Well, would you believe it? Bitcoin, the darling of digital daredevils, has decided to play hard to get — with its coins vanishing faster than a waiter at a wedding. The available coins for trading have plummeted, making fortune-hunters clutch their pearls and their wallets in anticipation. As demand clings on with the tenacity of a terrier, those prices might just do a Houdini and shoot up, no questions asked.

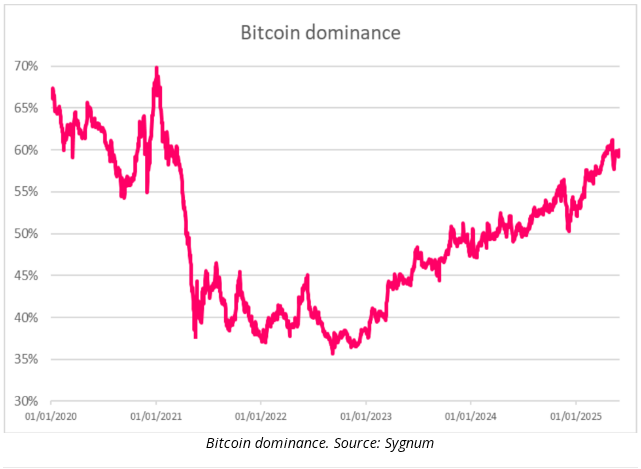

According to the venerable Sygnum Bank’s June 2025 Monthly Investment Outlook (a real page-turner), the liquid supply of Bitcoin has shrunk by approximately 30% over the last year and a half — nearly 1 million BTC have simply vanished from exchange shelves. That’s right, folks, fewer coins are now on the market than a modest garden gnome at a British garden party. These coins, once easily swiped, have mostly hopped into cold storage, long-term vaults, or fancy new exchange-traded funds — basically, they’ve gone into hiding, leaving traders competing for scraps like cats at a tin can auction.

Liquid Supply Tightens — Can You Feel the Tension?

Since late 2023, exchange balances have taken a nosedive by around 1 million BTC, which is roughly 5% of the entire Bitcoin stash — a veritable game of hide-and-seek. Many of these coins have been tucked away into vaults or dolloped into corporate coffers, as if the world’s billionaires were playing their own high-stakes game of Monopoly with real money. Naturally, the dwindling supply turns the trading floor into a mad scramble, setting the stage for price swings more volatile than a toddler on a sugar high.

Big Players and Government types Join the Party — Who Knew?

In a twist straight out of a Bollywod plot, three US states (including the ever-swaggering New Hampshire) have now made it official — holding Bitcoin as part of their reserves. Texas, that land of rodeos and oil, is expected to follow suit faster than you can say “Howdy.” Meanwhile, overseas, Pakistan’s government has hinted it might dive into Bitcoin reserves, and the UK’s Reform Party — who are currently polling higher than a puppy at a birthday party — is eyeing similar moves. When governments buy some Bitcoin, it’s like giving the market a big royal wave, stirring up more buying fervor and telling Wall Street that perhaps, just perhaps, Bitcoin isn’t just a passing fancy.

Safe-Haven or Just a Fancy Insurance Policy? 💰

With the US dollar wobbling on its heels and debt ceilings looking more creaky than an old ship, investors are seeking ballast — and Bitcoin is top of the charts. Particularly when the US Treasuries look shaky, “digital gold” gets more love than a puppy in a park. The latest data suggests that when The U.S. dollar takes a tumble, big players dump dollars and dive into crypto faster than you can say “Rothschild.” Larger swings upward than downward indicate that the big cats are soaking up dips with a gusto that would make a vacuum cleaner proud. It’s almost as if Bitcoin has become the new “big bad wolf” of financial safety nets.

Since June 2022, Bitcoin’s upward leaps tend to outstrip its downward dips, hinting that the institutional bigwigs are chummier with crypto than cats are with cucumbers. Confidence, my dear Watson, confidence.

Ethereum isn’t just sitting around twiddling its virtual thumbs anymore, no sir! With the recent Pectra upgrade, fees have grown fatter, and interest has begun to sprout like mushrooms after rain. Major banks and financial firms are now flirting with the idea of tokenization platforms — basically, turning assets into digital tokens faster than a chef whips up an omelette. When Ethereum kicks into higher gear, it tends to spill some of that exuberance over into Bitcoin, potentially ruffling the market’s feathers and adding a dash of demand to top-tier coins.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-06-05 14:11