As an experienced analyst, I closely monitor the Bitcoin mining ecosystem and market trends. The recent increase in Bitcoin mining difficulty by nearly 2% to over 84.4 trillion is a significant development that aligns with the growing optimism in the crypto market. This adjustment helps maintain network stability and security as it ensures a consistent block time despite the changing number of miners and their computing power.

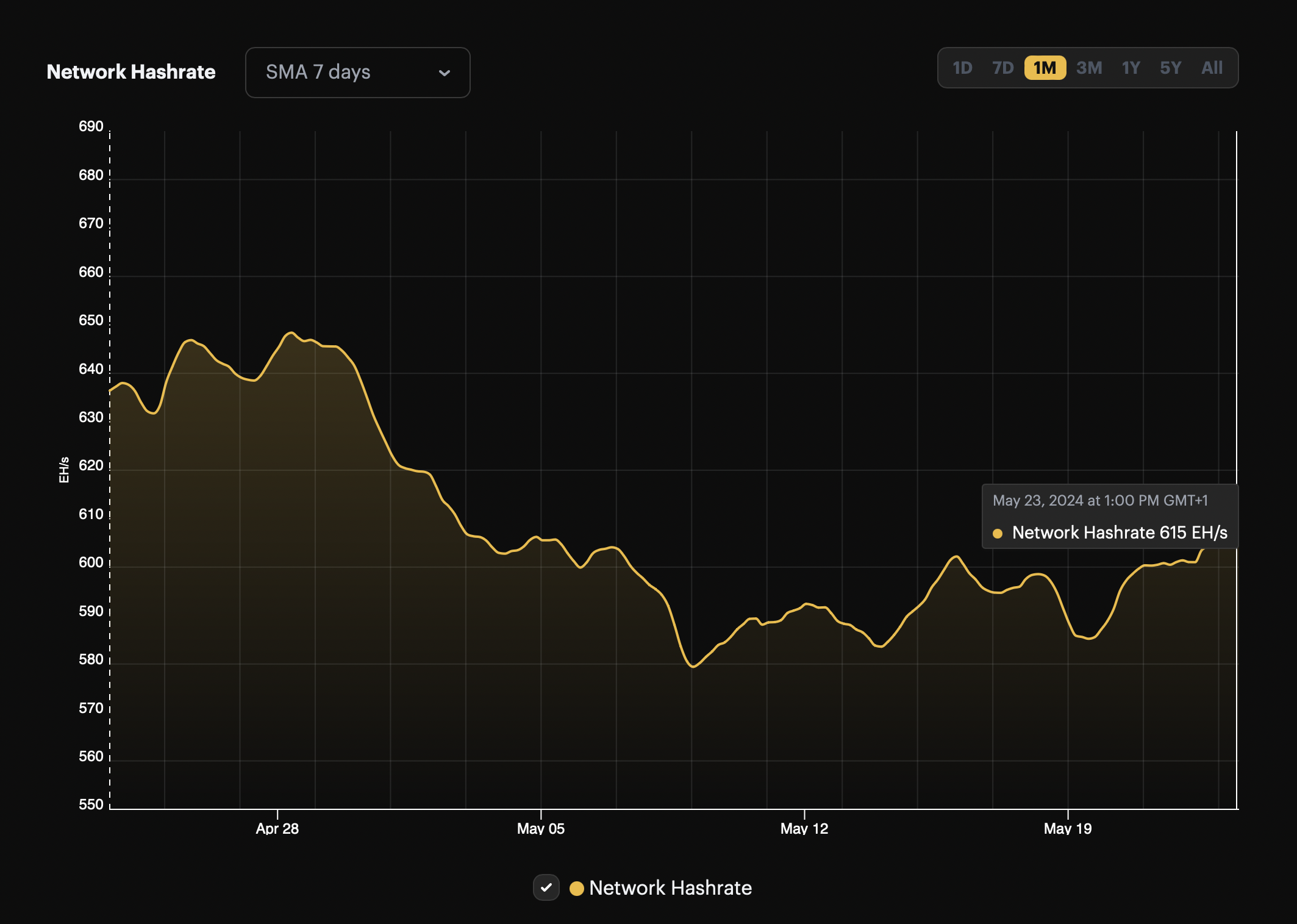

The mining difficulty for Bitcoin has increased by approximately 1.8 percent, rising above 84.4 trillion. This increase comes as the Bitcoin network’s average hash rate surpassed 600 exahashes per second.

