Bitcoin, ever the enfant terrible of financial soirées, has once again graced the stage with a performance so dramatic, the Dow Jones is weeping into its monocle. In the fleeting span of May’s first two evenings (bottle of port in hand, one imagines), this sovereign of crypto-coinage pirouetted upwards by over 4%, fluttering above the rather showy threshold of $97,000. Of course, a certain retracement followed—one cannot waltz forever without pausing to arrange their ruffles or, in this case, for investors to stare moodily into their candlestick charts.

In swoops IT Tech, a digital oracle known on X (which is not, as it seems, a treasure map), bearing “insights” for the masses. With the solemnity of a twelve-year-old entering a London smoking room, this wise figure expounds on the critical price levels liable to decide whether Bitcoin shall ascend to heavenly summits or trip over its own inflated reputation.

Bitcoin Ponders Its Next Move: Ernest Reflection or Comedic Farce? 🤔🎭

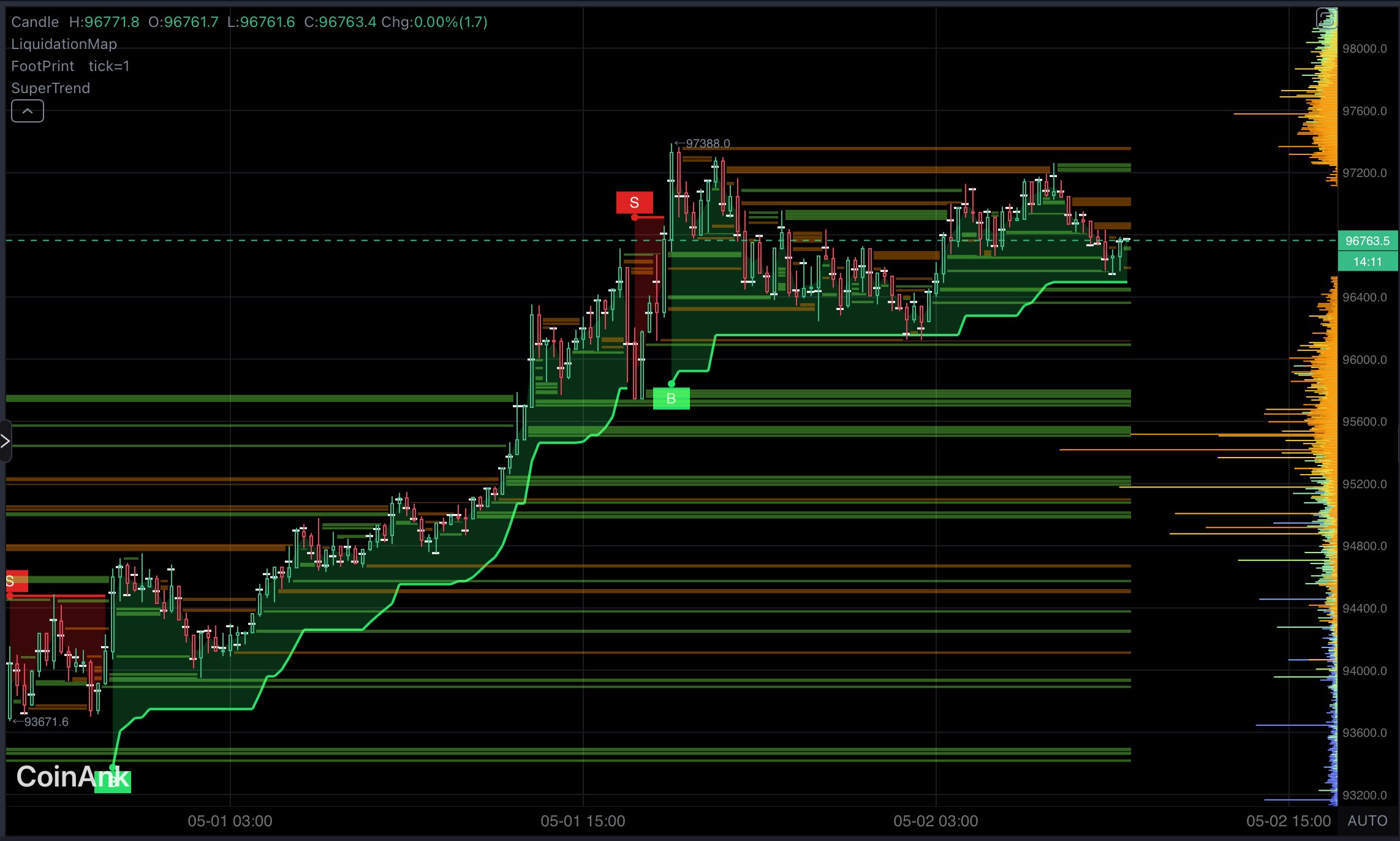

IT Tech, employing the mystical SuperTrend Indicator—an invention surely cooked up by someone who thought Tarot cards too passé—notes that when Bitcoin mid-foxtrotted to $94,000, the device blared ‘buy, buy, buy!’

Yet at $97,300, it abruptly squealed ‘sell!’ One imagines the poor indicator quite beside itself, standing in a dark corner, clutching its pearls. Despite all this fainting and flapping, as long as Bitcoin floats above $94,000, the mood at the soiree remains buoyant—or at least tolerably bullish.

But there’s more! The fabled liquidation data, beloved by those who find thrills in the prospect of financial disaster, whispers of turbulence near the $95,200 – $96,000 and $93,600 – $94,000 regions, like infamous cliques at a dinner party ready to upend the seating chart. Should Bitcoin lose its footing here, one can expect a slide as dramatic as a dowager duchess spurned at tea.

Presently, the mood is described as “cautiously bullish”—the financial equivalent of whistling past a graveyard, dressed to the nines but well aware the night could end in tears. Should the $96,000 veranda collapse, one expects a stampede for the $94,000 exit. Conversely, if our protagonist pirouettes above $97,400, it may yet clutch $98,500, swanning about the balcony with unconcealed glee.

Where Does Bitcoin Go From Here?Fortune or Farce Awaits🏰🤡

At this particular moment (which will soon be out of date, but why spoil the party?), Bitcoin can be found at around $96,463—a 1.64% climb, which might have looked more impressive if not paired with an ominous 21.82% drop in trading volume. Barely enough activity to keep the caviar cold.

Bulls continue to stampede optimistically through the halls, emboldened by the influx into Bitcoin Spot ETFs, and perhaps the faint scent of international decorum as the US and China swap notes on tariffs rather than invective. All told, analysts, those veritable cheerleaders in pinstripes, remain undaunted, tossing about lofty predictions of $150,000 as if it were mere cab fare.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

2025-05-04 07:23