Ah, Bitcoin. The cryptocurrency that’s like that friend who promises to pay you back but then mysteriously vanishes when the bill arrives. Just yesterday, it plummeted to a staggering $87,000, and if you believe the on-chain data, it might just be warming up for a deeper dive. 🏊♂️

Bitcoin’s Support Level: Gone Like My Willpower at a Buffet

In a recent post on X (formerly known as Twitter, because who doesn’t love a good rebranding?), the analytics wizards at Glassnode decided to share their thoughts on Bitcoin’s latest tantrum. Spoiler alert: it’s not pretty.

First up, we have the Realized Price of short-term holders. This fancy term tracks how much the average investor paid for their Bitcoin. Think of it as the price tag on that impulse buy you regret the moment you get home. If Bitcoin is trading above this price, congratulations! You’re in the green. If it’s below, well, welcome to the club of collective regret. 🎢

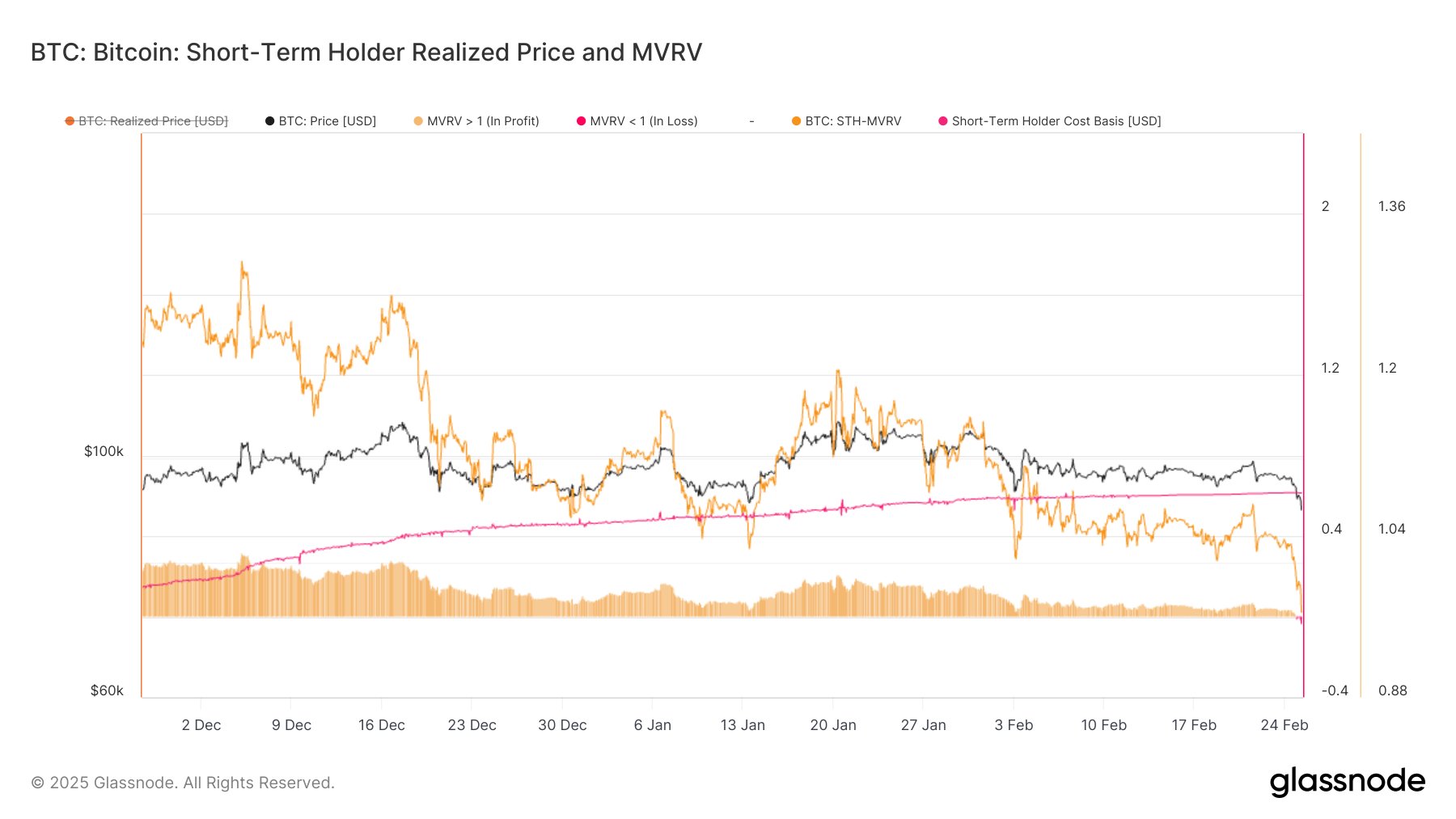

Now, let’s focus on the short-term holders (STHs)—those brave souls who bought their coins in the last 155 days. Here’s a chart that shows their Realized Price trend over the past few months:

