As a seasoned researcher with a keen interest in the crypto sphere, I find Willy Woo’s analysis both intriguing and thought-provoking. Having closely followed Bitcoin’s trajectory since its early days, I can attest to the rollercoaster ride it has been for us all. However, what sets Woo apart is his ability to provide nuanced insights into the asset’s potential growth, grounded in realistic assumptions and economic behaviors.

Bitcoin has experienced a series of ups and downs since it peaked at its record high of $73,737 in March. Despite these fluctuations, many analysts and traders within the cryptocurrency community continue to express a positive outlook for the asset. One such individual is Willy Woo, a prominent figure in the crypto world. Today, Woo expressed his optimistic perspective on Bitcoin and offered insights into how high its price might rise to reach this predicted peak.

Bitcoin Road To $700,000: Tough Or Smooth?

According to Woo in his latest post on Elon Musk’s social media platform, X, Bitcoin’s price projection can range dramatically based on the percentage of global wealth assets allocated to Bitcoin. In his explanation, Woo outlined two possible future scenarios for Bitcoin’s valuation: a more probable lower band and a highly unlikely upper limit.

Related Reading: Bitwise CIO On Bitcoin: ‘We’re Not Bullish Enough’ – Here’s Why

The expert predicts that Bitcoin could reach around $700,000 if it sees moderate usage and investment, based on a hypothetical scenario where a tiny portion of global wealth gets invested in Bitcoin, symbolizing a gradual, careful incorporation of Bitcoin within the larger financial market.

Woo’s study goes deeper into the potential impact of institutional investors on Bitcoin’s long-term value. Based on industry trends and advice such as Fidelity advocating for portfolios to hold 1-3% in Bitcoin, Woo sees these actions as indications of increasing, albeit cautious, belief in Bitcoin as a valid investment option.

1. He compares these amounts to BlackRock’s 85% investment in Bitcoin, emphasizing a significant gap in how institutions are approaching Bitcoin investments. Theoretically, if Bitcoin were to reach its maximum potential of $24 million per unit (as proposed by Woo), it would necessitate an extremely unlikely conversion of the world’s entire $500 trillion worth of wealth assets into Bitcoin.

He finds this situation unlikely and prefers to concentrate on the forecasts that are more realistic, based on present investment patterns and economic actions.

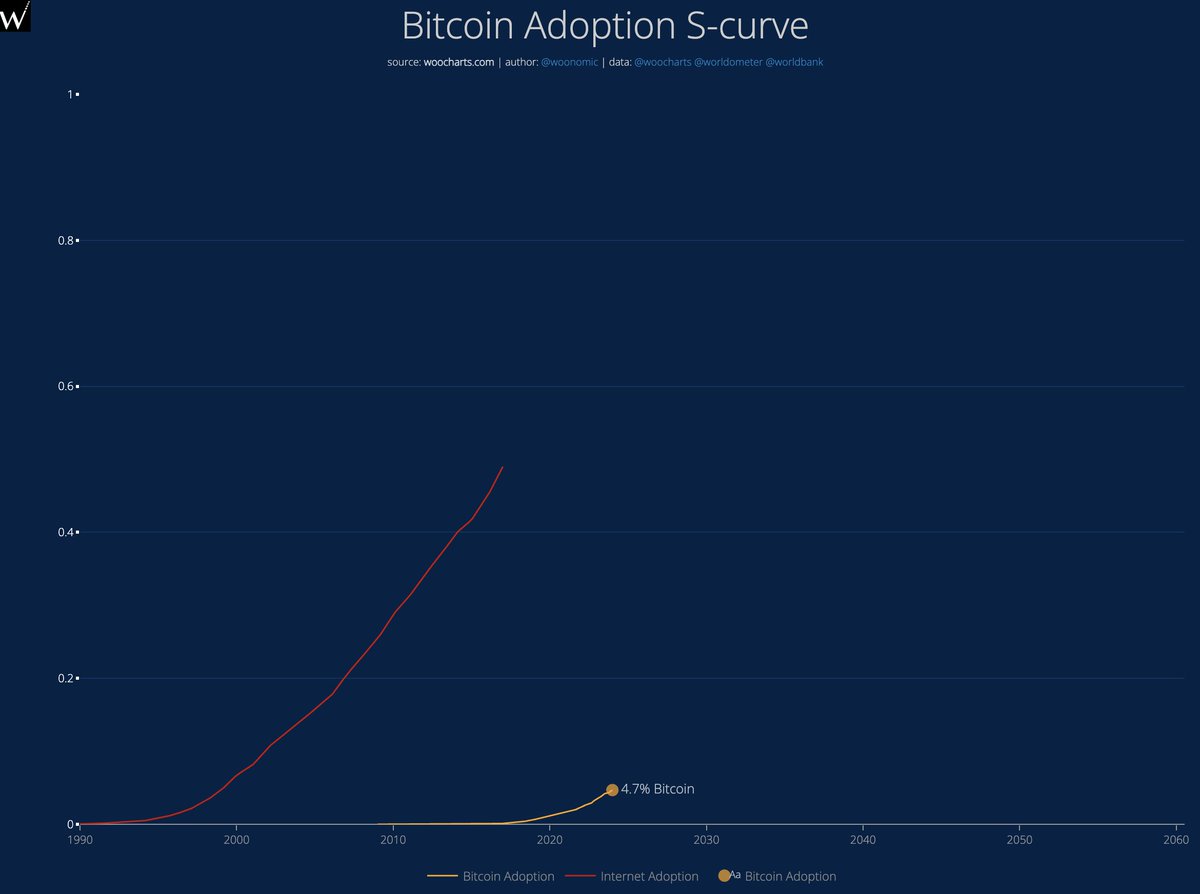

In simpler terms, according to Woo, if Bitcoin’s user adoption continues to mimic the typical pattern of technology acceptance (the S-curve), which is currently at 4.7%, there’s still a possibility for substantial price hikes as adoption increases towards the 16% to 50% range.

What The Future Holds

Towards the end of his reflections, Woo posits a hypothetical scenario where the total value of Bitcoins might outgrow that of all existing national currencies in the world.

Shifting to this new paradigm means that investors’ focus will change significantly, as they will prioritize assets based on Bitcoin (BTC) holdings instead of the conventional valuations tied to traditional fiat currencies. This would introduce a novel economic model where corporations’ worth could be assessed in terms of their Bitcoin reserves.

As someone who has been closely following the cryptocurrency market for several years now, I strongly believe that a shift in financial thinking is imminent and crucial. From my perspective, this transformation would signify a significant evolution in our approach to investing, moving away from merely trying to outdo Bitcoin’s value and instead focusing on assets that can capitalize on its stability and growth potential.

When a cryptocurrency’s market capitalization surpasses the total value of all global fiat currencies, it would no longer matter to you what the final price might be. This perspective is rooted in the traditional finance (fiat) mindset, which is limited by current circumstances.

Moving forward past this significant turning point, your focus will shift towards seeking investments that outperform Bitcoin. To begin with, such opportunities might include…

— Willy Woo (@woonomic) August 1, 2024

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-01 23:49