Bitcoin’s Big Sleep: The End of the Line or Just a Nap? 🔥💰

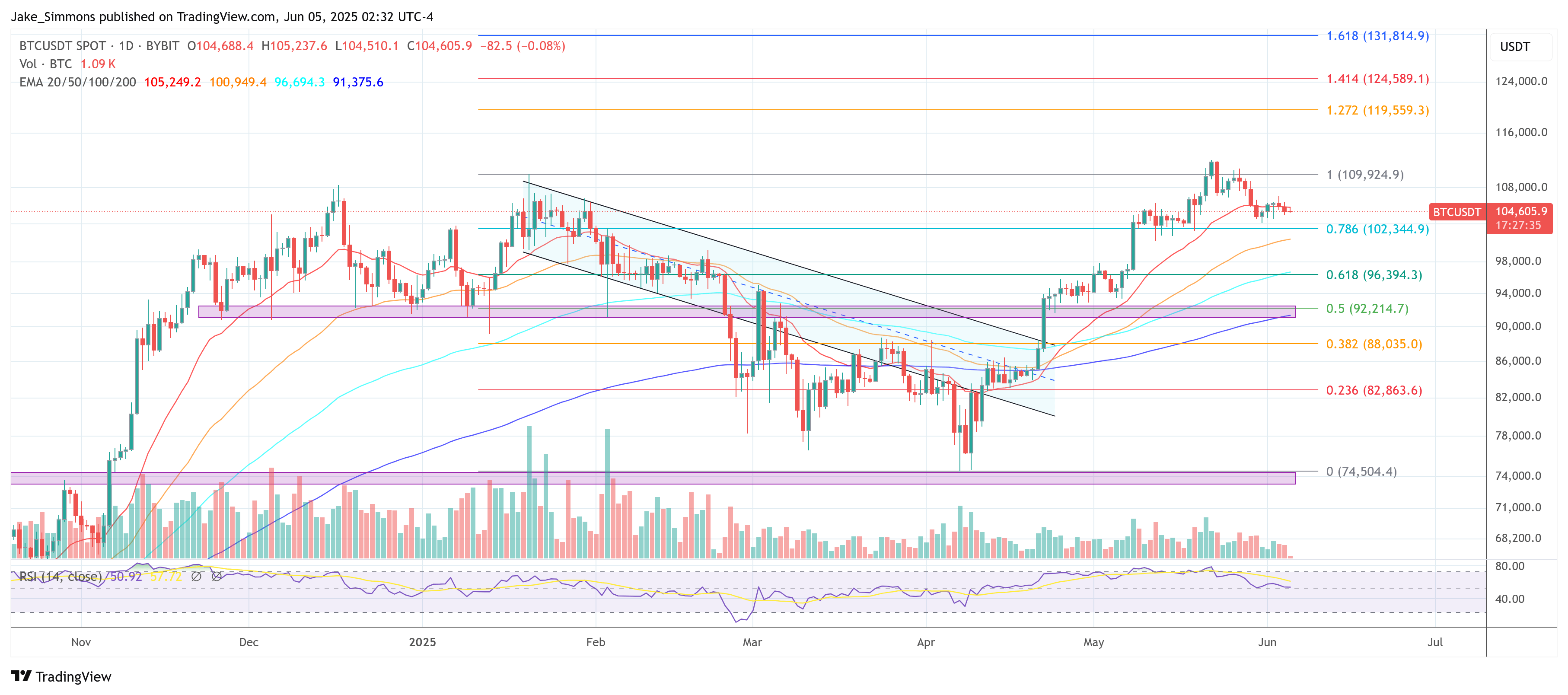

Well now, folks, here’s a tale with more twists than a Missouri river snake. Bitcoin is driftin’ just above $105,000 on June 5th, lookin’ about as lively as a barnyard hen at midnight. Its volatility’s so tame you’d think it was just a lazy Sunday afternoon, not the wild gamble of a decade. Yet, Swan—those Los Angeles folks who ONLY talk about Bitcoin—say the market’s on the verge of a re-pricin’ so radical it’d make a circus clown blush.

In a little yarn spun on X (or whatever fancy name they’re usin’ now), they claim the traditional four-year rodeo of boom and bust is giving way to “the last rotation”—a quiet handoff of coins from folks who buy for fun to those big-money fat cats with horizons longer than the Mississippi. Michael Saylor—yes, that fella with more gadgets than a pawnshop—says folks less committed are headin’ out, makin’ room for corporations, ETFs, and multinationals like BlackRock and Fidelity to set up shop in the vaults.

So far, this year’s bein’ as stubborn as a mule. Past cycles—2013, 2017, 2021—showed prices climbing straight up like Jack’s beanstalk, but this year’s more like a slow crawl—shallow dips, and plenty of sittin’ around doin’ nothin’. Swan admits the market’s boorin’ folks, but it’s probably just hidin’ an invisible squeeze—long-time holders takin’ profits while other folks quietly scoop up coins like mama’s apple pie.

And these corporate giants? They ain’t buyin’ Bitcoin to trade; they’re holdin’ it tight, takin’ coins out of circulation faster than a hound chases a rat. Swan says it’s a three-part dance—trustees and lawyers step aside, while ETFs and big firms move in, leaving retail’s little game behind.

Then there’s the shift in purpose—speculators turnin’ into long-haul investors. “This ain’t no gamblin’, partners,” Swan says. “They’re puttin’ their money where their mouth is.” As for the generations, the Silent Generation hoarded gold, Boomers piled into stocks, Gen X messed around with tech, and now Millennials—those young whippersnappers—are gettin’ serious and choosin’ Bitcoin to hold for keeps, tossin’ trillions into the mix.

Swan warns that once long-term investors start to pile in, there ain’t no easy pullback. “When long money meets inelastic supply, the float—that’s the free coins—begins to vanish, like breath on a cold window,” says he. And with the dollar weakenin’ while bond yields rise, the stage’s set for a wild ride.

In plain English, Swan says: “This ain’t just another cycle, folks. It’s the end of an era.” If you’re hurriedly sellin’, you’re just handin’ your Bitcoin over to some big institution, and buddy, you probably ain’t seein’ it again. Once ’tis gone, it’s gone, like a whiff of smoke in a pancake house.

What does that mean? Well, the stillness near $105,000 ain’t exhaustion—it’s the calm before a storm so mighty, it’ll make creaking timbers sound like a lullaby. The sellers will drop out, the buyers won’t sell, and the price will be climbin’ higher than Huck’s raft on a stormy river.

Swan warns, “Think twice, my friends. The float’s dryin’ up. The buyers are built different. This is the last big turn in Bitcoin’s rodeo.” If he’s right, all this hush is just the eye of a gully-washer, and the next explosion will make the 2021 days look like just a regular Monday.

As of now, Bitcoin’s sittin’ at $104,605, like a cowboy at the end of a long day—waiting, but ready for whatever comes next.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-06-05 13:17