As an analyst, I’ve observed a notable rise in crypto market values recently, fueled by heightened optimism. This surge can be largely attributed to rampant speculation surrounding the potential approval of spot Ethereum Exchange-Traded Funds (ETFs) in the US. Regarding Bitcoin, it’s important to note that mining difficulty is a measure of how challenging it is for miners to discover a hash below a specific target.

As a crypto investor, I’m constantly monitoring the Bitcoin network’s performance. One aspect that sets it apart is its ability to adapt to changing mining conditions. Every 2,016 blocks, or approximately every two weeks, the Bitcoin network adjusts the global block difficulty. This mechanism ensures that the time between mined blocks stays consistent, around the target of 10 minutes. Regardless of the number of miners and their increasing computing power, this feature maintains a healthy balance in the network.

As a crypto investor, I can explain that the difficulty adjustment is a mechanism that keeps the network’s block production rate consistent, thereby promoting stability and enhancing security.

Significant Shifts In Bitcoin Mining

The recent downward adjustment of Bitcoin’s mining difficulty represents a considerable change, with the figure dropping by almost 6% – the most substantial decline since the winter of 2022’s bear market.

The recovery of Bitcoin’s hash rate from around 580-590 Exahash per second (EH/s) to above 600 EH/s corresponds with the broader cryptocurrency market’s surge, driven by optimistic outlooks regarding regulatory progress in Ethereum-related products.

As a researcher studying the intricacies of the Bitcoin system, I cannot stress enough the significance of the mining difficulty concept in maintaining the balance and integrity of the network. Essentially, this mechanism adjusts itself based on the number of miners participating in the process of validating transactions and creating new blocks. When more miners join, the competition intensifies, leading to an increase in mining difficulty, making it harder for individual miners to successfully mine a new block and add it to the blockchain. This self-regulating mechanism ensures that the production of new blocks remains consistent despite fluctuations in miner participation.

In contrast, a decrease in the number of miners simplifies the mining process. This setup keeps a consistent and forecastable influx of new Bitcoin into circulation, regardless of miner count swings.

The surge in Bitcoin mining difficulty aligns with a modest bounce back in Bitcoin’s hash rate, which hit a record low towards the end of April.

