As a researcher with a background in cryptocurrency and blockchain technology, I find the recent decrease in Bitcoin mining difficulty and the corresponding drop in hash rate quite intriguing. The data presented indicates that this is the largest adjustment observed over the past 18 months, which is significant for the Bitcoin network.

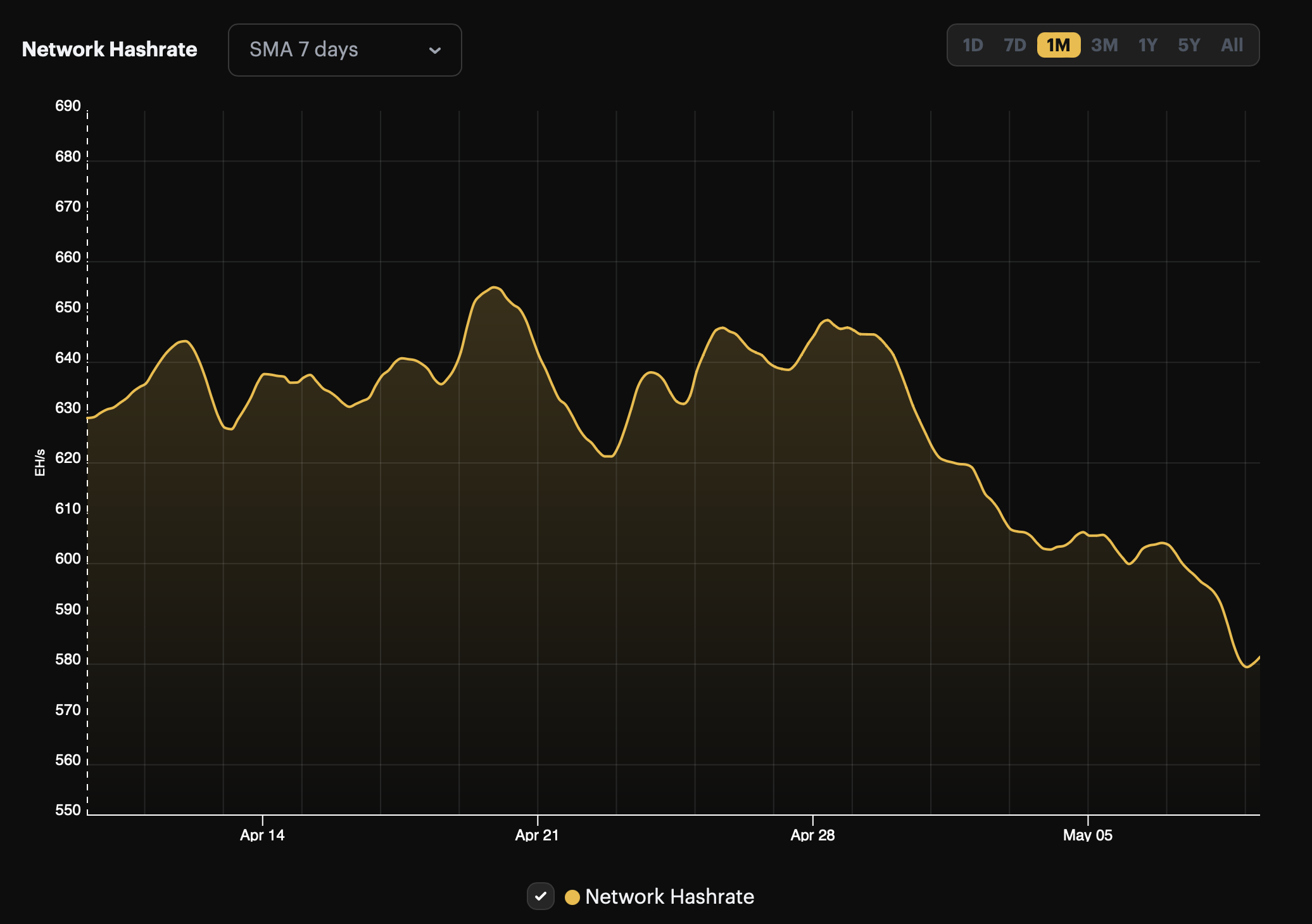

As a researcher studying the Bitcoin network, I’ve noticed a substantial decrease in mining difficulty – the largest drop observed over the past 18 months. This change is directly linked to the network’s hash rate, which has dipped below the 600 Exahash per second (EH/s) mark following the recent halving event.

