As a seasoned analyst with extensive experience in the cryptocurrency market, I’ve seen my fair share of trends and patterns. The latest development in Bitcoin’s on-chain data is particularly intriguing to me.

Bitcoin whales have recently reduced their exposure to risks in derivative markets, as indicated by on-chain data, after the latest cryptocurrency market dip.

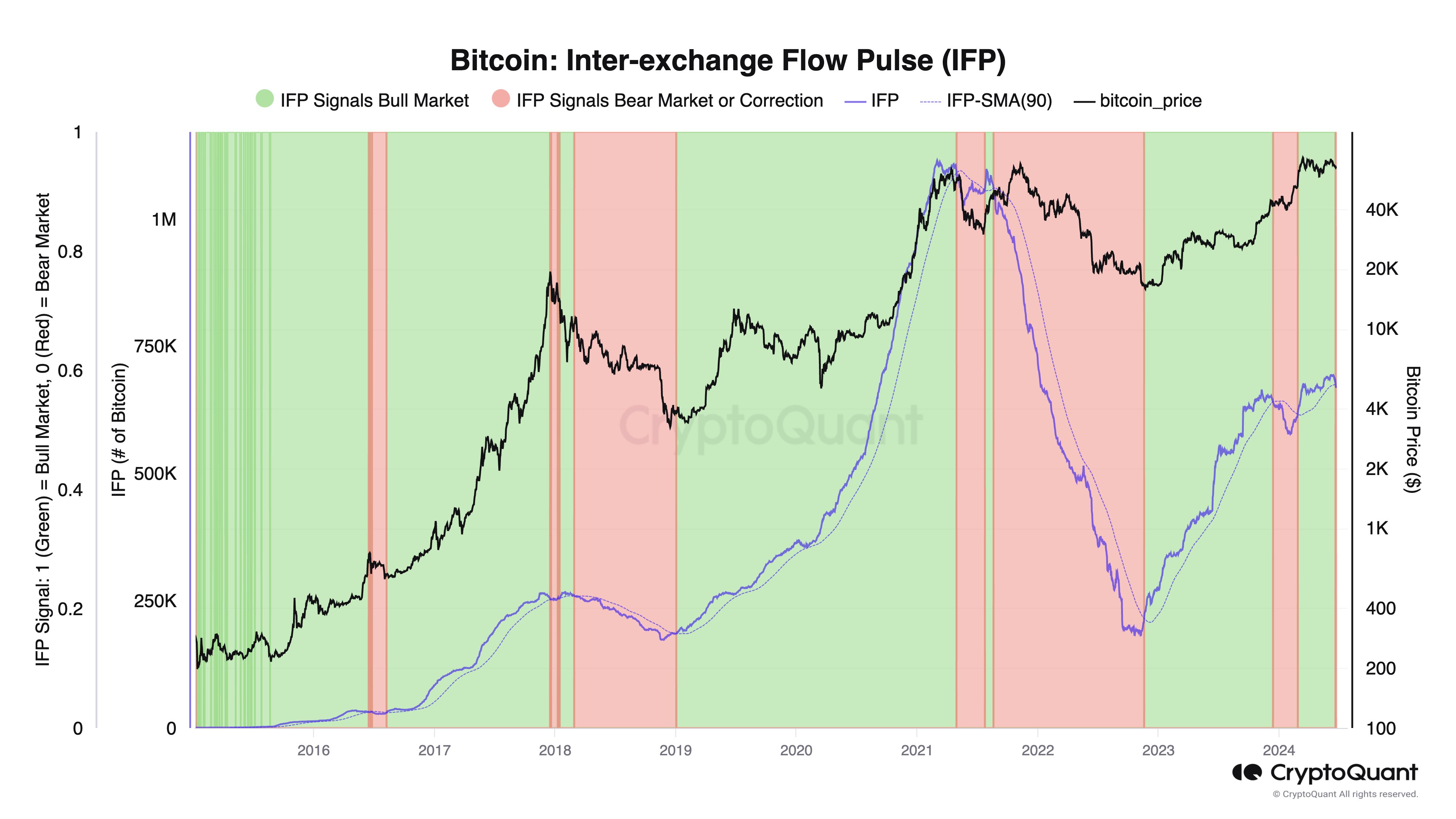

Bitcoin Inter-Exchange Flow Pulse Has Just Turned Red

In my role as a researcher studying the cryptocurrency market, I’ve been following the insights shared by Ki Young Ju, the founder and CEO of CryptoQuant. According to his recent post on X, the Bitcoin Inter-Exchange Flow Pulse has now turned red. This indicator, which I closely monitor, measures the flow of Bitcoin between spot and derivatives exchanges.

As a crypto investor, I’ve noticed an intriguing pattern: when the value of a specific metric increases, there seems to be a corresponding rise in the volume of cryptocurrency moving from spot markets to derivatives platforms. This trend suggests that substantial players like the “whales” might be planning to enter new positions within the derivatives market.

An opposite movement in the indicator implies that investors are moving fewer coins to deriveexchanges. This pattern might be indicative of waning interest in taking on riskier positions within the sector.

As a data analyst, I’d like to draw your attention to this chart depicting the evolution of Bitcoin’s Intraday Frequency Prices (IFP) and its corresponding 90-day Simple Moving Average (SMA) throughout the last ten years.

Based on the data presented in the given chart, I’ve noticed that the Bitcoin Interactive Fuel Price (IFP) had been trending upward earlier. However, it appears that the metric has undergone a change in direction lately, with the IFP now moving downward instead. After the most recent decrease, the indicator has dipped below its 90-day Simple Moving Average (SMA).

As an analyst, I’ve noticed historically that when the Intermarket Factor Model (IFP) crosses above its 90-day Simple Moving Average (SMA), it indicates a shift in market sentiment. A breakout above this line suggests that large investors, or “whales,” are ready to take on greater risk with the asset. This could potentially be a bullish sign for the market.

The chart indicates that a cross occurred approximately around the bottoms of the 2018 and 2022 bear markets. Conversely, a drop below the 90-day simple moving average tends to occur near market peaks, suggesting that large investors view derivative positions as excessively risky at those times.

If the indicator has crossed paths with this particular type again, there’s a chance that the asset may experience a downturn. This potential change in outlook might not persist for an extended period.

As an analyst, I’ve noticed that the Intermarket Favorite Index (IFP) dipped below its 90-day Simple Moving Average (SMA) back in January. This event occurred concurrently with Bitcoin’s price decline following the approval of the spot Bitcoin exchange-traded fund (ETF).

Despite the temporary downturn caused by bearish momentum, the cryptocurrency experienced a breakthrough and reached a new all-time high (ATH) shortly thereafter. In 2016, this asset underwent only a brief interruption in its uptrend following a crossover event before resuming its bull run.

It remains to be seen where this bearish Bitcoin IFP crossover will lead to this time.

BTC Price

Bitcoin hasn’t seen an end to its recent decline, as its price has now dropped to $61,200.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-06-25 07:02