As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-changing landscape of digital assets, I find myself cautiously optimistic amidst the current market turmoil. The recent correction, which has seen Bitcoin plummet under $95K and altcoins take a significant hit, is reminiscent of the rollercoaster rides we’ve all become accustomed to in this space.

In the past 24 hours, the crypto market has experienced a liquidation worth approximately $1.1 billion, causing Bitcoin (BTC) and other altcoins to plummet significantly. Currently, Bitcoin is trading at around $93,143 with a 24-hour volatility of 9.0%. Its market capitalization stands at an impressive $1.84 trillion, while the total volume within the last 24 hours amounts to $121.02 billion. Interestingly, the market cap of altcoins, excluding Bitcoin, has dropped by a substantial 18% this week, reaching a value of $1.27 trillion.

Currently, the temporary decrease in altcoin values within the market is signaling a possible upcoming downtrend, often referred to as a bear market. Some speculate that Bitcoin could reach a low of around $90,000 prior to 2025. Given this scenario, if you’re thinking about making an investment in the current market, it might be worth considering your options carefully.

Bitcoin Price Puts $90K as Potential Reversal Spot

On the 4-hour scale, the Bitcoin’s price movement suggests a significant downward adjustment, or what is commonly known as a bearish correction. Notably, the Bitcoin price has fallen beneath the ascending channel formation, indicating a gradual correction with a noticeable decrease in the lowest point reached, which is referred to as forming a lower low.

In simpler terms, the price of Bitcoin (BTC) has fallen below the important support levels of both the 200 Exponential Moving Average (EMA) and $95,000. As I write this, BTC is being traded at around $94,295, representing a 3.44% decrease over the past 4 hours. This significant price movement has formed a large bearish engulfing candle on the chart.

If the price drop breaches the $94,400 support point, it weakens the bulls’ control at this crucial level. Should the drop end with a close below this support, it is probable that the bears will sustain their aggressive advance.

According to past significant price movements, the key support levels for Bitcoin are currently at $90,742 and $86,700. The Relative Strength Index (RSI) has dipped into an oversold territory, while the 20-day and 100-day Exponential Moving Averages (EMA) are about to cross each other in a way that suggests increasing selling pressure. In essence, the downward trend seems to be strengthening.

Therefore, it’s expected that the Bitcoin price may return to the $90,000 support point. But even amidst the bear market, there’s a glimmer of hope: the number of active wallets suggests we might be nearing the optimal depth for investment before 2025.

Here’s Why $90K Could Be the Best Buying Spot

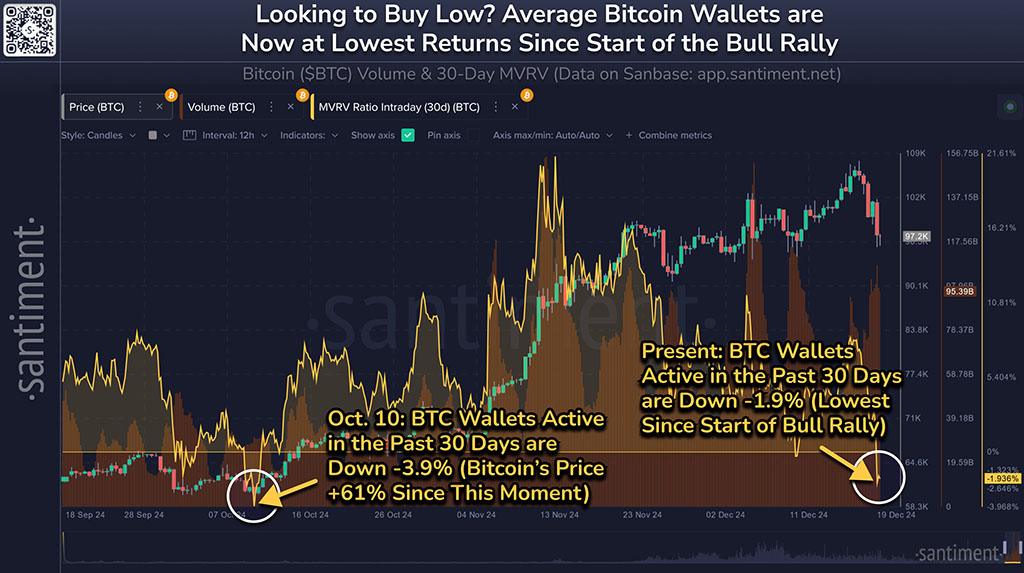

Recenty, Santiment, an analytics company, posted a tweet offering trading advice that goes beyond just focusing on prices when deciding to buy low or sell high. Instead, they recommend examining the actions of other traders in the market as well.

On average, bitcoins held in wallets that made at least one transaction within the last month are showing a negative return of 1.9%. Remarkably, this is the case even though the price of Bitcoin reached its peak only three days prior to this analysis.

An MVRM (MVRV stands for Moving Average Realized Value) below zero might suggest a contrarian perspective, implying potential market undervaluation. Yet, some traders can find themselves stuck at the peak as the market’s excitement reaches its height.

In simpler terms, it’s uncertain if we’ve reached or are close to the lowest point in the market. But, using a dollar-cost averaging approach might be a wise move for entering the market during this period of uncertainty. This method involves investing a fixed amount of money at regular intervals, regardless of the price of the investment.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-12-20 15:03