Bitcoin‘s Wild Spiral: Will It Crash to $70K? 😱📉

The Bitcoin price—like a wild west drifter with a drinking problem—keeps stubbornly inching downward.

It’s now hanging around $88,588, clutching its crumpled $1.756 trillion market cap like a gambler’s

last dollar. Market folks are swirling coffee, shaking heads, and muttering about how BTC is once

again doing that 2021 stunt—building up a market-top formation like a bad sequel nobody asked for.

In short, there’s a chance of another slap-worthy 10-20% drop coming this way. Y’know, just for kicks.

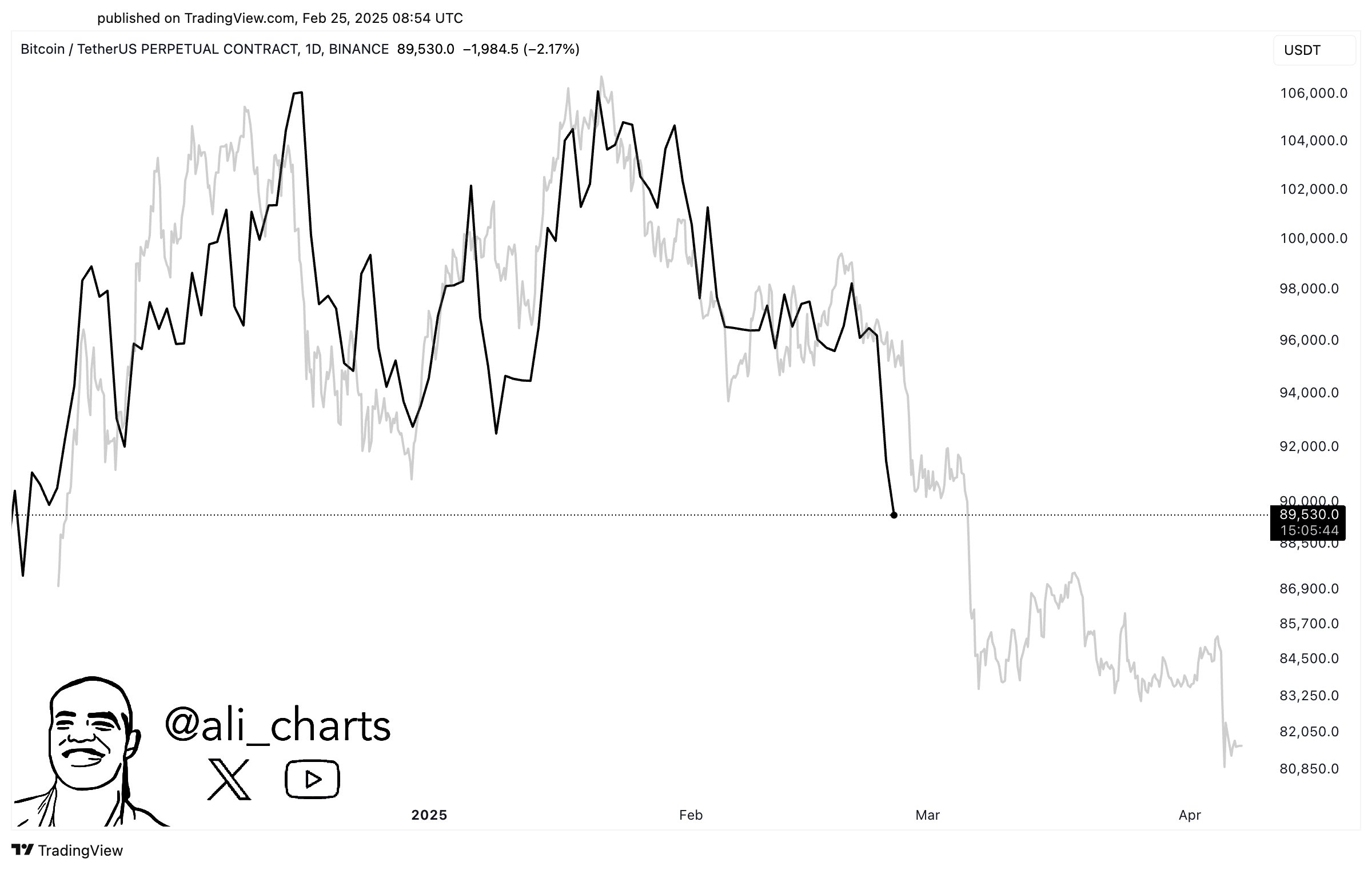

Bitcoin’s Nostalgia Kick: 2021 Market Top Flashbacks

Crypto analyst Ali Martinez chimes in, armed with charts and a grim demeanor. Apparently, our good

ol’ Bitcoin friend is tracing the same erratic patterns as it did back in 2021, when it thought it

could reach for the stars but slipped on a banana peel instead. Martinez predicts BTC might dance in

place for a while—like someone nervously waiting in line at the DMV—before *wham!* another potential

tumble.

Source: Ali charts. Don’t shoot the messenger 😬.

