As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous cycles and trends that have shaped the investment landscape. The current Bitcoin cycle, however, presents a unique conundrum – the whales are holding on to their assets more than ever before.

2024 saw Bitcoin‘s price trajectory take an unpredictable course, even though it began the year promisingly. For much of the subsequent half-year, Bitcoin has been in a phase of consolidation, oscillating between roughly $50,000 and $70,000.

This lackluster showing has ignited discussions about the present phase, as numerous analysts and specialists ponder if the upward trend in cryptocurrency prices continues. Recently, even the head of CryptoQuant added his thoughts, providing a thought-provoking perspective based on on-chain analysis regarding the cycle.

Why Are Whales Taking Less Profit This Cycle?

In a post on the X platform, CryptoQuant CEO Ki Young Ju revealed that the Bitcoin whales have held onto their assets this cycle. As a result, the large investors have set the record for the least profit-taking compared to other cycles if the current bull run ends now.

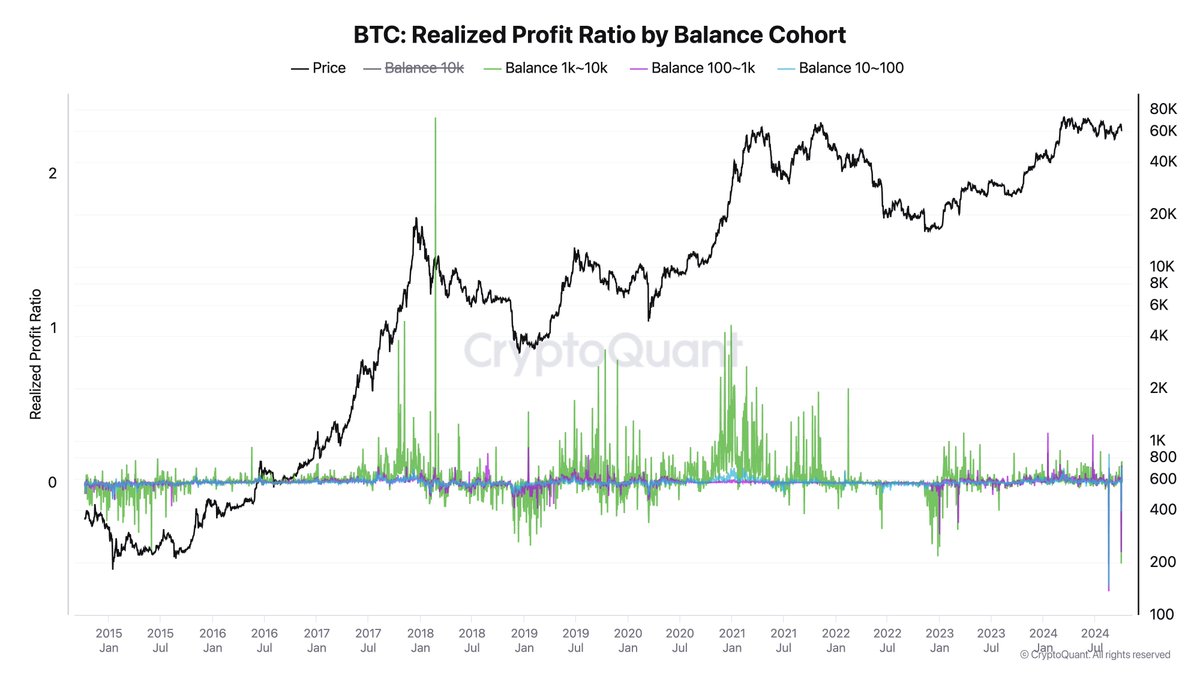

The information presented here is derived from the Realized Profit Ratio by Balance Cohort indicator, which calculates the proportion of Bitcoins sold for a gain by various investor groups compared to the total number of coins sold at a specific moment. In simpler terms, it assesses the profitability levels among different groups of Bitcoin holders at that time.

Generally speaking, when the Realized Profit Ratio of whales is significant, it usually means they’re in the midst of selling off since they think the prices have reached their maximum. Conversely, a low Realized Profit Ratio usually suggests minimal profit-taking, indicating that investors are either not cashing out or anticipating more price increases.

The current on-chain data points to a trend where the large holders have taken the least amount of profits across any bull cycle. This could mean that the Bitcoin whales still have faith in Bitcoin’s long-term potential. Ultimately, this suggests that the current bull run is far from the end, and there is the possibility of the Bitcoin price uptrend resuming.

Bitcoin ‘Dolphin’ Addresses On The Rise Again: Santiment

On X’s latest post, Santiment disclosed a trend: The group of Bitcoin investors, known as “Dolphins” (those with between 0.1 to 10 BTC), have experienced consistent growth over recent months. According to their analysis, these investors predominantly cashed out for profits during the first half of the year.

Since early July, there’s been an increase in the number of Bitcoin addresses holding between 0.1 and 10 BTC. More specifically, we’ve seen a rise of around 25,671 additional addresses for those with 0.1 to 1 BTC, and approximately 4,000 more addresses for those with 1 to 10 BTC.

It seems like small-scale investors are making their way back into the market, which could potentially boost the value of Bitcoin over the next few months. At present, Bitcoin’s worth stands at approximately $61,940, representing a 1.7% rise compared to the previous day.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-05 19:16