Ah, the illustrious Bitcoin, that capricious creature of the digital realm! It has recently taken a rather theatrical plunge of 11% from its lofty heights, a spectacle that might send shivers down the spine of the faint-hearted investor. Yet, let us not be too hasty in our alarm; history, that wise old sage, whispers to us that such a decline is but a mere trifle in the grand tapestry of cryptocurrency’s tumultuous existence.

Indeed, the chronicles of Bitcoin are replete with tales of wild oscillations, where the price dances like a dervish, rising and falling with a fervor that would make even the most seasoned investor clutch their pearls. One must ponder the context of this latest dip, for it is in the shadows of the past that we may glean insights into the future.

The Historical Context of Bitcoin’s Corrections

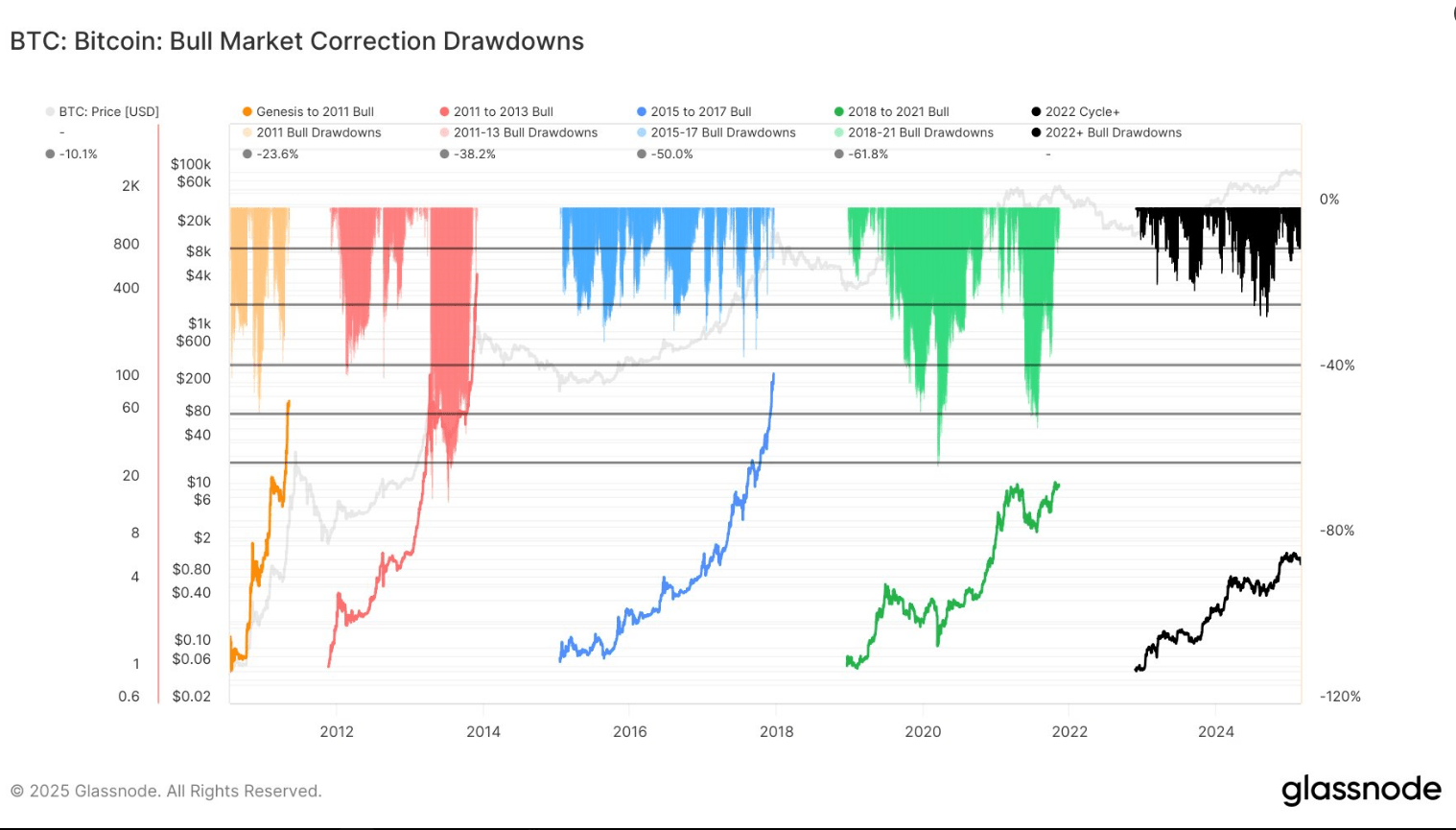

Since its inception, Bitcoin has been no stranger to corrections. Between the years of 2012 and 2017, our dear alpha coin experienced a staggering drop of over 10% on no less than 13 occasions! Some of these corrections were so severe that they left market values in tatters, only to rise again like a phoenix from the ashes. A few even dared to plunge by 20% or more, as if to mock the very notion of stability.

What is particularly noteworthy about our current cycle is its relative calmness compared to the tempestuous bull runs of yore. Historical data reveals a pattern of drawdowns that would make even the most stoic observer raise an eyebrow:

This cycle continues to be the least volatile of all:

2011-2013: Avg. -19.19%, Max. -49.45%

2015-2017: Avg. -11.49%, Max. -36.01%

2018-2021: Avg. -20.41%, Max. -62.62%— glassnode (@glassnode) February 26, 2025

