Ah, Bitcoin, darling! Just when you thought it had gone on a lengthy siesta, up it pops again, like a phoenix adorned in digital sparkles. The latest gossip? Our dear ex-president Donald has hinted at dialing back those oh-so-charming tariffs on China — one might even call it a truce in the tariff wars that’ve been dragging on since January 2025. Naturally, this whispered détente sent the cryptocurrency whales into a frenzy of purchasing, scooping up nearly 20,000 BTC like it’s the last canapé at a party. Exchange outflows have pirouetted to their highest crescendo in over two years. How delightfully dramatic!

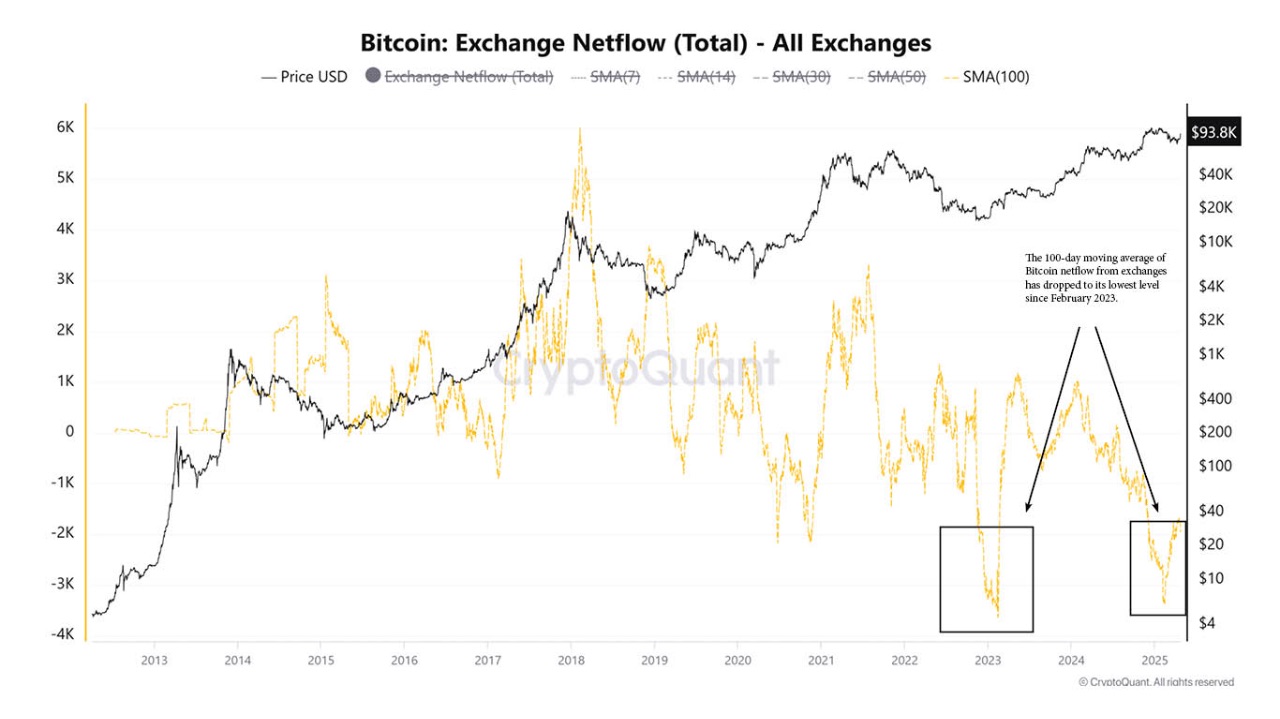

Exchange Outflows: The Bitcoin Ballet Returns to February 2023 Levels

Thanks to our ever-diligent on-chain snoop, CryptoQuant, we’ve discovered that Bitcoin’s exit stage left from exchanges is at a dramatic low, traced on a 100-day moving average — or, put simply, Bitcoin is playing hard to get, darling. The netflows have plummeted more precipitously than my spirits after a dreadful dinner party, down fifty percent from last year and even haunter than the mess left by 2023’s FTX collapse.

This slump in outflows blatantly suggests that Bitcoin holders have locked their treasure chests tight, choosing to accumulate rather than part ways. They’re stashing their digital doubloons somewhere safe, probably polishing their monocles and counting their coins in private. Patience, dear investors, the price might just pirouette upwards before the grand sell-off begins.

CryptoQuant, ever the party commentator, remarked, “This essentially indicates the highest Bitcoin outflow from exchanges since that date.” Translation? The whales are getting their flappers and tailcoats ready for round two of asset accumulation.

BTC Whales: The Jolly Bullish Gentlefolk Return

What’s behind this cheeky little surge? Well, it seems those bullish cetaceans saw a golden bargain and went on a whimsical shopping spree. Santiment piped in with the numbers — a rather sprightly 11% rise in Bitcoin coinciding with these heavyweights stacking their wallets faster than you can say “old sport.”

To put it mildly, investors clutching between 10 and 10,000 BTC fancied a spree, adding a jaw-dropping 19,255 coins last week alone. It’s as if they’ve decided Bitcoin was as undervalued as last season’s hats at Ascot, and so they rushed to snag the bargains before the crescendo.

At this very moment, the Bitcoin ticker languidly flirts with the $94,578 mark — a rather bold figure that shows our bullish whales have some serious staying power. One might say they’re the dandies of the digital currency ball, refusing to dance away just yet.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-04-26 17:34