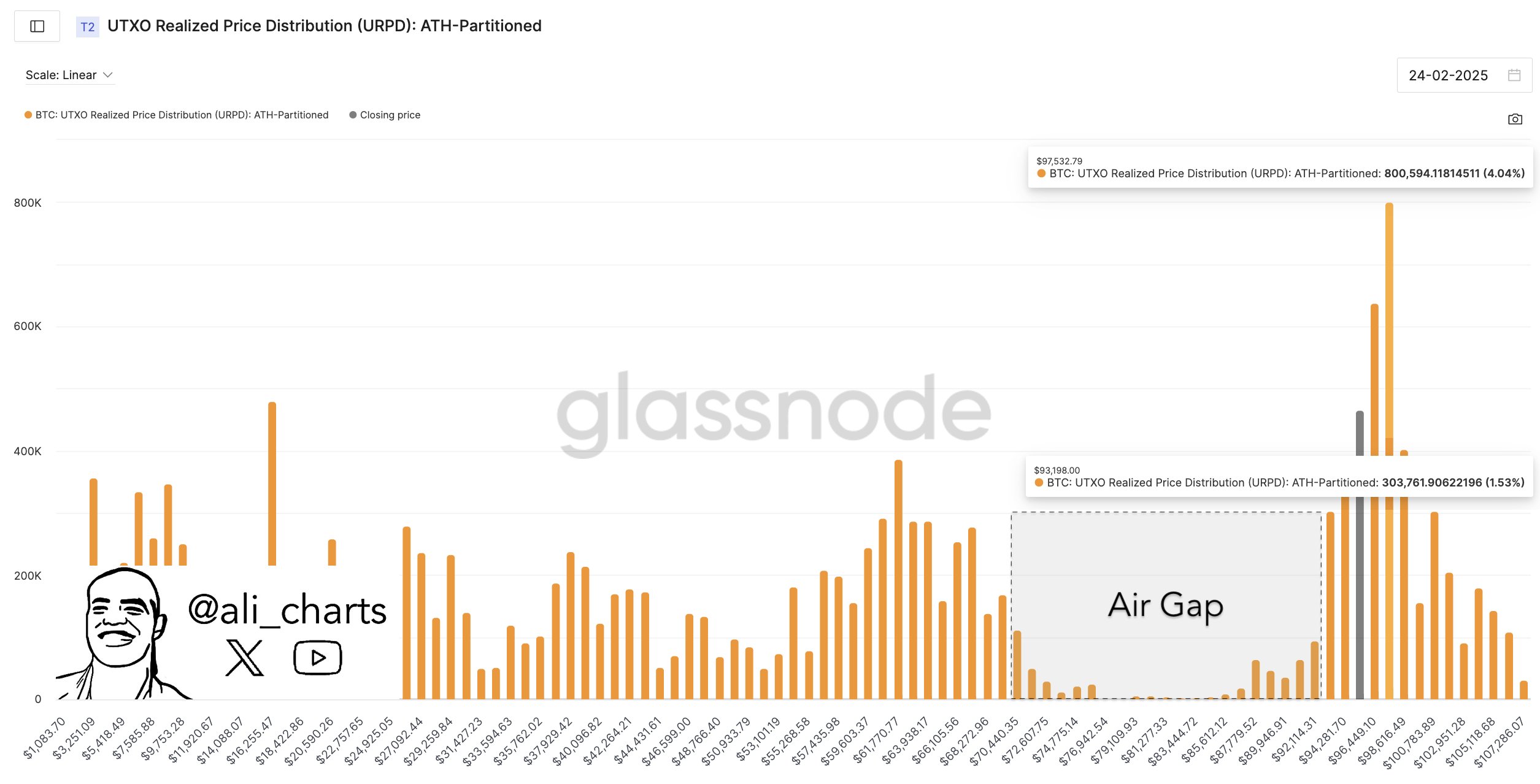

Ali also threw a little scare our way, warning how BTC keeps losing crucial support levels like a rowdy

kid forgetting their math homework. The next major support? $93,198. But watch out—fall under that, and

it’s like someone just opened a trapdoor. The next thing you know, BTC could drop 10 floors straight to

$70,440. And guess what? It’s already living below that comfy support line, with CoinGlass data showing

open interest is feeling queasy, dropping 1.34% to $56.69 billion.

Source: Glassnode. Fancy graphs, sad stats 😓.

Arthur Hayes Chimes In: More Doom, Just in Case

BitMEX co-founder Arthur Hayes—never one to sugarcoat things—shared his thoughts amid the delightful

circus that is US politics. According to Hayes, BTC might decide to nosedive to pre-election levels

around $70,000–$75,000 if former President Trump can’t get his budget passed. Yep, it’s budget chaos

time again, folks! Hayes advises traders to “chill out, retrace, and wait” like it’s the apocalypse

but with popcorn.

On top of that, investors are pulling money out of spot Bitcoin ETFs faster than you can say “Oops.”

Net outflows hit $937 million, with Fidelity’s FBTC leading the charge (or retreat?) at $344 million

and BlackRock’s IBIT close behind at $164 million. Apparently, when calm waters turn murky, everyone

grabs the lifeboats.

Meanwhile, the inflation monster’s still roaring, and the Fed seems to think “rate cuts” is some

sort of forbidden magic spell. All in all, traders are left without a decent catalyst in sight,

sipping cheap coffee, and bracing for whatever comes next.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

2025-02-26 12:42