As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market cycles and trends, but the current state of Bitcoin is truly intriguing. The Non-Realized Profit metric, as highlighted by Darkfost, presents a unique perspective on the market that I find particularly compelling.

Currently, Bitcoin is having difficulty reaching significant peaks again, but a recent examination of its underlying factors suggests that this could be a promising moment for purchasing Bitcoin, according to the Non-Realized Profit indicator’s insights.

In a recent article on the CryptoQuant QuickTake platform, an analyst named Darkfost emphasized the significance of this particular metric and explained how its pattern could impact investors.

As per the analyst’s viewpoint, the Non-Realized Profit measure gives an insight into the potential profits or losses that Bitcoin investors have yet to realize, which could impact future trends in the market.

Understanding The Current Zone In Non-Realized Profits

Instead of calculating the profit realized from selling Bitcoins, the Non-Realized Profit measure focuses on determining the gap between the current Bitcoin price and the price at which each coin was last traded, excluding those Bitcoins that haven’t been sold yet.

A high reading in this measurement implies that investors have substantial unrealized profits, potentially causing them to sell more due to the desire to convert these potential earnings into actual ones, leading to higher selling activity.

On the flip side, when values are negative, it means that numerous investors are carrying losses on their investments. This could suggest that the market has reached its lowest point, making it an attractive time for new investors to enter the market.

Based on analysis by CryptoQuant, the Non-Realized Profit figure typically falls below zero, suggesting that a large number of Bitcoin owners find themselves either at a breakeven point or incurring unrealized losses.

Historically, these situations are often linked with market low points, where an asset might be perceived as underpriced. Such instances may offer a tactical “chance” for investors aiming to get into the market or boost their existing investments.

As per Darkfost’s analysis, the unique characteristic of the present market is that the potential earnings yet to be realized have soared to record-breaking levels compared to past market cycles, despite currently being in the red.

Based on my extensive experience in the cryptocurrency market and observing Bitcoin’s behavior over the years, I find it intriguing to see this anomaly that suggests a departure from past market cycles. As someone who has seen both the spectacular highs and devastating lows of Bitcoin investments, I understand the potential for unique opportunities this deviation might bring. However, I also recognize the inherent risks involved when straying too far from established trends. Investors must tread carefully to avoid being blindsided by unexpected market movements.

Bitcoin Continuous Struggle Below $70,000

Yesterday, Bitcoin momentarily reached approximately $64,000 before experiencing another dip and now hovers around $62,340, a decrease of about 1.8% over the last 24 hours.

It seems that the drop in Bitcoin’s performance is also affecting the entire cryptocurrency market, as the total market capitalization has decreased by 3.3% over the past day, bringing it down to approximately $2.26 trillion at present.

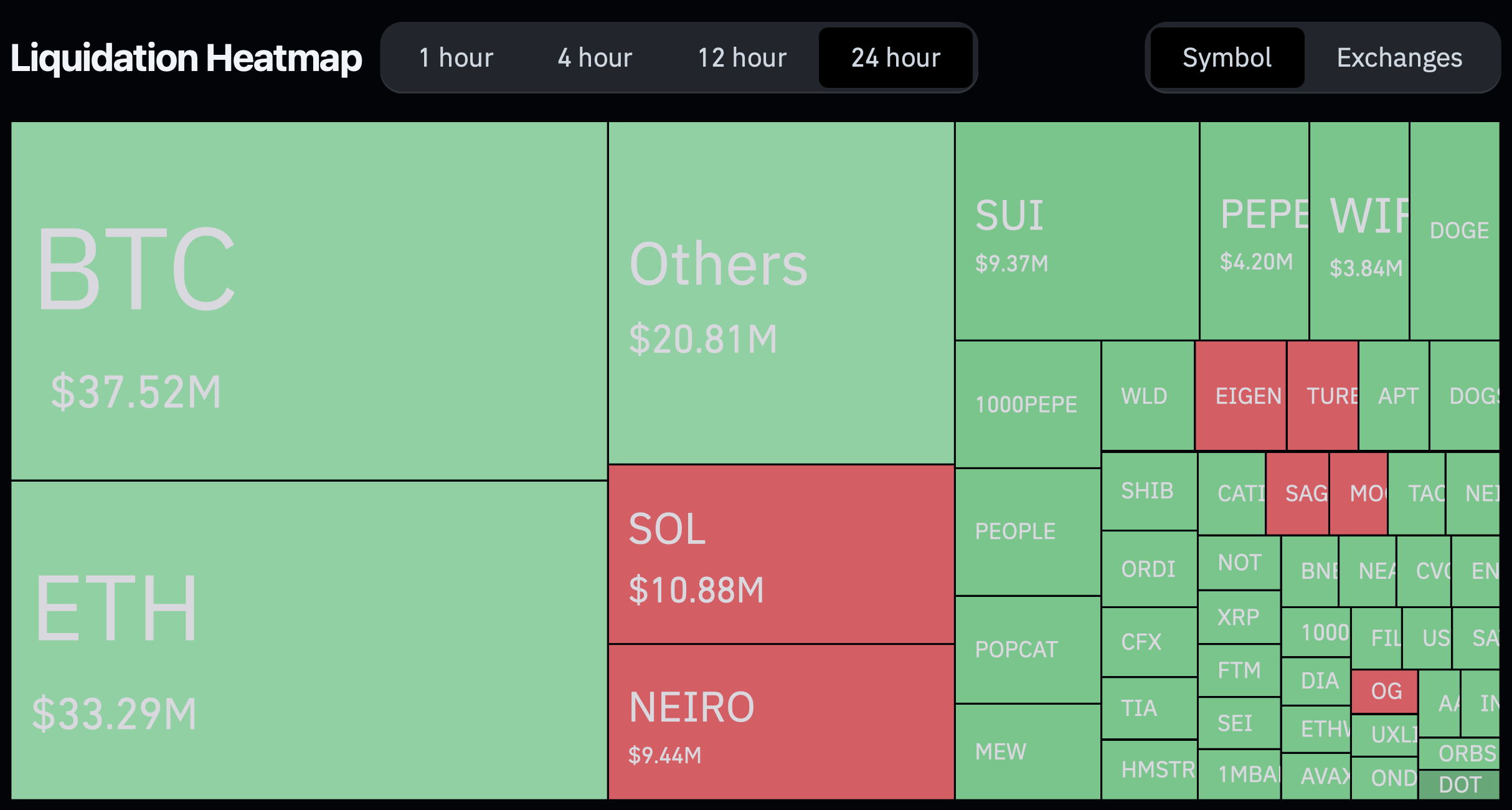

The dramatic drop has significantly affected traders, particularly those holding long positions. As per the data from Coinglass, over the last 24 hours, a staggering 59,005 trades were terminated, resulting in a total liquidation value of approximately $176.57 million.

Long positions make up approximately $130 million in total liquidations, whereas short positions account for roughly $45.91 million.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-09 12:04