After experiencing a drop in price below $90,000 earlier, Bitcoin ended the previous week with a strong price increase that translated into a net growth of 9.30%. This upward trend has been accompanied by substantial advancements within the network, as per Santiment’s report, which suggests positive signs for the leading cryptocurrency.

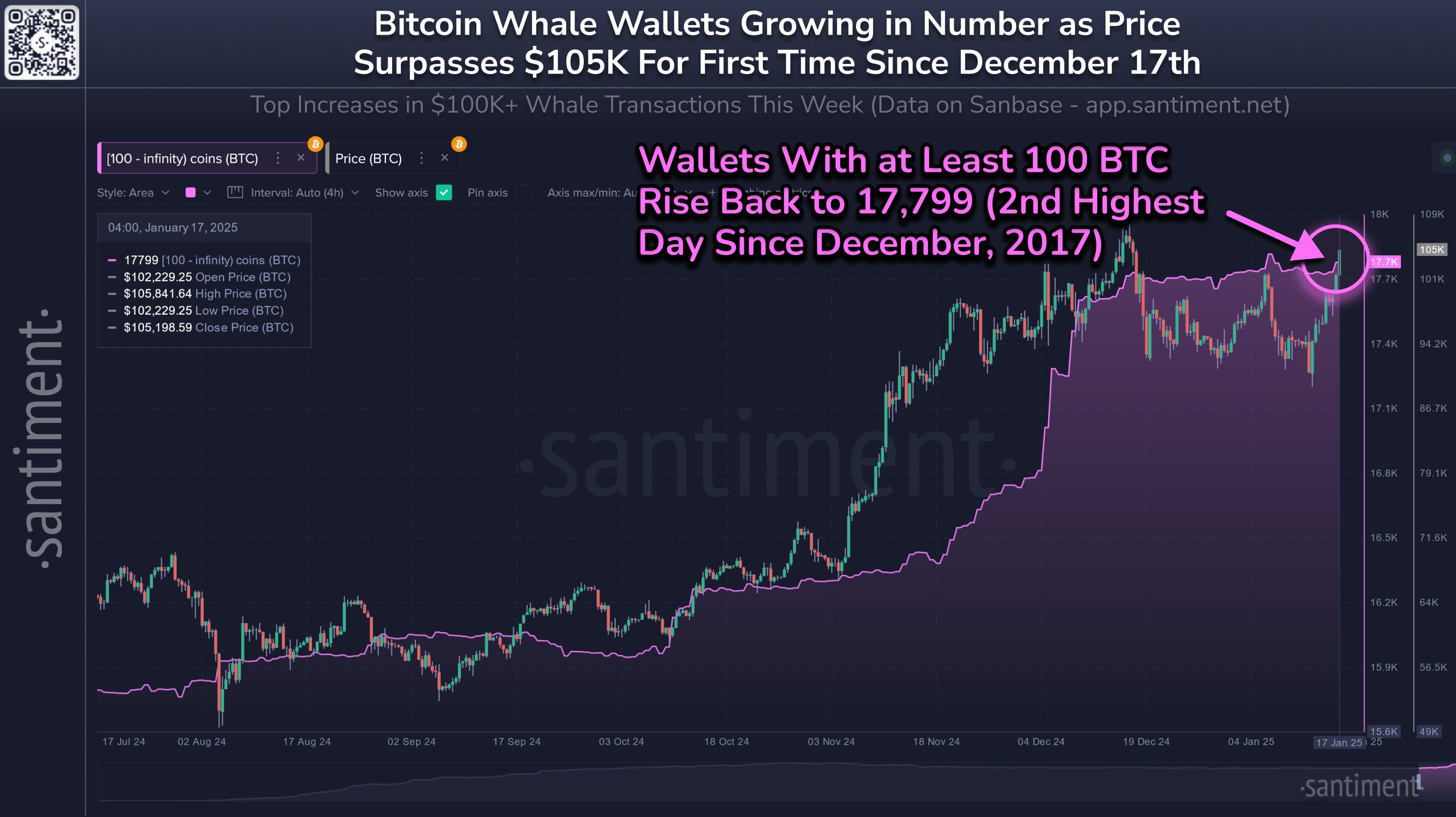

Bitcoin Whale Wallets Heading For 18,000

On their latest blog post about X, well-known blockchain analysis company Santiment shared real-time insights into the current Bitcoin market surge. It’s worth mentioning that Bitcoin had another strong week of gains, almost recovering entirely from its price drop in late December.

On Friday, the Bitcoin market showed a strong upward trend with prices jumping by more than 7%, peaking at $105,970. It’s worth noting that as Bitcoin approached its one-month high, the number of large Bitcoin wallets (holding at least 100 BTC) increased to 17,799, according to Santiment.

This growth is notably significant because an uptick in large Bitcoin holders (often referred to as “whales”) suggests they’re amassing more Bitcoin, which typically indicates a bullish trend. Given that this buildup is happening close to Bitcoin’s current record high of $108,268, it seems that major Bitcoin investors are quite optimistic about substantial price increases and potentially setting a new record price.

It’s noteworthy that this pattern aligns with the prevailing optimistic views about Bitcoin, fueled by several key factors, particularly anticipation for favorable cryptocurrency regulations in the U.S.

As Donald Trump’s inauguration draws near within just a few days, investors hold optimism that he will fulfill his pledges towards the cryptocurrency community, such as establishing a national Bitcoin reserve and repealing the Securities Act Bulletin 121 (SAB 121) policy, among other measures.

Furthermore, those who invest in Bitcoin (BTC) are optimistic about the successes of Spot Bitcoin Exchange-Traded Funds (ETFs), having achieved a remarkable $37.10 billion in total net inflow during their inaugural year. According to Nate Geraci, President of the ETF Store, these Spot Bitcoin ETFs could amass more net assets than gold ETFs by 2025. If this happens, it would result in substantial growth for Bitcoin both in terms of price and popularity.

BTC Price Overview

Currently, when this text was penned down, Bitcoin was being exchanged for approximately $104,174. This price increase came from a 3.19% rise in the past day. Moreover, it’s worth mentioning that the asset’s daily trading volume has also seen an uptick to around $65.88 billion, thanks to a 16.27% surge.

Attention investors: The Bitcoin relative strength index stands at 69.16, edging towards the overbought zone, suggesting a possible price reversal may occur soon. It’s also important to mention that Bitcoin holds the largest share in the digital asset market with a market capitalization of 2.06 trillion dollars, representing approximately 56.4% of the total crypto market cap.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2025-01-18 14:10