As you can see, Bitcoin was once the belle of the ball, dancing above the STH Realized Price. But with the latest crash, it’s like the party ended early, and everyone’s left with soggy hors d’oeuvres. 🍴

The STH Realized Price is currently sitting at $92,500, which means our short-term friends are now nursing an average loss of over 6%. Glassnode warns that if Bitcoin doesn’t bounce back, we might see a sell-off that would make Black Friday look like a gentle stroll through the park.

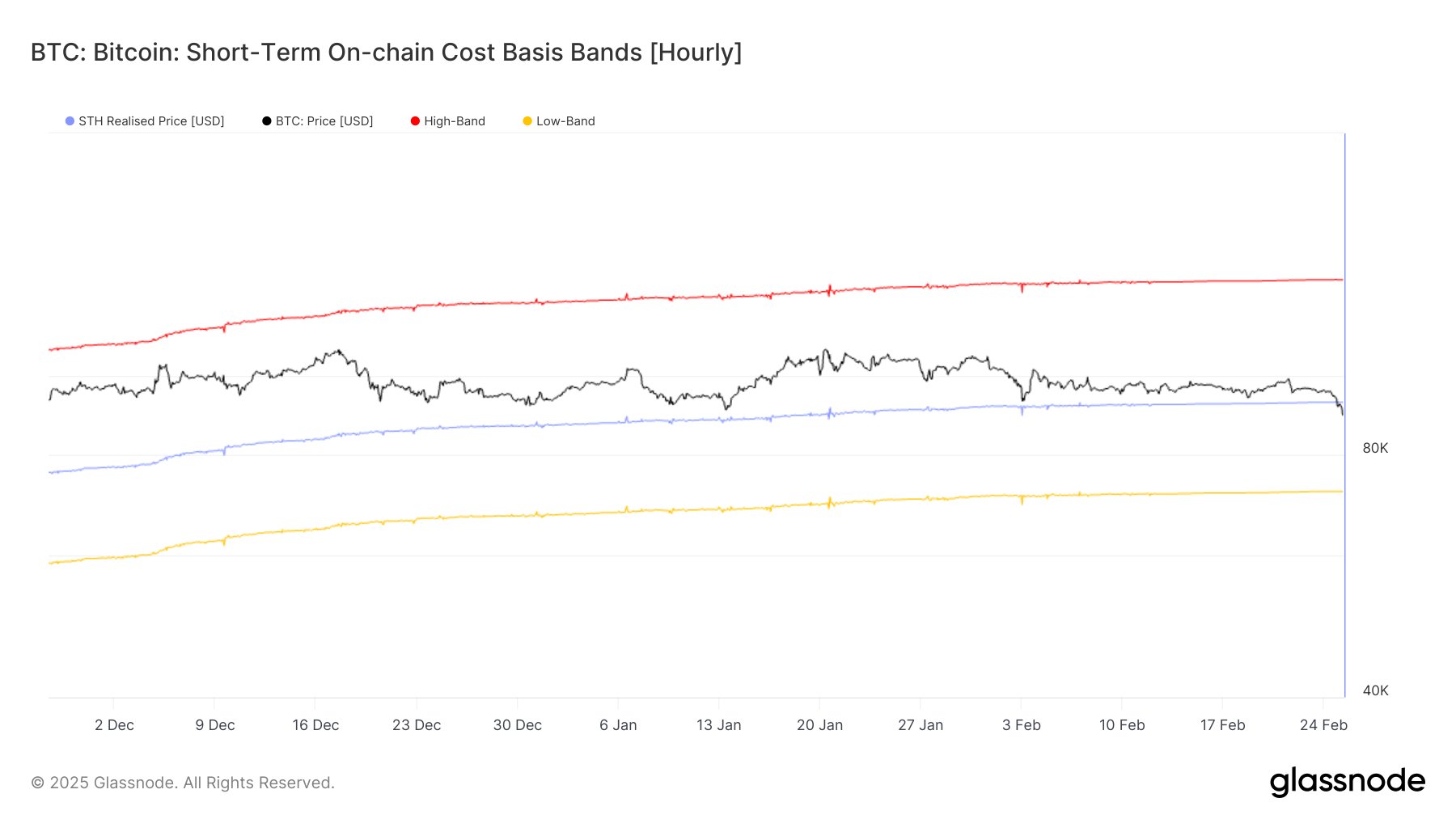

Now, how low can it go? Well, if history is any guide, we might be looking at a price drop that mirrors past corrections. According to Glassnode, Bitcoin has a habit of falling one standard deviation below the STH Realized Price after an all-time high. Here’s another chart to illustrate this delightful trend:

Currently, this ominous price band hovers between $71,000 and $72,000. If history repeats itself, we might just find Bitcoin taking a leisurely stroll down to that range. 🥴