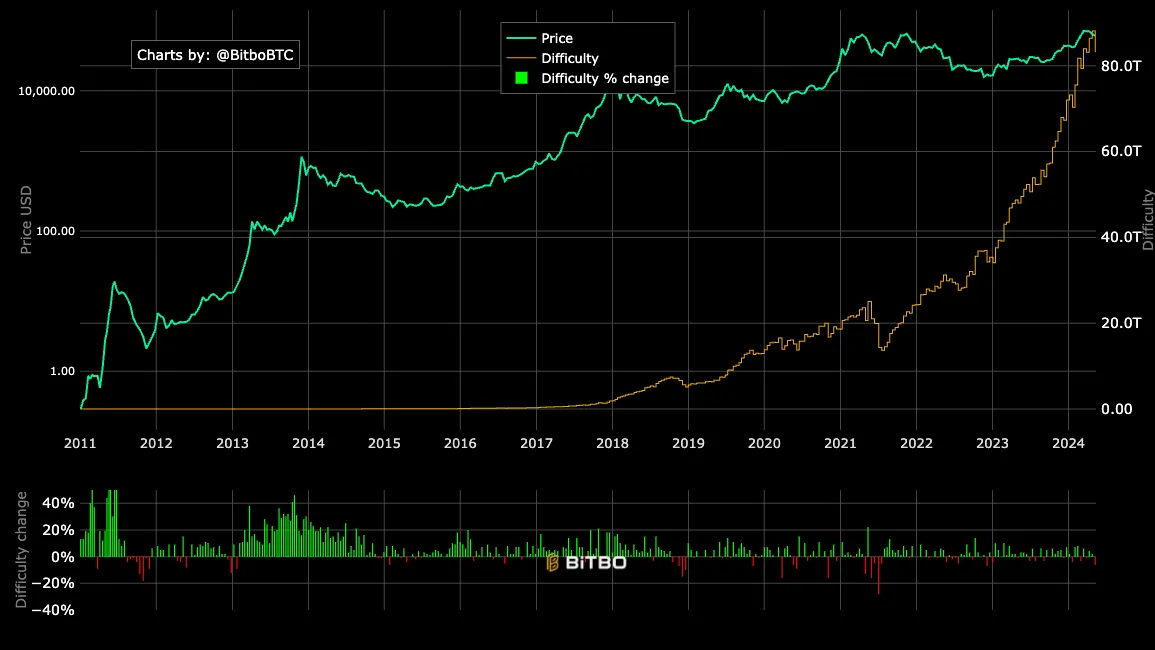

The 5.7% decrease in mining difficulty results in a new level of 83.1 trillion, as indicated by Bitbo’s data.

The significant change observed since late 2022 represents larger trends in the Bitcoin mining sector. In December 2022, the price of Bitcoin was approximately $17,000, a stark comparison to its present value.

Significantly, the mining difficulty – a measure indicating the level of complexity involved in discovering a new block – adjusts roughly every fortnight or following the completion of approximately 2016 blocks. This mechanism maintains a steady block discovery pace, averaging around ten minutes, regardless of the miner population size.

Impact On Miners And Market Dynamics

After a decrease of 10% in the network’s hash rate over the past week, from an average of 639.58 Exahashes per second (EH/s) to 581.74 EH/s, there has been a noticeable reduction in mining difficulty.

The reduction in mining power caused blocks to take an average of around 10 minutes and 36 seconds to be mined, which is longer than the usual 10-minute interval, prior to the network’s difficulty level being adjusted at block height 842,688.

