethereum ETFs could lead to even greater price surges than what we saw with Bitcoin.

As an eager crypto investor, I’m closely monitoring the upcoming launch of spot Ethereum Exchange-Traded Funds (ETFs). The anticipation is palpable, and Matt Hougan, the Chief Investment Officer at Bitwise Asset Management, has highlighted the significant potential for these ETF inflows to propel Ethereum prices to unprecedented heights.

As a crypto investor, I’ve recently taken note of Hougan’s insightful analysis regarding the potential influence of Exchange-Traded Fund (ETF) inflows on Ethereum’s price. These flows could potentially surpass the impact we’ve witnessed in the US market for Bitcoin spot ETFs.

Ethereum ETFs Poised To Surpass Bitcoin’s Impact?

Hougan expresses high confidence that the introduction of spot Ethereum Exchange-Traded Funds (ETFs) will significantly boost ETH‘s value, potentially reaching new peaks above $5,000. However, he issues a warning that the initial period following the ETF launch may experience volatility, as funds might shift from the existing $11 billion Grayscale Ethereum Trust (ETHE) once it is transformed into an ETF.

The experience of the Grayscale Bitcoin Trust (GBTC) could resemble a scenario where over $17 billion worth of assets were withdrawn following the approval of Bitcoin ETFs in January. Subsequently, the initial inflows occurred five months later, on May 3.

Despite the current instability in the Ethereum market, according to Hougan’s prediction, it is expected to recover and reach new highs by the end of the year once any initial turbulence subsides. This perspective can be better understood by referencing Bitcoin’s behavior in similar market conditions.

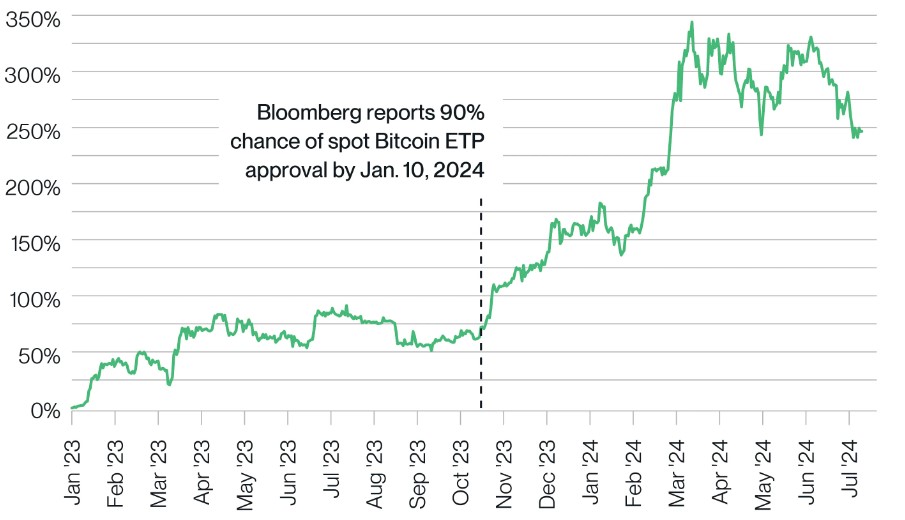

Since the launch of Bitcoin ETFs in October 2023, they have bought approximately double the amount of Bitcoin that was mined during the same time frame. This significant purchase has led to a price increase of 25% for Bitcoin since the ETF’s debut and a remarkable 110% rise from the point when the market started factoring in the launch.

According to Hougan’s perspective, Ethereum may experience a more substantial influence due to three key factors that distinguish it from Bitcoin when it comes to ETF inflows.

Lower Inflation, Staking Advantage, And Scarcity

As an analyst, I’ve noticed that one key factor Bitwise’s CIO emphasizes is Ethereum’s lower short-term inflation rate in comparison to Bitcoin. When Bitcoin exchange-traded funds (ETFs) were introduced, Bitcoin’s annual inflation rate was at 1.7%. In contrast, Ethereum’s inflation rate over the past year has been zero percent.

As a crypto investor, I’ve noticed an intriguing distinction between Bitcoin miners and Ethereum stakers. The reason being, Bitcoin miners incur significant expenses to mine new coins. Consequently, they often have to sell a considerable portion of the mined Bitcoins just to cover their operational costs.

Instead of Ethereum, which utilizes a proof-of-stake (PoS) system and has users stake ETH as collateral to validate transactions, experiences less pressure for daily selling compared to Bitcoin. This reduction in selling pressure stems from the fact that ETH stakers do not bear significant direct costs, allowing them to retain the ETH they earn without feeling compelled to sell it. According to Hougan’s analysis, Ethereum’s lower forced selling pressure differentiates it from Bitcoin.

One explanation is: The third reason arises because a significant amount of Ethereum (ETH) is being held off the market for staking and smart contracts. Approximately 28% of all ETH is currently staked, while an additional 13% is secured in smart contracts, making it unavailable for sale.

Approximately 40% of Ethereum (ETH) is currently withdrawn from circulation, leading to a significant scarcity that could potentially boost its price. This outcome hinges on the ongoing trends of outflows and inflows within the market. As per Hougan’s analysis:

Based on my previous statement, it’s reasonable to anticipate that the newly introduced Ethereum Exchange-Traded Products (ETPs) will be highly successful, attracting approximately $15 billion in new assets within their initial 18 months of operation. If these ETPs perform as well as anticipated, it’s unlikely that Ethereum (ETH) won’t attempt to surpass its previous record.

ETH was trading at $3,460, up 1.5% in the past 24 hours and nearly 12% in the past seven days.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-07-18 03:40