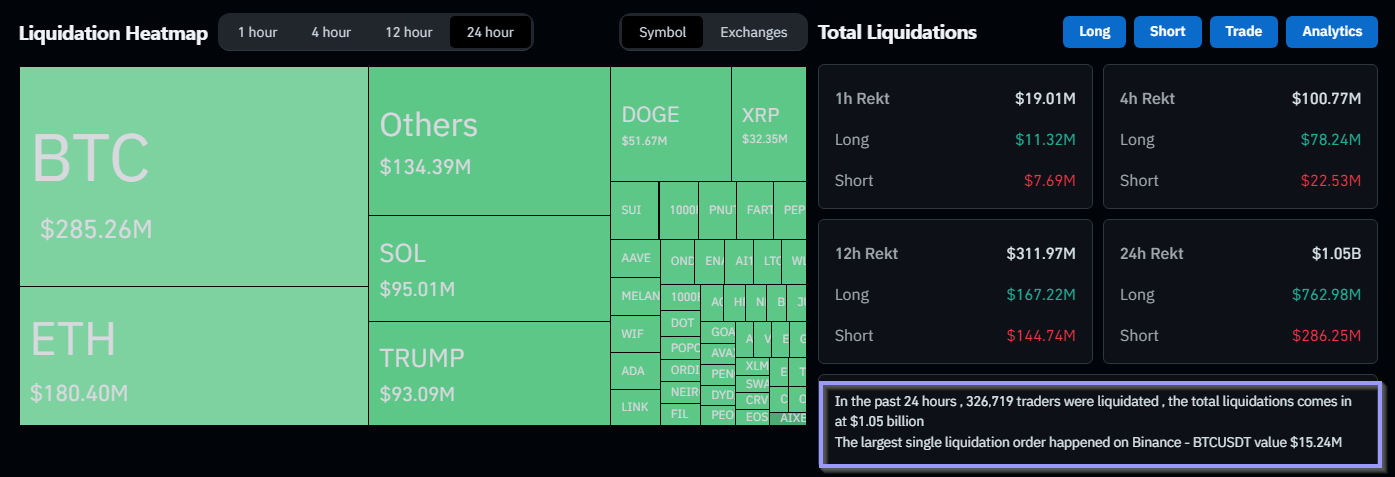

In simple terms, the value of cryptocurrencies plummeted by approximately $1 billion over a 24-hour period due to volatile events. The primary cause for this drop was Bitcoin‘s steep fall below the $100,000 mark, which many people considered unreachable before.

A large number of liquidations led to a noticeable drop in major alternative cryptocurrencies, reflecting the apprehension over market instability that experts had been cautioning about for quite some time.

Extensive Liquidations Throughout Bitcoin Market

Many purchasers found themselves unprepared as Bitcoin’s value plummeted rapidly. The significant losses were incurred by those with substantial holdings, and they constituted a large proportion of all the forced sales.

As an analyst, I’ve observed a significant trading activity over the past day. Approximately 406,000 traders have offloaded assets valued at approximately $1.2 billion. This figure includes long sales amounting to about $920 million and short sales totaling around $260 million, as reported by CoinGlass.

Surprisingly, a significant decrease in Bitcoin’s value caught numerous traders off balance. Long-term investments took the hardest hit due to this sudden drop, leading to increased liquidations. Even other cryptocurrencies like Ether, Cardano, and Dogecoin weren’t spared from these losses as they followed suit with Bitcoin’s downturn.

theres crypto top signs everywhere rn.

Regardless of the appealing charts I see, I believe it’s time to exercise caution and consider cashing out some profits, as we seem to be approaching a phase in the cycle where it might be wise to secure our gains.

— Bluntz (@Bluntz_Capital) January 19, 2025

The Bearish Trend Impacts Altcoins

Previously promising cryptocurrencies, like XRP, have seen their values decrease unexpectedly, causing concern among investors. The unpredictable dip in XRP’s price took many by surprise, leading some to question the market’s stability and potentially signaling a prolonged downturn or bear market.

On X, cryptocurrency trader “Bluntz” said that “top signs everywhere.”

“I think we’re at the stage in the cycle where it would be prudent to take some chips off the table,” they added.

Market Sentiment Change Due To Price Declines

The change in market attitude is quite concerning, as panic-induced selling due to the fear of further losses has led to uncertainty within the market.

2021’s market corrections, where investors swiftly sold off their assets as the mood suddenly turned sour, bore a striking resemblance to a significant downturn. Now, analysts are urging investors to exercise caution and closely monitor market signals before making any investment decisions.

Bitcoin Hits New ATH

As the day progressed and before Republican Donald Trump’s inauguration later on, Bitcoin (BTC) soared to a new peak of over $109,000 during the Asian trading session on Monday. On Binance, the leading cryptocurrency touched $109,335.

In his speech on Sunday, Trump highlighted the exceptional track record of the asset as well as growth within the overall U.S. stock market.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2025-01-20 17:28