As an analyst with over two decades of experience in the financial sector, I have witnessed numerous market manipulations and rug pulls throughout my career. The recent allegations against Bitstamp by Dr. Artur Kirjakulov, CEO of XPMarket, raise concerns that warrant a thorough investigation.

Dr. Artur Kirjakulov, head of XPMarket, has openly criticized Bitstamp for allegedly carrying out an underhanded tactic known as a “rug pull” against the XRP community. This significant claim has sparked a heated discussion within the industry, causing concern about the trustworthiness and dependability of Bitstamp when it comes to financial tools linked with the XRP Ledger (XRPL).

Has Bitstamp Rug Pulled The XRP Community?

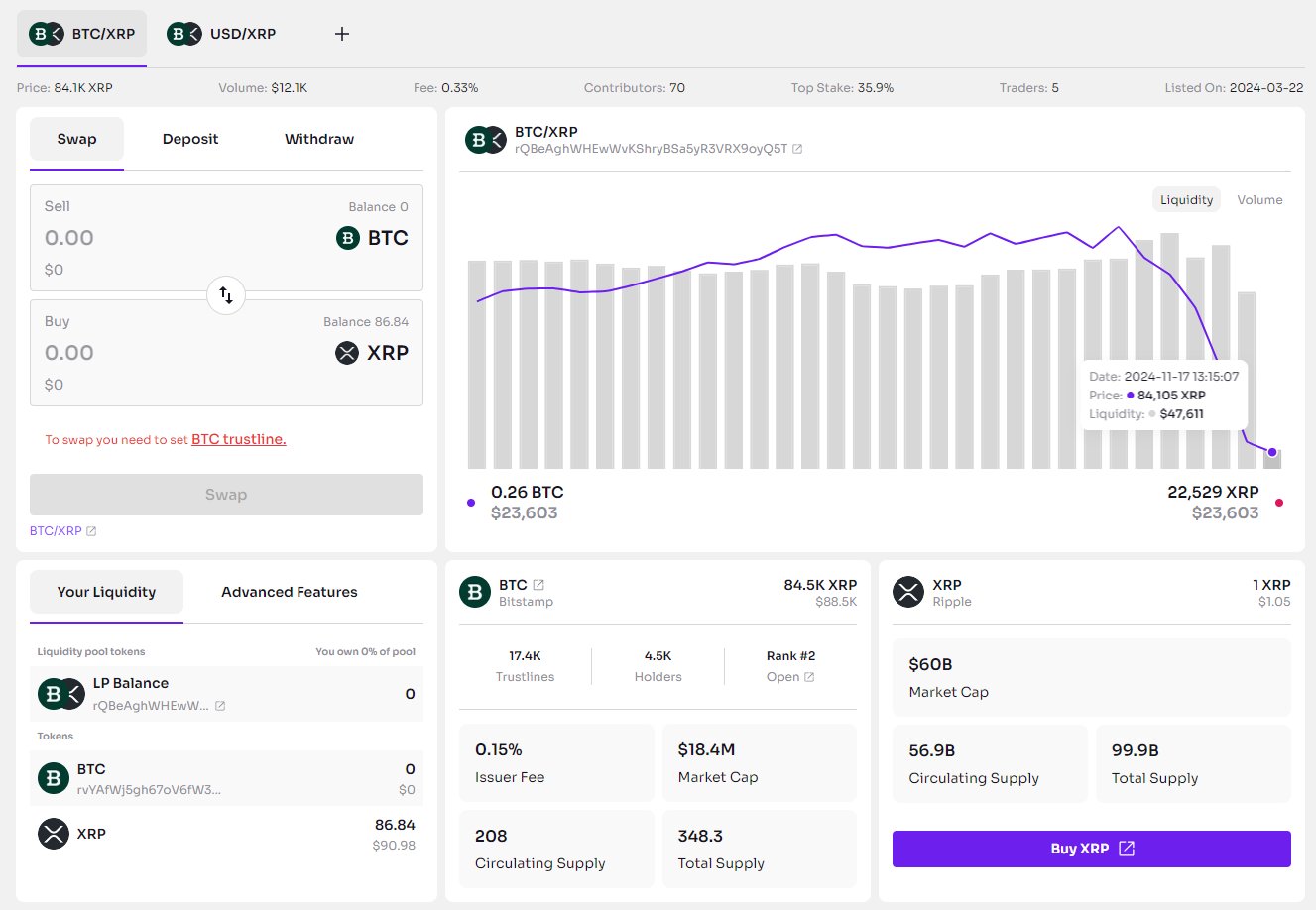

On Sunday, November 17th, Dr. Kirjakulov publicly spoke out about Bitstamp’s recent decisions. He stated emphatically that Bitstamp had “suddenly withdrawn a significant amount of liquidity from the USD/XRP and BTC/XRP Automated Market Maker (AMM) Pools,” which he described as a stealthy and unannounced move that has put the XRPL community in a vulnerable state. In simpler terms, he accused Bitstamp of “pulling a rug” on the XRPL community.

