Ah, the price of Bitcoin, that elusive creature, now frolicking at a modest BTC $96,321. One might say it’s like a cat on a hot tin roof, with a 24h volatility: 0.7% and a market cap: $1.91 T.

It seems our dear Bitcoin has once again teased the crucial support range between $94K and $95.7K, like a flirtatious debutante at a ball, signaling that sellers are gaining ground. The flagship coin has taken a tumble of more than 2% since the week began, now trading at about $95,746 on this fine Wednesday, February 19, during the mid-London session. One can only imagine the drama unfolding in the crypto salons!

Since the second inauguration of President Trump, Bitcoin has led the crypto market into a bearish waltz. As Coinspeaker so eloquently put it, BTC is forming a potential reversal pattern, characterized by a double top around $108K and a bearish divergence of the weekly Relative Strength Index (RSI). Quite the dance, wouldn’t you agree?

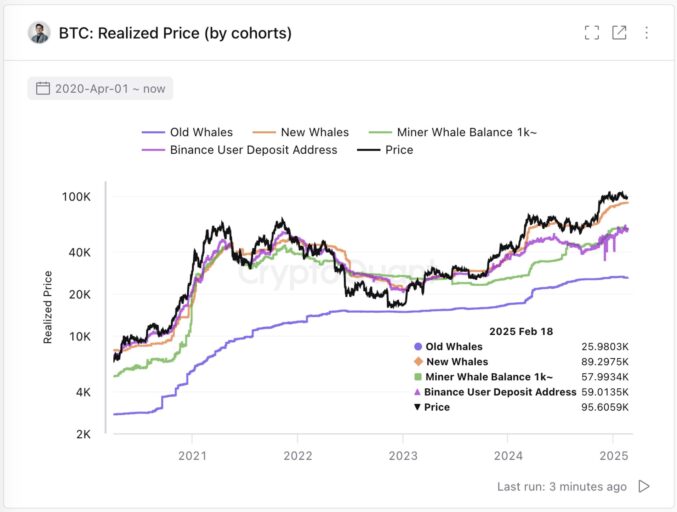

Market data from Cryptoquant reveals that Bitcoin is inching closer to a major support range between $91K and $95K, where the 111-day moving average, SMA 111D at $95K, meets the price at which short-term holders have realized their profits or losses, the STH Realized Price at $91K. A meeting of the minds, if you will!

Bitcoin Whales Show Low Appetite 🐋

It appears that the appetite for Bitcoin among our whale investors has significantly waned in recent weeks, much like a fine wine left uncorked. According to CoinGlass, the overall supply of Bitcoin on centralized exchanges has increased by nearly 54k in the last four weeks, now hovering around 2.24 million. A veritable buffet of Bitcoin, yet no one seems hungry!

This increase on CEXes is largely due to notable cash outflows from the US spot Bitcoin ETFs. On Tuesday, the US spot BTC ETF recorded a net cash outflow of about $60 million. Meanwhile, BlackRock’s IBIT continues to nibble away, recording a net cash inflow of about $68 million on Tuesday. It seems some are still feasting while others are fasting!

Fundamental Aspects 📈

The Bitcoin network has blossomed into a robust ecosystem, much like a well-tended garden, supported by institutional investors and clearer regulatory frameworks in 2025. The United States and European countries are leading the charge in mainstream adoption, with institutional investors and positive regulatory frameworks sprouting like daisies.

As Coinspeaker noted, over 20 states in the US have proposed the implementation of a strategic Bitcoin reserve, led by Texas, Florida, Massachusetts, and Wyoming. The success of El Salvador in its Bitcoin strategy has convinced more central banks to consider Bitcoin as digital gold. Who knew that gold could be so… digital?

Over the past few years, the BTC hashrate has continued to grow exponentially, now hovering at about 792 Ehash/s, up around 1.1 percent in the past 24 hours. The involvement of nation-states and institutional investors in BTC mining has fortified the Bitcoin network, making it as sturdy as a well-built dacha.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-02-19 13:24