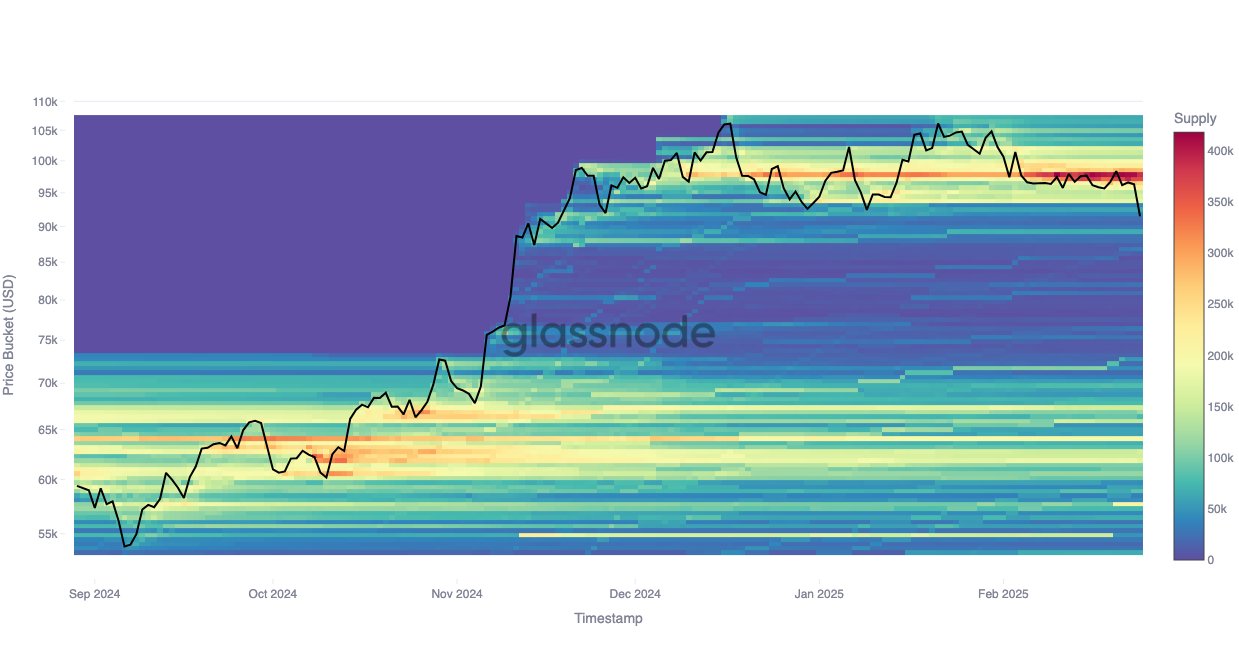

And let’s not forget the Cost Basis Distribution, which is just a fancy way of saying where most investors bought their Bitcoin. Spoiler: it’s not pretty either.

From the chart, it’s clear that a lot of investors bought in above $87,000. Below that? Crickets. This could mean that if Bitcoin dips into the $71,000 to $72,000 range, it might not have much support left, giving the bears a chance to throw a wild party. 🐻

BTC Price: The Current State of Affairs

As I write this, Bitcoin is floating around $87,200, down more than 7% over the last week. It’s like watching a soap opera—just when you think it can’t get any more dramatic, it does. Stay tuned! 📉

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best Heavy Tanks in World of Tanks Blitz (2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

2025-02-26 12:41