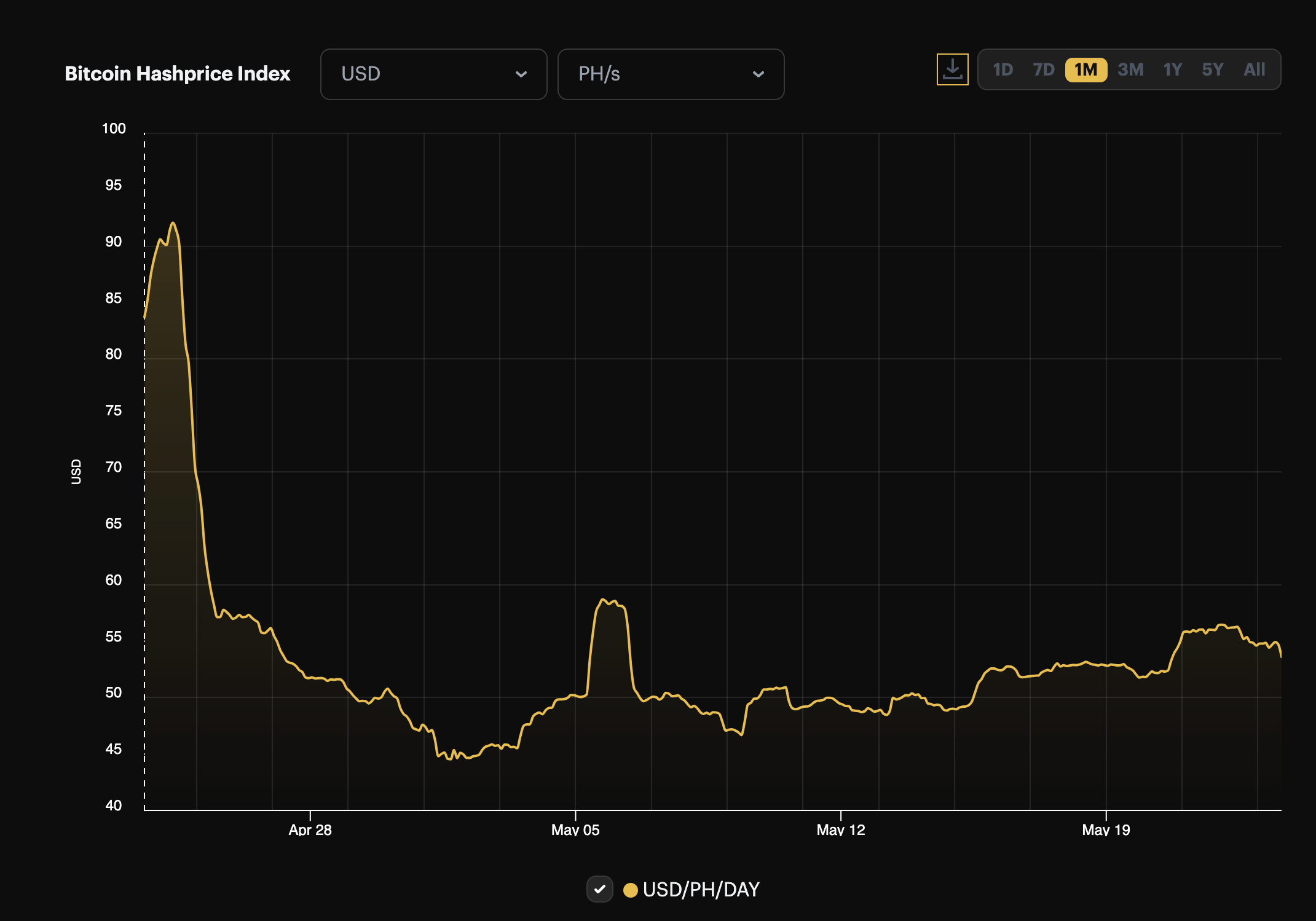

The metric called hash price, created by Luxor, a Bitcoin mining company, calculates the anticipated daily income for every hash rate unit. It has bounced back from approximately $49.50 to around $54.60 per PH/s, offering a slight consolation to miners following the recent market slumps.

Bitcoin’s Price Movements And Future Expectations

In the past day, Bitcoin’s value has seen a small decrease of 2%. However, its price has continued to climb by 3.9% over the last week, currently sitting at $68,132.

As a researcher studying the crypto market, I can tell you that the anticipated decision by the US Securities and Exchange Commission (SEC) regarding spot Ethereum Exchange-Traded Funds (ETFs) is generating considerable interest among investors and traders. The potential approval of these ETFs could carry substantial implications for the entire crypto market.

As a researcher, I’ve come across some intriguing developments in the cryptocurrency market recently. One notable analyst, who goes by the name BitQuant, has shared their perspective on these trends via social media platform X. According to their analysis, Bitcoin is projected to experience significant growth and could potentially reach a price of $95,000. Moreover, they anticipate a more rapid rise, with Bitcoin possibly reaching $80,000 as early as May.

As an analyst, I would rephrase it as follows: I have analyzed the data provided by BitQuant and they predict a significant drop from the current peak in June. However, their overall outlook for this market top remains unchanged.

For those focused on creating generational wealth outside of day trading:

— BitQuant (@BitQua) May 22, 2024

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-05-24 05:10