As per Kirjakulov’s perspective, the lack of any official communication from Bitstamp or RippleX increases the ambiguity about the liquidity withdrawal, which could result in highly unstable trading scenarios and substantial price fluctuations for those asset pairings.

Dr. Kirjakulov underscored the complex association between Ripple and Bitstamp, pointing out that Ripple has a percentage of ownership in Bitstamp. This link implies that Ripple’s ownership in Bitstamp could potentially impact the exchange’s strategic choices within the XRPL ecosystem. The CEO of XPMarket voiced serious worries regarding the reliability of a 1:1 swap for tokens issued by Bitstamp, bringing up the Stably case where such commitments were not kept. He underlined his concern, “How can we trust DeFi on XRPL when partners with official status make such decisions? The image is very poor.

Within the XRPL community, the allegations weren’t ignored. Daniel Keller, who serves as CTO at Eminence and acts as an XRPL ambassador, showed some doubt about Kirjakulov’s claims. Specifically, Keller expressed skepticism over the validity of the accounts linked to the liquidity pools. He raised a question, “Are we certain that’s an authentic Bitstamp account? Upon examining the activation sequence, it was set up via Binance, which seems unusual if Bitstamp manages it.

Dr. Kirjakulov explained that the accounts under scrutiny were indeed connected to Bitstamp. He elaborated, “Upon examination, it’s clear that these accounts have been involved in market-making for these specific tokens. In fact, there seems to be no other entity involved in this niche and unpopular market-making of these tokens.

He further explained that the liquidity had been pulled back to a market-making (MM) account, reinforcing his assertion of Bitstamp’s direct involvement. Kirjakulov also dismissed the significance of activation accounts, noting, “Activation account does not mean anything. I activate my account from multiple exchanges specifically to make less traceable.”

Keller insisted on receiving solid proof for the assertions. He inquired, “Could you possibly provide some examples of these related transactions? If you’ve already checked them out, it would be great if you could share. Having an active account is crucial when dealing with an exchange that serves as a liquidity provider, because it helps establish trust and transparency about your company.

Dr. Kirjakulov underscored the strong indications suggesting Bitstamp, explaining, “Indeed, it’s circumstantial evidence. However, this evidence seems to strongly point towards Bitstamp because no one else possesses such a vast quantity of these assets issued by them, except for someone closely associated with them. Overlooking this evidence based on its nature would be unwise.

The discourse extended to the topic of Bitstamp’s IOU services. Michael Nardolillo, a user on X, defended Bitstamp by highlighting its regulated status and the redeemability of its IOUs. He argued, “There’s no guarantee Bitstamp will honor their IOUs?! That’s like saying there’s no guarantee you can withdraw your crypto from an exchange. Bitstamp is highly regulated, IOUs are always redeemable they are no different than holding an asset on an exchange.”

In response to this argument, Kirjakulov expressed doubt, citing past industry shortcomings as a point of reference. He retorted, “Certainly, FTX creditors must have sighed in disbelief once more. Just like Stably before, they didn’t uphold the 1:1 conversion promise. There is no evidence on Bitstamp or GateHub records to suggest a 1:1 conversion will occur, and there is absolutely no proof of funds provided.

To strengthen his argument, Nardolillo provided a snapshot of Bitstamp’s webpage explaining their IOU service. The image demonstrates that users can move value on the XRP Ledger by receiving IOUs from Bitstamp in exchange for actual assets such as Bitcoin (BTC), US Dollars (USD), Euros (EUR), or Ethereum (ETH).

Dr. Kirjakulov pointed out a significant flaw in the setup he was referring to. In essence, he explained that this is the predicament at hand. He mentioned that there’s only one method available for the exchange, but it doesn’t address the issue of 1:1 conversion. Furthermore, he questioned what would happen if the peg were to drop by 50%. Would a swap of 1 bUSD (worth 50 cents) be exchanged for 1 USDT (which is worth 1 USD)?

As of press time, the XRP community awaits an official response from Bitstamp. XRP traded at $1.15.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-18 12:41