As a seasoned crypto investor who has weathered numerous market cycles, I find myself both intrigued and cautiously optimistic about the current state of Bitcoin. Having witnessed the ebb and flow of this digital tide since its inception, I can attest to the unpredictable nature of the cryptosphere.

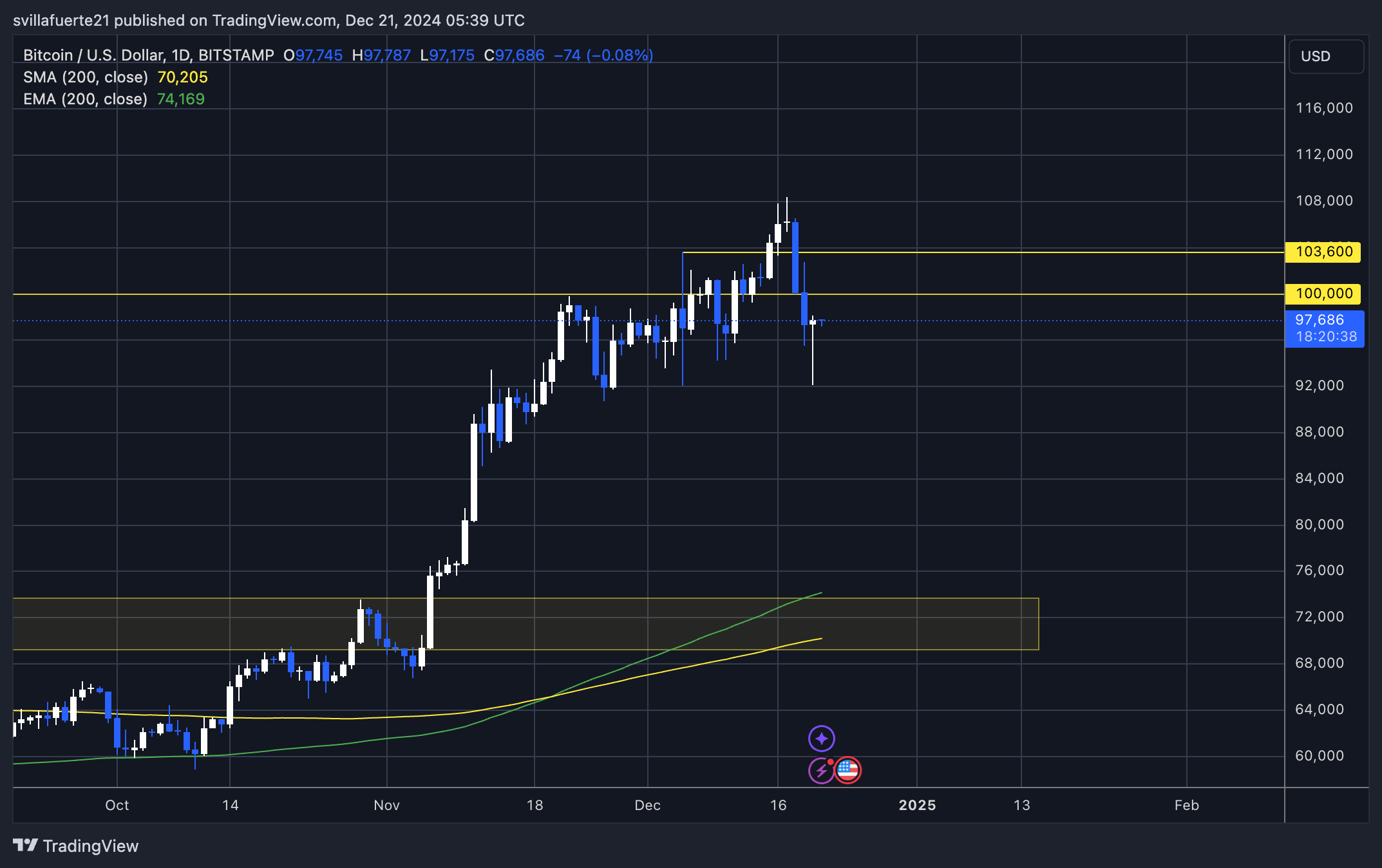

At present, Bitcoin is being exchanged at approximately $97,600. After experiencing a steep decline from its record high, it has bounced back somewhat from the crucial $92,000 support point. This latest price fluctuation underscores the market’s ongoing volatility as investors navigate changing opinions and technical indicators. Although there has been some recovery, Bitcoin now faces a substantial hurdle in maintaining its positive trend.

