Picture, if you will, the Bitcoin network—a once bustling metropolis of transactions, now resembling a sleepy village where even the postman’s taken up knitting. According to the chaps over at CryptoQuant, the Bitcoin Network Activity Index has plummeted to a one-year low. Yes, my dear reader, it appears the old boy is taking an extended nap, much to everyone’s bemusement.

Bitcoin’s Activity: From Disco Fever to Dad Dancing

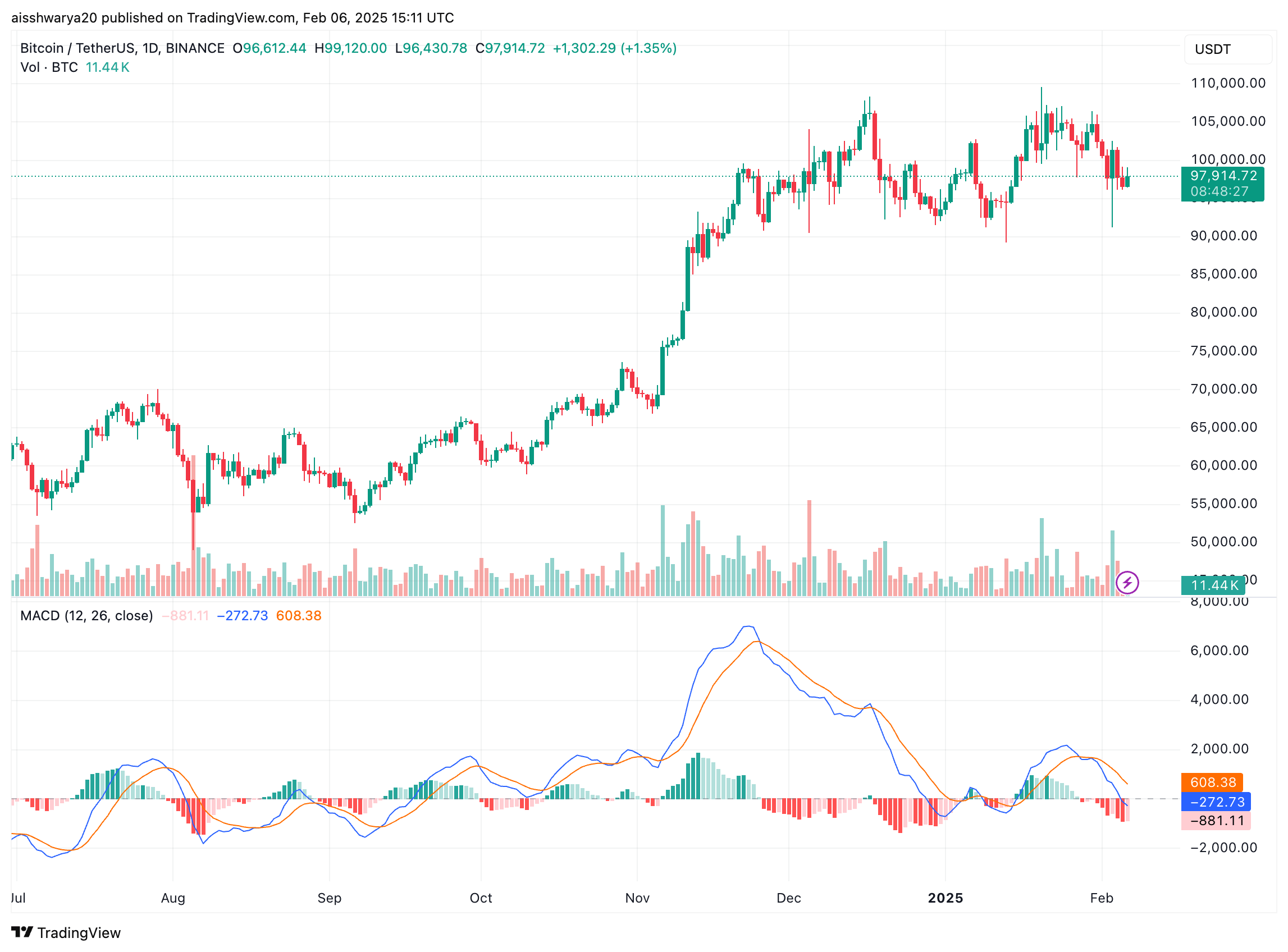

Back in November 2024, the Index was strutting its stuff at a peak of 4,423. Now? A modest and decidedly less peppy 3,760. Transactions, once as abundant as confetti at a wedding, have dropped from a dazzling ATH of 734,000 to a mere 346,000. It’s as if the Bitcoin faithful collectively decided to pack up their digital wallets and head to the beach.

The villains of this piece? The Runes Protocol, apparently. CryptoQuant notes that the protocol, which burst onto the scene in April 2024 with all the subtlety of a marching band, has experienced a dramatic fall from grace. At its zenith, OP RETURN codes (whatever they are, but they sound frightfully important) spiked to 802K. Now, they’ve dwindled to a paltry 10K. It’s the blockchain equivalent of a celebrity who’s gone from red carpets to supermarket openings. 🎭

“This is evident in the total daily number of OP RETURN codes in Bitcoin transactions…”—CryptoQuant. Translation: The Runes Protocol isn’t quite the life of the party it once was.

For those scratching their heads, the Runes Protocol is a dashing new standard for Bitcoin tokens. It promised efficiency, scalability, and possibly world peace. Alas, enthusiasm for it has waned faster than a New Year’s resolution.

Adding to the tale of woe, Bitcoin’s mempool traffic (think of it as the waiting room for transactions) has seen a 99% drop in pending transactions. From 287,000 in December 2024 to a measly 3,000 now. If it were a pub, you’d hear the tumbleweed rolling by. 🍺🍂

Bitcoin’s Price: Champagne or Lemonade? 🍾🍋

With activity dwindling, some analysts are clutching their monocles and declaring Bitcoin overpriced at its current $98,000. Fair value, they say, lies somewhere between $48,000 and $95,000. Others, however, are gleefully shouting “bargain!” and urging everyone to dive in. It’s all rather like a stock market soap opera, with everyone playing their part.

Still, the long-term optimists are out in full force. A Standard Chartered executive predicts Bitcoin will soar to $200,000 by the end of 2025. And if that doesn’t cheer you up, perhaps this will: BTC is down a mere 0.1% in the past 24 hours. Truly, the drama never ends. 🤷♂️

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-02-07 06:41