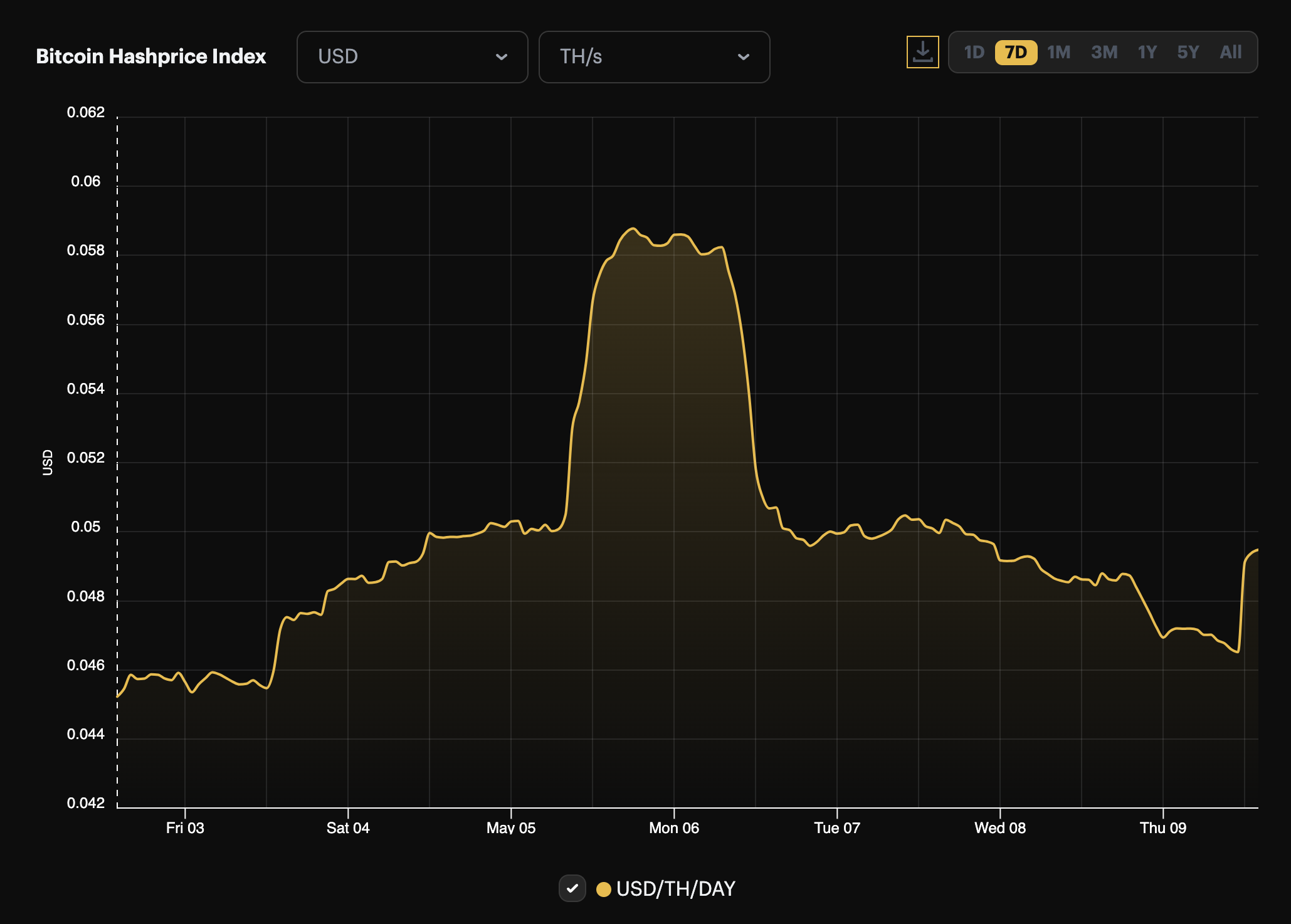

As a crypto investor, I’ve noticed that the decrease in hash rate led to a drop in the hash price, reaching approximately $0.049 per TH/s per day.

The decrease in this area affects miners’ financial gains since the hash rate price, a term coined by Bitcoin mining company Luxor, denotes the daily earnings a miner can obtain for each unit of mining power.

As a crypto investor, I can tell you that today’s downward difficulty adjustment comes as a breath of fresh air for miners. This means that mining new blocks will now be less challenging compared to the past two weeks. The adjustment aims to restore the balance between the mining network’s computing power and the desired block confirmation time, making it an essential part of Bitcoin’s stability.

Bitcoin Market Reactions And Investment Trends

When Bitcoin’s price exhibits instability, experiencing a drop of approximately 16% from its peak at around $73,000 in March to its current trading value of roughly $61,376, mining difficulty and hash rate undergo adjustments.

The decrease in this metric aligns with the larger pattern observed in mining difficulty, implying a potential connection between the two data points.

The Bitcoin spot ETF market has seen a decrease in trading activity as of late. According to Soso Value’s data, most funds have reported negligible net gains or losses. However, the Bitwise Bitcoin ETF was an exception, experiencing inflows the previous day.

As a researcher studying the Bitcoin exchange-traded fund (ETF) market, I’ve discovered some interesting data from May 8th. The total net inflow for Bitcoin spot ETFs amounted to $11.5409 million. Specifically, Bitwise ETF (BITW) experienced a single-day inflow of this magnitude. In contrast, Grayscale ETF (GBTC) did not record any inflows or outflows on that day. The combined net asset value of all Bitcoin spot ETFs reached $51.504 billion.

— Wu Blockchain (@WuBlockchain) May 9, 2024

As a researcher studying the cryptocurrency market, I have observed a noteworthy trend that could indicate a decreasing enthusiasm among investors towards Bitcoin investments or perhaps a strategic shift in response to the latest price fluctuations and mining adjustments.

Feature image from Unsplash, Chart from TradingView

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-05-09 23:10