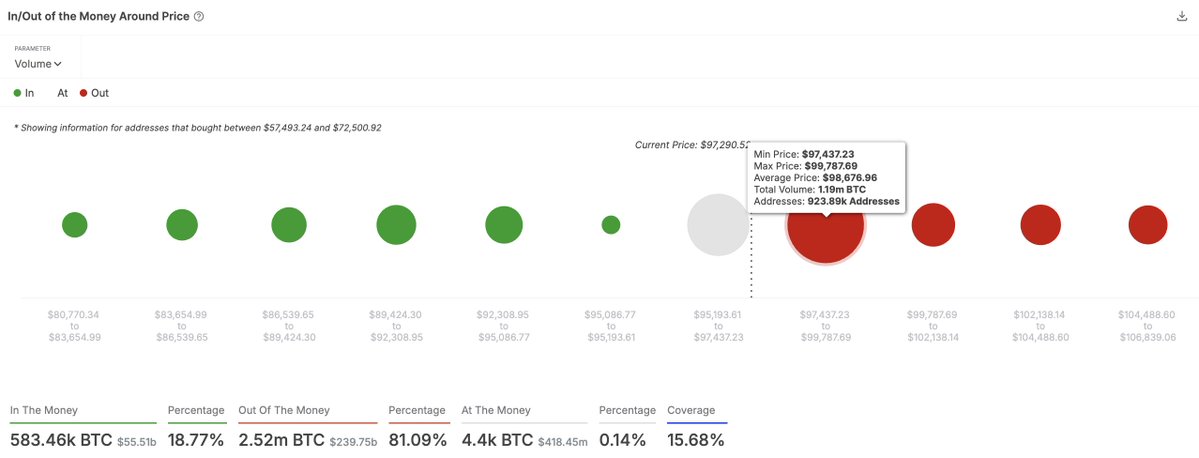

Analyst Ali Martinez presented striking evidence showing that Bitcoin faces a significant obstacle priced between $97,500 and $99,800. This barrier, comparable to a solid wall, is supported by the actions of approximately 924,000 wallets that together bought over 1.19 million Bitcoins within this range. The robust resistance from these on-chain activities could potentially prevent Bitcoin from regaining the psychological $100,000 mark in the short term.

In simple terms, whether Bitcoin surpasses this significant barrier or not will significantly influence its future direction. If it manages to break through, there’s a possibility of another price surge. However, if it fails, we might witness increased selling and a possible retest of lower price levels for support. As the market monitors this crucial stage, attention is focused on important technical and on-chain indicators to decide if Bitcoin’s recovery is long-lasting or if a bigger correction is imminent.

Bitcoin Holding Strong

Over the last few days, Bitcoin has seen significant ups and downs in value. After a 15% drop, it quickly rebounded by 6% within just three days. This quick shift shows how volatile the market currently is, as Bitcoin seems to reflect the overall uncertainty. Even with all this market turbulence, there’s increasing optimism among analysts about Bitcoin’s future prospects, as its swift recovery from yesterday’s intense selling took only a few hours.

Martinez provided crucial information about X, illuminating a substantial barrier area where Bitcoin is expected to encounter resistance, currently estimated to be between $97,500 and $99,800. According to her analysis, this region functions much like an immovable obstacle for Bitcoin’s continued upward movement.

Approximately 924,000 digital wallets have accumulated more than 1.19 million Bitcoins at these price points, creating a significant blockade that might hinder Bitcoin’s continued rise in value.

If Bitcoin successfully moves beyond the significant barrier, it might pave the way towards new record highs. On the flip side, if it fails to breach this level, there could be an escalation of selling activity and continued consolidation below $100,000. At present, Bitcoin continues to show strength, maintaining its position despite market fluctuations, with analysts expressing a cautious yet hopeful outlook for another price surge.

Technical Analysis

At present, Bitcoin is being traded at approximately $98,200. This represents a robust rebound from the $92,000 milestone, which has demonstrated notable demand. The surge following the $92,000 price point suggests a powerful resilience in Bitcoin’s price movement, hinting at the possibility of increasing bullish trends over the coming weeks.

If Bitcoin (BTC) breaks through the significant $100,000 barrier in the near future, it may spark a substantial increase, possibly propelling the price to unprecedented peaks. This important psychological and technical hurdle is likely to ignite a strong wave of buying enthusiasm as investors and traders prepare for the next phase of the upward trend.

Despite the ongoing market instability, there’s a chance Bitcoin might move sideways rather than upwards or downwards. This could mean that Bitcoin may stay within its current peak and trough levels, suggesting a phase where investors are buying (accumulation) as the market adjusts following recent price fluctuations.

As an analyst, I find myself observing a robust base established by the $92,000 mark in Bitcoin’s price trajectory. The anticipation is palpable as we approach the $100,000 milestone, which many are viewing as the next significant hurdle. Time will tell if Bitcoin surges past this level or consolidates its position. However, the recent resilience of Bitcoin indicates that it’s gearing up for substantial price fluctuations in the immediate future.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- List of iOS 26 iPhones: Which iPhones Are Supported?

2024-12-22 00:04