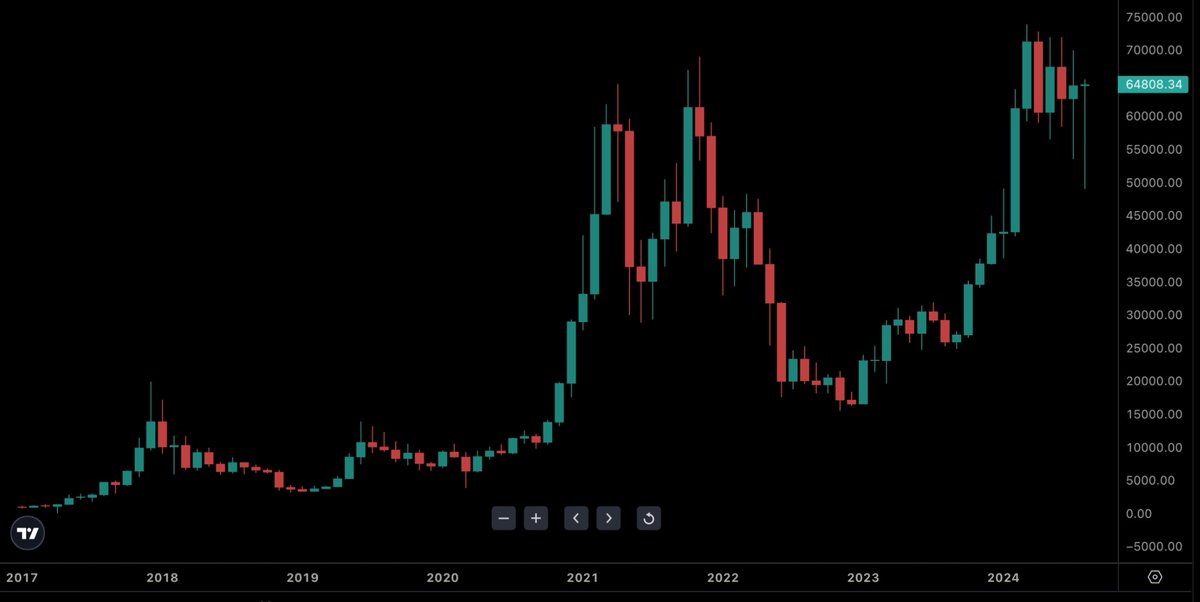

As a seasoned crypto investor with a decade of market experience under my belt, I’ve learned to approach every candlestick pattern with a healthy dose of skepticism and caution. The August candle, with its dragonfly doji formation, has certainly piqued my interest. However, I remember the old saying: “Beware of false prophets, and don’t put all your eggs in one basket—especially when it comes to crypto!”

As the end of August approaches, experts in financial analysis are finding themselves intrigued by the recent movements in Bitcoin‘s price. They suggest that the closing price for this month could hold great historical significance for the value of this digital currency.

Discussions about possibly reversing the current trend have been ignited due to the price movements at month’s end, with technical analysts paying close attention.

As a crypto investor, I’m keeping a watchful eye on Bitcoin’s price movements. While some experts are hopeful about its future, others are urging us to tread cautiously, pointing out that the month isn’t over yet, and unexpected external factors could potentially impact Bitcoin’s course.

August Candle Shows Dragonfly Doji

As a keen crypto investor, I find myself captivated by the emerging possibility of a “dragonfly doji” candlestick pattern unfolding in the Bitcoin price chart on the monthly scale.

In their latest discussion on X, an analyst from HODL15Capital described this monthly Bitcoin candle as “possibly the most intriguing in Bitcoin’s history.” It’s important to note that the dragonfly doji is a Japanese candlestick pattern often signaling a potential shift in price trend.

The pattern emerges when the starting, midpoint, and ending prices are quite similar, yet the lowest price is noticeably lower, resulting in a long, dark tail. This configuration often implies that sellers had dominance during the beginning of the month, but buyers regained control by the end, demonstrating robust bullish energy.

Bitcoin Bulls About To Take Over?

Some traders and analysts are feeling hopeful due to the possibility of an upcoming “dragonfly doji” pattern on Bitcoin’s monthly graph, as this formation might suggest a significant change in direction for Bitcoin’s price trajectory.

On cryptocurrency platform X, Javon Marks – a renowned crypto analyst – emphasized the importance of this month’s closing candle. He pointed out that if Bitcoin ends the month with a “dragonfly doji,” it would indicate one of the most substantial buyer resistance (strongest bullish sentiment) since March 2020, signifying strong rejection from sellers.

Mark also noted that a comparable trend in 2020 was present prior to one of Bitcoin’s major bullish surges during its past bull market, implying that the past might recur. In simpler terms, what happened in 2020 could be a sign of a repeat of Bitcoin’s significant price increase from its previous cycle.

To clarify, although a dragonfly doji pattern is frequently interpreted as a bullish indicator, it’s crucial to remember that this doesn’t necessarily predict future market movements with certainty.

The trend suggests that the market has turned away from lower prices, but it doesn’t automatically imply an extended upward movement will occur. Keep in mind, the month isn’t finished yet; thus, the candles haven’t closed, and a great deal can shift during the remaining 4 days of trading.

Furthermore, important elements like major economic happenings, notably the upcoming U.S. news event, or general market mood, could significantly influence Bitcoin’s future direction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-08-28 04:16