As a seasoned researcher with over two decades of experience in financial markets, I must admit that the current state of Bitcoin is intriguing. The relatively low volatility we’ve seen recently has been a breath of fresh air amid the usual rollercoaster ride that comes with Bitcoin.

The fluctuations in Bitcoin‘s price during the 2024 U.S. presidential election have caused it to be valued at approximately $69,092 now, after falling beneath the $70,000 threshold last week.

Over the last few days, Bitcoin’s volatility has been comparatively low, leading to a more tranquil phase and its consistent hovering between $68,000 and $69,000.

Over time, the consistent pattern in prices has led experts to predict a possible price increase, citing numerous technical patterns and signs that suggest an upcoming surge.

30% Bitcoin Rally In Play

As a keen crypto investor, I’ve been keeping an eye on some intriguing predictions about Bitcoin’s future. Lately, a well-respected figure in our community, Captain Faibik, has offered insights into a fascinating technical pattern known as the “Descending Broadening Wedge.” This pattern could potentially shape the price action of Bitcoin in the coming days.

Faibik pointed out that Bitcoin has broken through a specific pattern, known as a Descending Broadening Wedge, on its weekly graph. At present, it’s experiencing what is often referred to as a “re-test” phase. In the realm of technical analysis, this type of wedge shape is generally viewed as a bullish reversal pattern.

As the price movement follows a pattern where it hits successively lower peaks (lower highs) and troughs (lower lows), this could suggest that the current decline’s intensity might start to ease off, as indicated by the diverging trendlines.

If the cost climbs above the resistance level, it might signal an upcoming price spike for the asset. Faibik anticipates a successful repeat of the recent breakout trend in BTC and has marked a mid-term goal of $88,000, suggesting a possible 30% rise in Bitcoin’s value by year-end.

Bullish Divergence And Long-Term Holder Behaviour

Additionally, renowned analyst Javon Marks also highlighted potential indications of a bullish trend in Bitcoin’s graph based on his analysis, similar to Faibik’s observations.

In the realm of technical analysis, a condition known as bullish divergence emerges when an asset’s price forms lower troughs, but a related technical metric like the Relative Strength Index (RSI) produces higher troughs instead. This discrepancy may signal an impending change, suggesting that buying momentum could be gaining strength and potentially indicating a reversal in the asset’s downward trend.

Based on Mark’s analysis, this divergence suggests that Bitcoin’s bullish investors might be gearing up for a potential surge, possibly reclaiming control over the market. This perspective lends credence to the idea of an uptrend in the foreseeable future, despite any short-term market uncertainties.

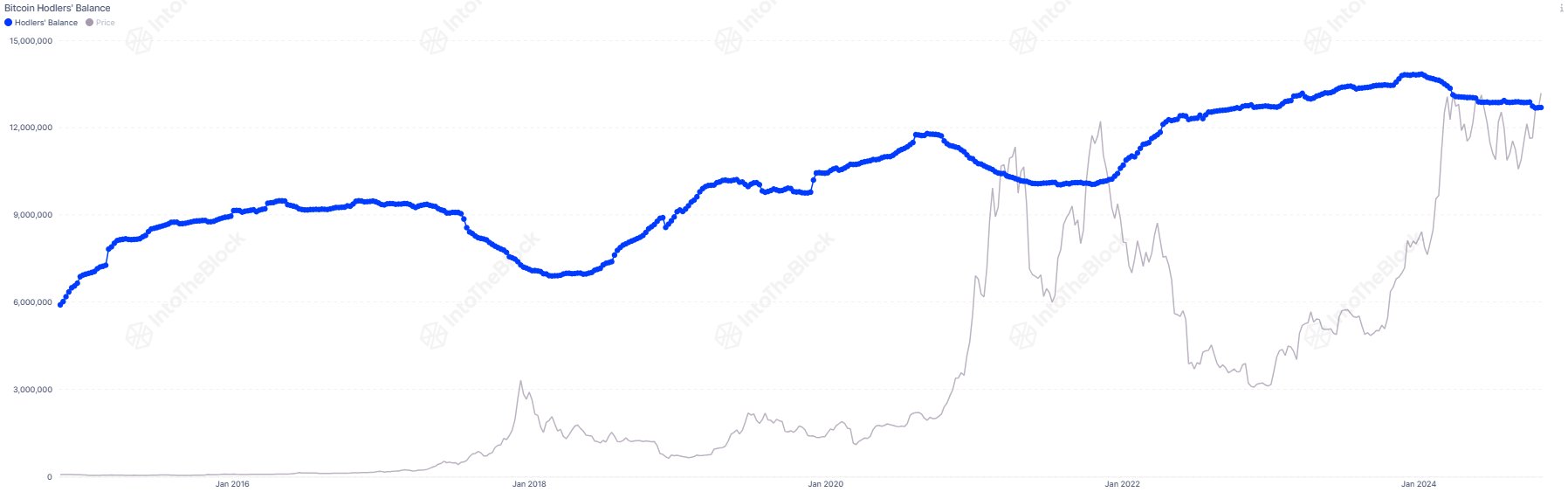

Currently, a notable blockchain analysis company called IntoTheBlock has shared some intriguing patterns in the balance metrics of Bitcoin holders.

Based on the information they’ve gathered, it seems that long-term Bitcoin holders are unloading their coins now, but the extent of these sales is relatively mild when compared to past bull markets. During earlier cycles, long-term investors tended to sell more forcefully, which was usually a sign of overheated market sentiment.

At present, it appears that long-term investors are holding back on selling more than usual, which might indicate a degree of caution given the prevailing conditions in the Bitcoin market. According to IntoTheBlock’s analysis, this cautious stance could hint at a change in the cycle dynamics, possibly suggesting a transition into a new phase for Bitcoin’s market.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-11-06 04:16