As a researcher with experience in Bitcoin mining and cryptocurrency markets, I find the recent trend of the hash price reaching unprecedented lows following the latest Bitcoin halving event quite concerning. The decrease in potential miner earnings, coupled with the market volatility, has added pressure on an already struggling sector.

The profitability of Bitcoin mining is greatly impacted by a measurement called “hash rate price” or simply “hash price.” Lately, this figure has dropped drastically, leading to worry among miners.

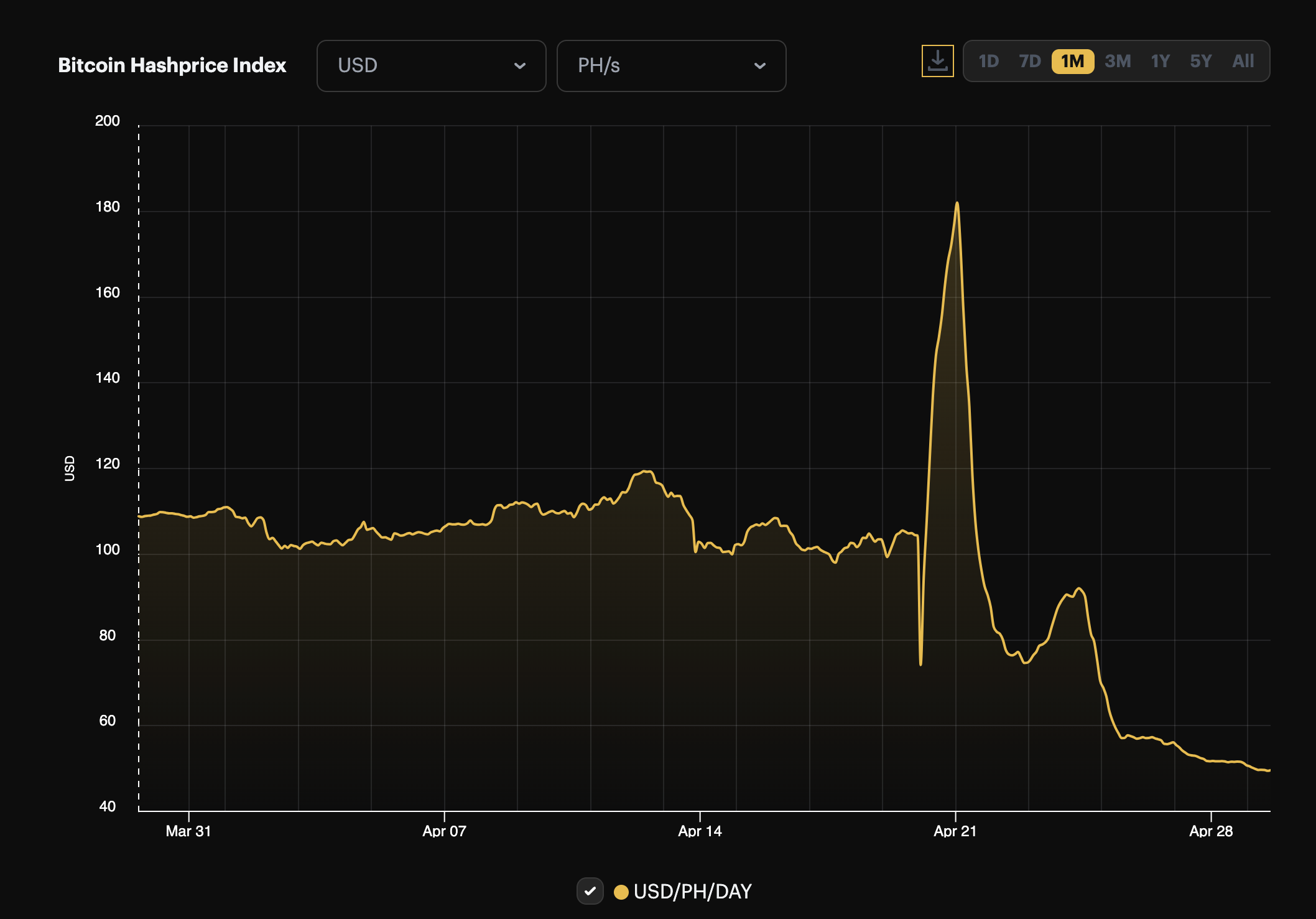

Bitcoin’s Latest Halving Sends Hash Price Into Freefall

During Bitcoin’s fourth halving on April 20th, there was much anticipation that miner income would rise. Yet, surprisingly, the hash rate price took a sharp downturn and is now below $50 per PH/S daily.

Hash price, a term coined by Luxor, a Bitcoin mining services provider, serves as a useful tool for estimating the daily US dollar revenue a miner can generate with each hash rate unit.

Even with Bitcoin’s hash rate staying robust, the mining reward reduction from 6.25 BTC to 3.125 BTC per block due to the halving event has put pressure on the essential profitability measure.

As a crypto investor, I’ve noticed that the potential returns on my investments have decreased recently due to market volatility affecting Bitcoin and other cryptocurrencies.

The drop in hash rate for Bitcoin isn’t occurring in isolation; it aligns with other declining indicators in the cryptocurrency. As per TradingView, Bitcoin’s dominance index has decreased, suggesting a reduction in its capitalization share compared to the entire crypto market.

The proportion of the total cryptocurrency market that Bitcoin represents has decreased from roughly 57.1% mid-month to around 54.69% currently. At the same time, Bitcoin’s value in the market has dropped. Over the past week, there was a nearly 4.4% decrease in Bitcoin’s worth.

This downward trend persisted into the past day, with Bitcoin’s price dropping an additional 0.8%.

Signs Of A Bullish Future Amid Bitcoin Current Slump

As a crypto investor, I’ve been keeping a close eye on the market’s ups and downs lately. Despite the recent bearish trend, analysts like those from CryptoQuant have offered some encouraging signs. They believe that bullish indicators may still be in play, and they back up their claim with data on the Adjusted Spent Output Profit Ratio (aSOPR). Even though the market is currently indecisive, the aSOPR continues to exhibit bullish trends. This means that investors who spent coins at a profit during previous market cycles are accumulating more coins at lower prices, which could lead to a potential price rebound in the future.

Additionally, according to the insights of seasoned Bitcoin analysts such as Rekt Capital, this ongoing halving event may lead to a substantial price increase for Bitcoin over the long term. They make comparisons to past cycles to support their prediction.

As a researcher studying the bitcoin market, I’ve discovered some intriguing trends based on historical data. Specifically, I’ve noticed that Bitcoin tends to reach its market peak around 500-550 days after each halving event. If we apply this pattern to the current situation, it suggests that substantial gains for Bitcoin could be on the horizon around mid to late 2025. This observation underscores the cyclical nature of Bitcoin’s market movements.

In summary, although the initial impact on hash rate and market conditions following the halving may seem dismal, the hidden data conveys a blend of warning signs and hopeful indicators.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-04-30 05:10