Last week, the President of the United States, Donald Trump, in a move that could only be described as either a stroke of genius or a moment of madness, formally established a strategic Bitcoin reserve. The announcement, as one might expect, has sent ripples—nay, tsunamis—through the industry, leaving in its wake a cacophony of cheers and jeers. At the heart of this maelstrom lies a single, burning question: Will Bitcoin ascend to the lofty heights of a geopolitically significant global macro asset, akin to gold, or will it remain the darling of libertarians, cypherpunks, and speculators, forever relegated to the fringes of financial discourse?

This is the crux of Bitwise’s latest investor memo, penned by none other than Chief Investment Officer Matt Hougan. Dated March 10, 2025, and provocatively titled “The Only Question That Matters in Bitcoin,” the memo posits that the long-term fate of Bitcoin hinges on whether governments around the world—starting with the United States—deem it indispensable enough to continue building strategic reserves. A question, it seems, as profound as it is perplexing.

Hougan, in his memo, draws attention to the audacity of the US government’s decision, writing: “Fifteen years after Bitcoin was born—a decade and a half of mockery, skepticism, and being dismissed as a ‘pet rock’ and ‘rat poison squared’—the US government has declared Bitcoin a ‘strategic’ asset that ‘shall not be sold.’” He argues that this endorsement marks a historic turning point, one that will, in time, propel Bitcoin to new, dizzying heights. “Congratulations,” he writes, “to all who believed in this possibility before it was cool.”

