As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market analysis and resistance levels. Based on the latest on-chain data shared by analyst Ali, the current resistance level for Bitcoin at $66,250 holds significant weight due to the cost basis of over 2% of all Bitcoin UTXOs being held there.

Aanalyst has outlined a potential scenario for Bitcoin to reach new peak prices (ATHs) once it surmounts the specified resistance level in its underlying network data.

Bitcoin On-Chain Data Could Suggest This Level Holds Major Resistance

Analyst Ali shared insights in a recent article on X about the current resistance points for Bitcoin based on its on-chain data. On-chain analysis determines the significance of support and resistance levels by considering the total quantity of cryptocurrency last transacted at those specific price points.

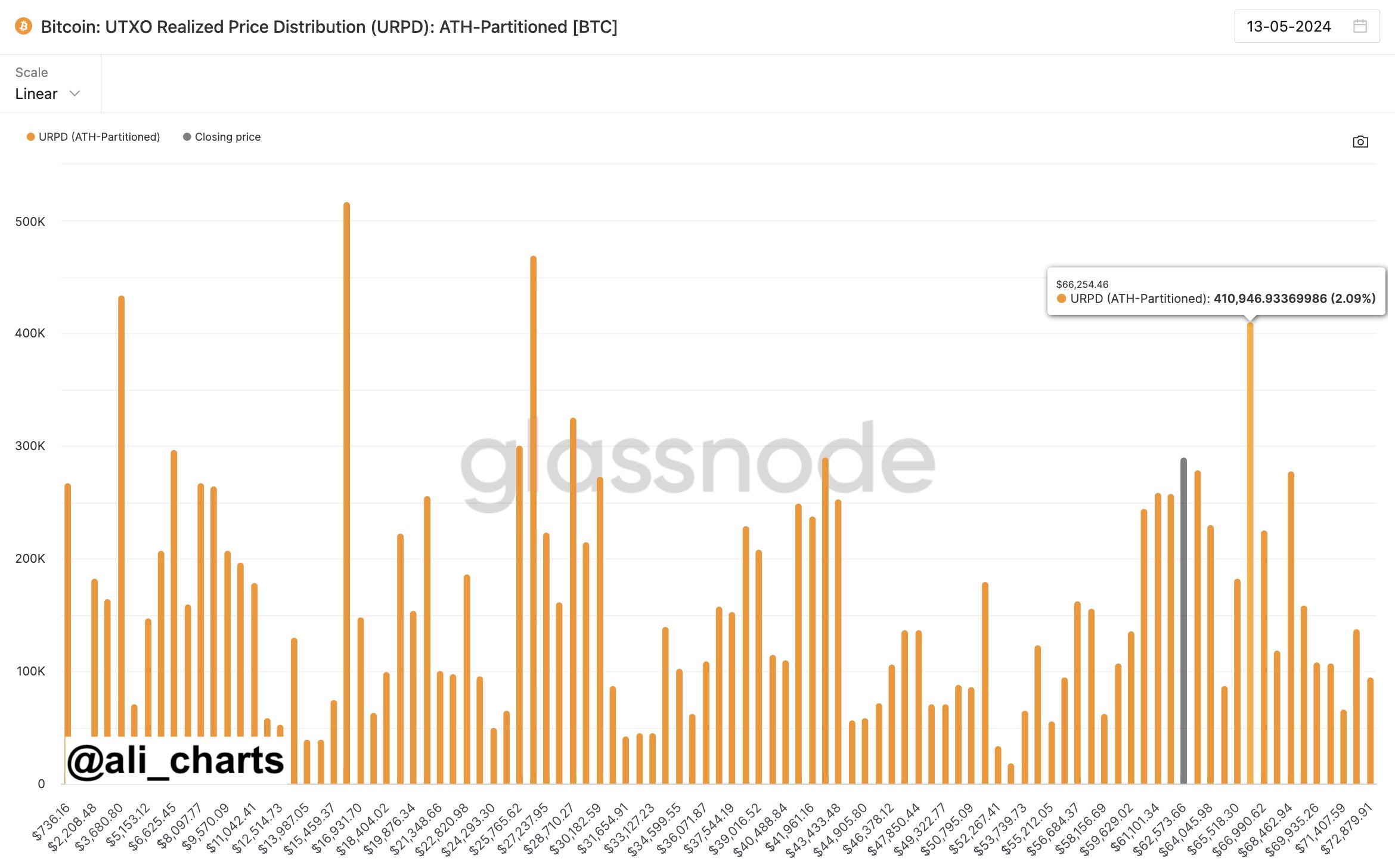

The following chart depicts Glassnode’s UTXO Realized Price Distribution (URPD), which illustrates the percentage of Bitcoin supply held at different price points based on when investors originally purchased their coins.

The graph clearly highlights that approximately 2% of all Bitcoin transactions outside the exchange (UTXOs) have a cost basis at the $66,250 mark.

As an analyst, I would explain that the cost basis holds significant importance for investors, and whenever it’s retested, there’s a higher probability of eliciting a response from them. This is due to the fact that a change in the cost basis can significantly impact their profit or loss status.

As an analyst, I would observe that if only a few investors have costs basis near the current spot price level, then a retest of this level may not elicit significant market reaction. However, if a large number of holders bought in at that price, the cryptocurrency could experience noticeable effects upon a retest.

For investors experiencing losses, the prospect of a potential retest can provide an opportunity to cut their losses and reach the point where they initially invested, known as the break-even point. Fearful that the asset’s value might decrease further, exiting at this stage could seem like the most prudent choice.

If I’m a crypto investor, I would interpret this as follows: When the price of Bitcoin approaches a level where there are many unspent transaction outputs (UTXOs), a retest of that level from below could trigger sell orders from investors holding those UTXOs. Consequently, these levels function as formidable resistance points for Bitcoin’s price advancement.

As a market analyst, I’ve noticed that a significant number of coins were bought at the $66,250 level based on historical data. Therefore, it may prove challenging for the cryptocurrency to surmount this resistance level and reach new heights.

As a crypto investor, I’d say, “Despite the current resistance, there’s a silver lining: The resistance levels beyond this point are not very strong. In fact, if Bitcoin manages to surmount this hurdle, we’re looking at fresh all-time highs!”

I, as an analyst, have come across an interesting discussion by market intelligence platform IntoTheBlock regarding on-chain cost basis distribution. According to their findings, approximately 10% of all crypto addresses purchased their coins between the current market price and the all-time high that was reached in March.

Approximately 10% of the entire address count on the Bitcoin network amounts to around 5.16 million addresses, which currently hold negative balances.

BTC Price

Bitcoin’s price remains within its current price bracket, hovering around the $62,800 mark at present.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-14 07:16