Over the years, Bitcoin has demonstrated a remarkable resilience, often rebounding to new heights after each tumultuous dip. Even in the midst of bullish fervor, it is not uncommon for Bitcoin to undergo brief declines, a necessary purging of the weak hands before it resumes its upward trajectory.

Present Market Conditions

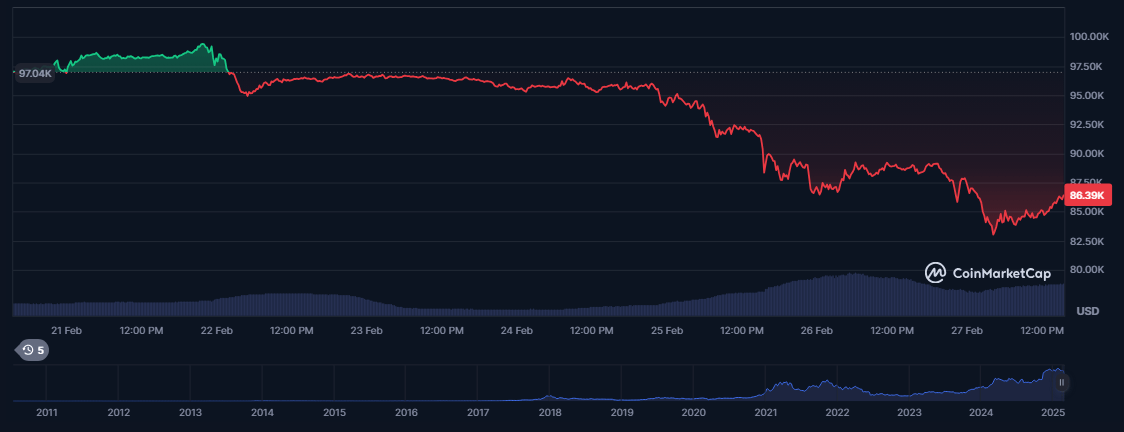

As of February 27, 2025, Bitcoin finds itself trading at a modest $85,800, a 4% decrease from the previous day’s close. The day has seen an intraday high of $89,230 and a low of $82,460. This recent 15% decline, while surpassing the cycle’s average drawdown of 8.50%, is but a whisper compared to the 26% declines of previous cycles.

In comparison to other corrections, which have often lingered like an unwelcome guest, this one is rather tame. Many analysts, with a twinkle in their eye, argue that it is not a harbinger of doom, but rather a natural ebb and flow of Bitcoin’s cyclical nature.

However, a word of caution: unless Bitcoin swiftly ascends beyond the $92,000 threshold, there exists a possibility of further declines, as if the market were playing a game of limbo. This barrier is crucial, for it marks the point at which the majority of short-term traders find themselves in the land of profitability. Should they choose to mitigate their losses, Bitcoin may very well retrace to the realms of $70,000 or even $71,000.

Factors Influencing the Recent Decline

The reasons behind Bitcoin’s recent descent are as varied as the characters in a Dostoevsky novel. Sentiment, that fickle mistress, plays a significant role in the Bitcoin market, where even the slightest shift in investor confidence can lead to dramatic price swings.

Panic selling has also re

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-02-27 17:12