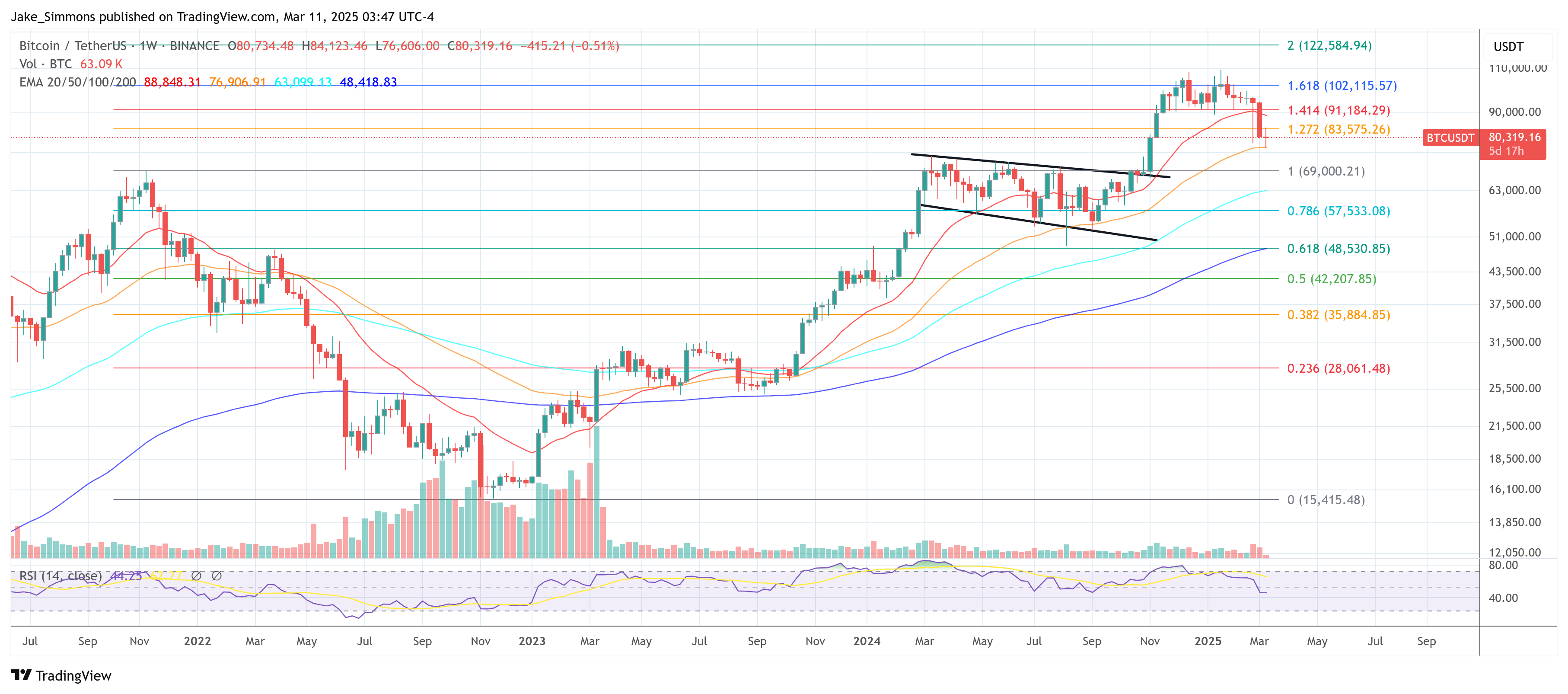

Yet, the markets, ever the fickle beast, have not greeted this announcement with universal acclaim. While the government’s recognition would seem to lend Bitcoin a veneer of legitimacy, it has also left some investors disheartened, having expected an immediate, massive influx of government purchases. In the wake of the reserve news, Bitcoin’s price tumbled 13% from its recent high of over $92,000, dipping below $80,000 for the first time since November 2024. Hougan attributes this to a confluence of factors: broader economic anxieties, a pullback in the equity market, and, most crucially, what he terms a “misunderstanding” of the government’s actual stance.

“Despite the historic nature of the declaration,” he notes, “Bitcoin is down sharply in recent days.” Investors, it seems, had hoped for immediate, large-scale purchases from the US Treasury. Instead, they learned that the reserve would initially consist of the government’s existing Bitcoin holdings—an estimated 200,000 BTC, worth approximately $16 billion at current prices. Hougan, however, believes the market’s negative reaction is unwarranted, emphasizing that merely retaining those 200,000 Bitcoin—instead of selling them, as was once anticipated under the prior administration—removes a significant overhang from the market.

Moreover, the new executive order explicitly states: “[T]he Secretary of the Treasury and the Secretary of Commerce shall develop strategies for acquiring additional Government BTC provided that such strategies are budget neutral and do not impose incremental costs on United States taxpayers.” Hougan underscores the significance of the word “shall,” suggesting it indicates a mandate rather than a mere possibility. Above all, Bitwise’s memo insists on a long-term perspective, urging investors to focus on what Hougan terms “the only question that matters in Bitcoin.” That question, of course, is whether Bitcoin becomes globally important, akin to gold, or whether it remains peripheral.

“If Bitcoin does matter globally,” Hougan writes, “here’s my view: It will be a $10-50 trillion asset, implying a 5x-25x return from current prices. If it doesn’t, it’ll be a footnote in history, bouncing around below $150,000, supported only by a small cohort of libertarians, cypherpunks, and speculators. There is no in between. Bitcoin either matters globally or it doesn’t.”

From this vantage point, the US government’s decision to retain—and potentially expand—its Bitcoin holdings represents an enormous signal to other nations. If, as Hougan suggests, countries like Czechia, Russia, China, El Salvador, and India are contemplating their own strategic moves in the digital asset space, the US adopting Bitcoin as strategic could spur them to follow suit—especially if they wish to front-run any further American acquisitions.

While some investors may be disheartened by the immediate lack of massive government buys, Bitwise’s memo remains optimistic in the face of Bitcoin’s recent volatility. Hougan labels the current price dip as an opportunity for those with a longer-term perspective. “I see one big takeaway,” he concludes. “This short-term weakness is a gift.”

At press time, BTC traded at $80,319.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2025-03-11 14:15