As a researcher with extensive experience in the cryptocurrency market, I find the recent decrease in Bitcoin whale activity to be an intriguing development. While it may initially seem like a bearish sign, the situation is more complex than it appears.

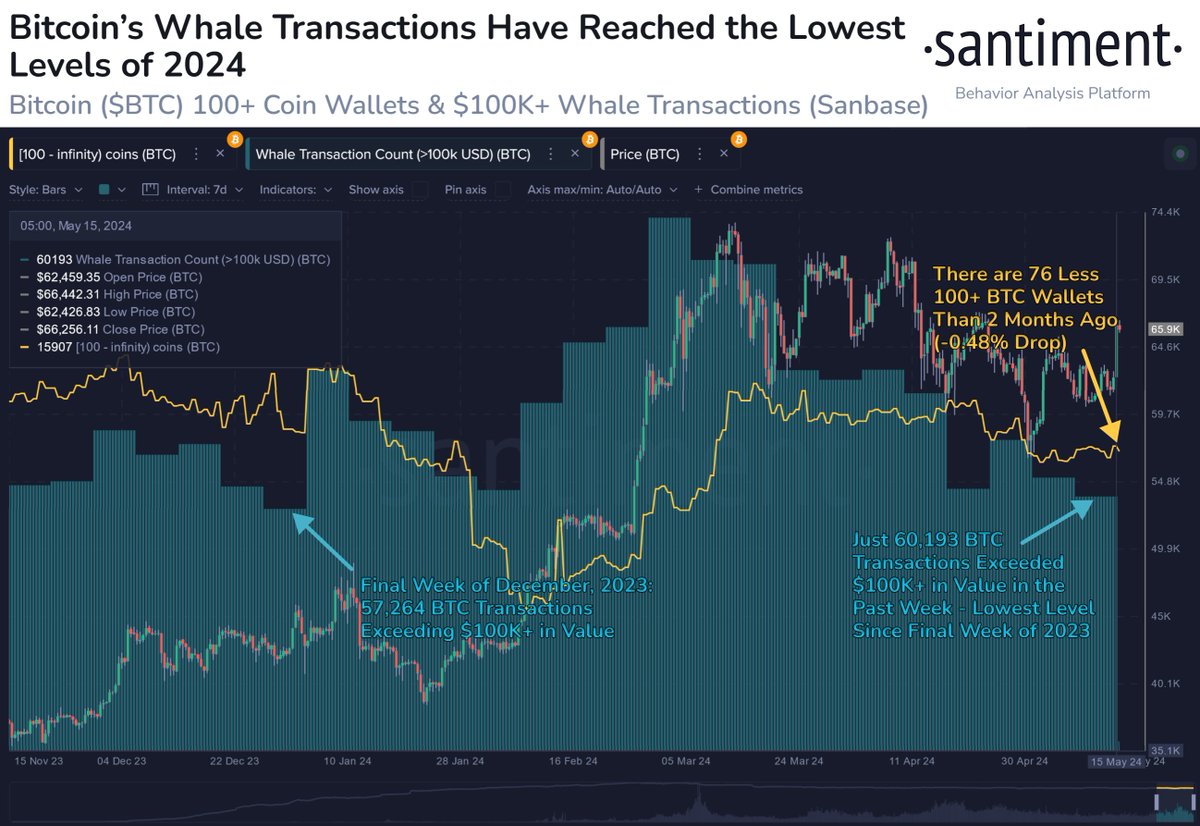

According to Santiment’s latest findings, Bitcoin whale transactions have significantly dropped, hitting their lowest point in 2024. This decrease suggests that major Bitcoin investors, referred to as whales, have been reducing their trading activity.

Although this may indicate a downward turn, the intricacies of the cryptocurrency market reveal a multifaceted scenario.

As a seasoned crypto investor, I’ve noticed that whale activity has taken a dive lately. However, this doesn’t seem to have significantly impacted the total number of Bitcoin wallets holding at least 100 coins. Currently, there are approximately 11.79 million BTC stashed away in 15,907 such wallets.

Previously, heightened involvement from major Bitcoin investors has frequently signaled impending price fluctuations in Bitcoin. However, at present, these investors are relatively inactive. The uncertainty lies in what this lull could portend for the market’s future prospects.

Analyzing Whale Activity: What This Means For Bitcoin

A decrease in whale involvement might at first seem to signal reduced price instability for Bitcoin. However, the actions of these major investors can significantly influence Bitcoin’s value, leading to unexpected and sudden price changes.

As an analyst observing the Bitcoin market, I’ve noticed that despite the presence of over 100 large-scale Bitcoin wallets, collectively holding approximately 11.79 million coins, whale activity has reached its lowest point in 2024. Specifically, there are now around 15,907 wallets containing at least 100 Bitcoins each. A potential bullish indicator would be the increase in this number.

— Santiment (@santimentfeed) May 16, 2024

As a crypto investor, I’ve noticed that the absence of large whale players in the market could result in increased stability and predictability for the near future. This is because their diminished presence reduces the impact of significant buy or sell orders. However, this newfound stability might clash with the traditional trading dynamics of cryptocurrencies, where volatility usually presents lucrative opportunities for traders to capitalize on price swings.

Additionally, the retention of Bitcoin by these whales is indicative of a bullish outlook. Their decision to keep their Bitcoins instead of selling implies that they believe in its future value appreciation and are confident in holding onto their investments.

The price of Bitcoin currently standing at over $66,000 further strengthens this viewpoint, representing a roughly 5% rise in value during the last seven days.

Indicator Shows Further Surge Ahead

As a crypto analyst, I’ve been keeping a close eye on the latest developments with the Bitcoins Volume-Weighted Average Price (VWAP) Oscillator. This valuable trading indicator calculates the average price of an asset by considering both price and volume over a specified time frame. Willy Woo, a renowned figure in the crypto community, recently delved into the trends emerging from this oscillator.

As a crypto investor, I would focus on analyzing trading volume at various price points to gain a deeper understanding of market trends. By doing so, I can give greater importance to price levels that have seen significant trading activity, providing me with a more holistic perspective on the market’s behavior.

Woo’s findings indicate that the Bitcoin VWAP Oscillator has been below zero for an extended period, but it’s currently showing signs of recovery. If this uptrend persists, the oscillator may soon hit the zero mark, signaling a neutral position.

As a researcher studying the behavior of Bitcoin’s Relative Strength Index (RSI), I have observed that when this oscillator makes a transition from negative to neutral territory, it often indicates an approaching bullish phase based on historical data. This pattern has consistently been associated with significant price growth for Bitcoin.

Still a lot of room to run before reversal or consolidation.

Hate to be a trapped #Bitcoin bear right now.

— Willy Woo (@woonomic) May 16, 2024

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-17 22:16