So, Bitcoin (BTC) is hitting new all-time highs (ATH), like, you know, $118,869 on Binance. But here’s the kicker: it’s doing it without the usual fanfare. 🎉 Like, where are all the retail investors? Are they on a different planet? The lack of retail-driven hype suggests there might still be some room for growth in this crypto darling.

Bitcoin’s ATH: A Party Without the Guests?

According to a recent CryptoQuant Quicktake post by burakkemeci, Bitcoin’s current rally is surprisingly devoid of retail investors. The post argues that this absence of retail participation means BTC might still have some serious upside potential. Like, how does a party get better without the guests? 🤔

The analysis focuses on the Spot Retail Activity Through Trading Frequency Surge metric, which tracks how often retail traders are buying and selling Bitcoin. The analyst shared a chart to show the trend. Check it out:

When retail trading activity spikes compared to the one-year moving average (MA), the chart forms bubbles. Green bubbles mean there are very few retail investors in the market. Orange bubbles show that retail activity is picking up, and red bubbles are a warning sign that there are too many retail investors, suggesting it might be time to cash out. 🚨

But here’s the thing: retail activity remains pretty low, even as BTC keeps hitting new ATHs. The metric has been in the gray zone since March 2024, indicating a lack of mass retail entry. It’s like a concert where the headliner is on stage, but the crowd hasn’t shown up yet.

Historically, retail trading surges as BTC approaches or exceeds ATH levels. The analyst notes that this absence might mean the cycle top is still ahead:

The bull market is still largely driven by institutions and exchange-traded funds (ETFs). When retail finally enters the scene, that might mark the beginning of the final phase. 🚀

BTC: The Quiet Giant

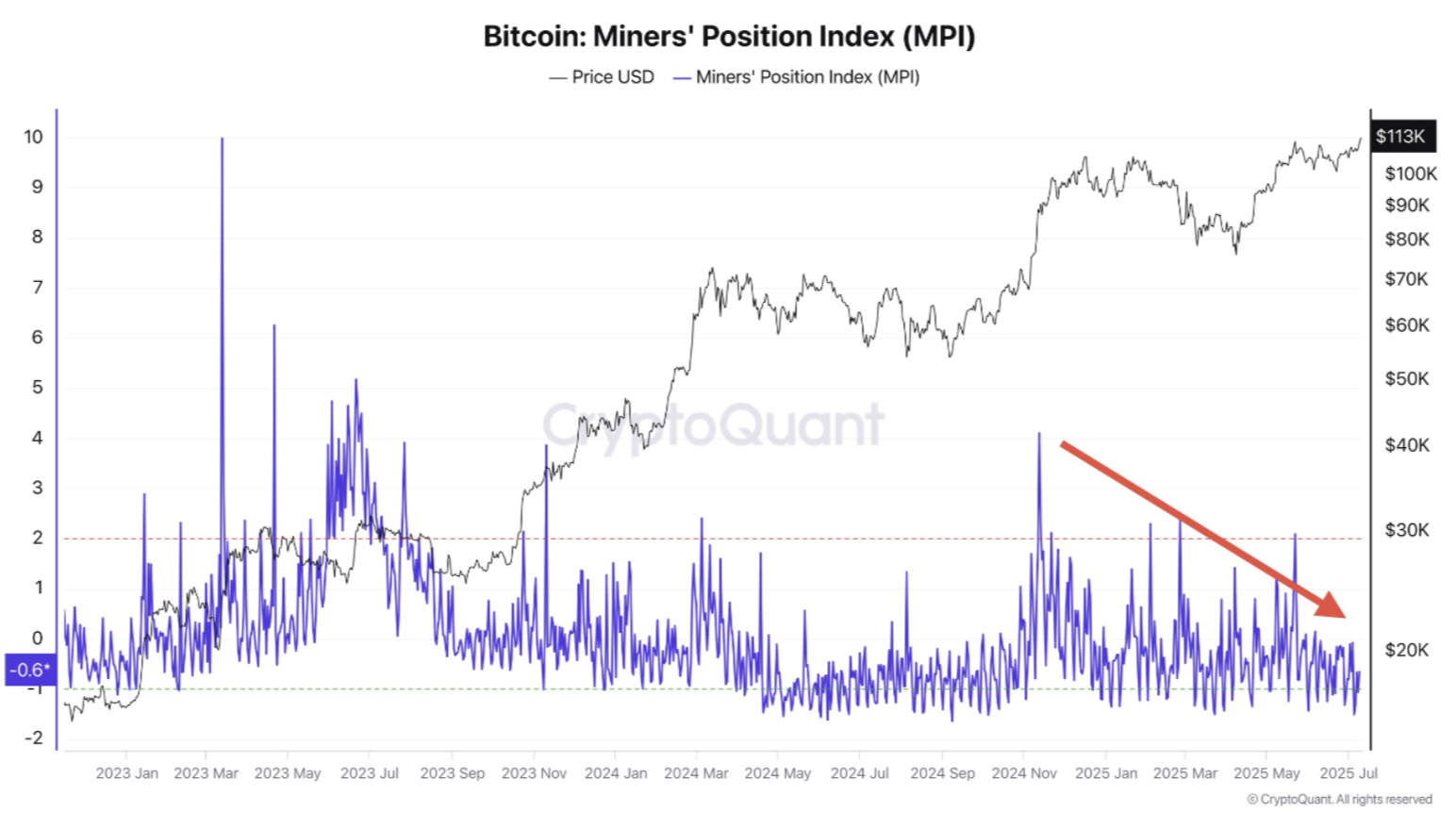

Aside from the low retail presence, other on-chain indicators suggest that Bitcoin’s current rally isn’t overheating. For instance, the Miner Position Index has been declining since November 2024, indicating that miners are selling less. Like, they’re holding onto their BTC for dear life. 🤝

Another key metric, the Market Value to Realized Value (MVRV) ratio, is holding steady around 2.2 – below the 2.7 levels seen during ATHs in March and December 2024. Analysts predict the next significant resistance might be around $130,900. So, we might not be at the peak just yet.

Despite the weak selling pressure and limited retail activity, some recent exchange trends hint at a possible short-term pullback. At the time of writing, BTC is trading at $117,746, up a solid 6% in the past 24 hours. So, it’s still a wild ride, but maybe the best is yet to come. 🌟

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

2025-07-12 05:11