Oh, dearie me! Bitcoin, that cheeky little rascal, is prancing about at a whopping BTC $84,141! But wait, hold your horses! It’s trading at a delightful discount of nearly 25% from its all-time high of $109,350. What a bargain! 🤑 Currently, our beloved Bitcoin boasts a market cap of $1.61 Trillion, while the entire crypto market is feeling a bit under the weather at $2.66 Trillion.

As the market takes a nosedive, the rising Fear, Uncertainty, and Doubt (FUD) sentiments are waving their red flags, warning of a major crash ahead. But will the global market’s rising liquidity be the knight in shining armor to save the day? 🦸♂️

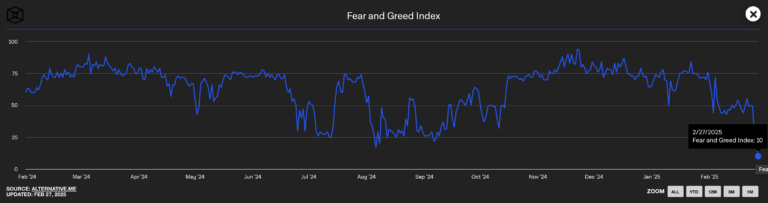

Extreme Fear Grips the Crypto Market

Oh, what a fright! The crypto market is gripped by a wave of fear, like a child who’s just seen a ghost! 👻 The fear and greed index has plummeted to a shocking value of 10, marking a sudden shift in market sentiments over the past two months. Talk about a rollercoaster ride!

Crypto Market Liquidations Near $1 Billion

Despite the whispers of a bullish comeback, Bitcoin is currently wearing its grumpy pants. The liquidations in the crypto market are teetering on the edge of a billion dollars over the past 24 hours. Yikes! 😱

Right now, the 24-hour liquidations stand at a staggering $993.16 million, with long liquidations making up a hefty $818.16 million. The short liquidations are just a wee bit shy at $174 million. Poor Bitcoin has seen a total liquidation of $491.68 million, with long liquidations accounting for $415.09 million and short liquidations at $76.59 million.

Raoul Paul Marks Correlation in Bitcoin and the 10-Week M2 Lag

Now, let’s talk about Raoul Paul, the CEO of Real Vision, who’s got his eyes on the prize! He’s spotted a rather astonishing relationship between the global M2 money supply and Bitcoin price movement. According to his latest X post, Bitcoin’s price is doing a little dance influenced by the Global M2 line, with a lag of about 10 weeks. How very peculiar! 🕺

I will put out a Flash Update video later today with more details but the Global M2 vs BTC chart has largely played out now. Patience.

Volatility is the price you pay for the returns…

— Raoul Pal (@RaoulGMI) February 28, 2025

According to the chart, Bitcoin’s price movement is like a puppet on a string, strongly influenced by the Global M2 supply line. With a surge in M2 supply, Bitcoin might just bounce back like a rubber ball! But beware, the 10-week lag is lurking like a sneaky cat! 🐱

The ongoing Bitcoin price fall is closely tied to the M2 money supply line, which has dipped from $108 trillion to nearly $104 trillion in early 2025. With the 10-week lag, Bitcoin’s price correction was long overdue. However, the M2 supply line has recently bounced back to nearly $107 trillion. So, hold onto your hats, folks! A consolidation phase is likely before a bullish comeback! 🎩

The Global M2 Money Supply refers to the total amount of available money circulating in the global economy. This includes both liquid cash and easily accessible highly liquid financial assets. The M2 Money Supply is a key indicator of the financial content of the broader market and global liquidity. And there you have it, folks! What a wild ride

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2025-02-28 18:35