As a seasoned analyst with over two decades of experience in financial markets, I find myself intrigued by the recent behavior of Bitcoin whales ahead of the 2024 US presidential election. The 2% decrease in the number of wallet addresses holding 1,000 or more BTC seems to indicate a cautious approach, possibly to mitigate potential price volatility tied to the elections.

It seems that significant Bitcoin (BTC) investors, often referred to as ‘whales’, might be choosing to sell a portion of their assets before the highly anticipated 2024 U.S. presidential election.

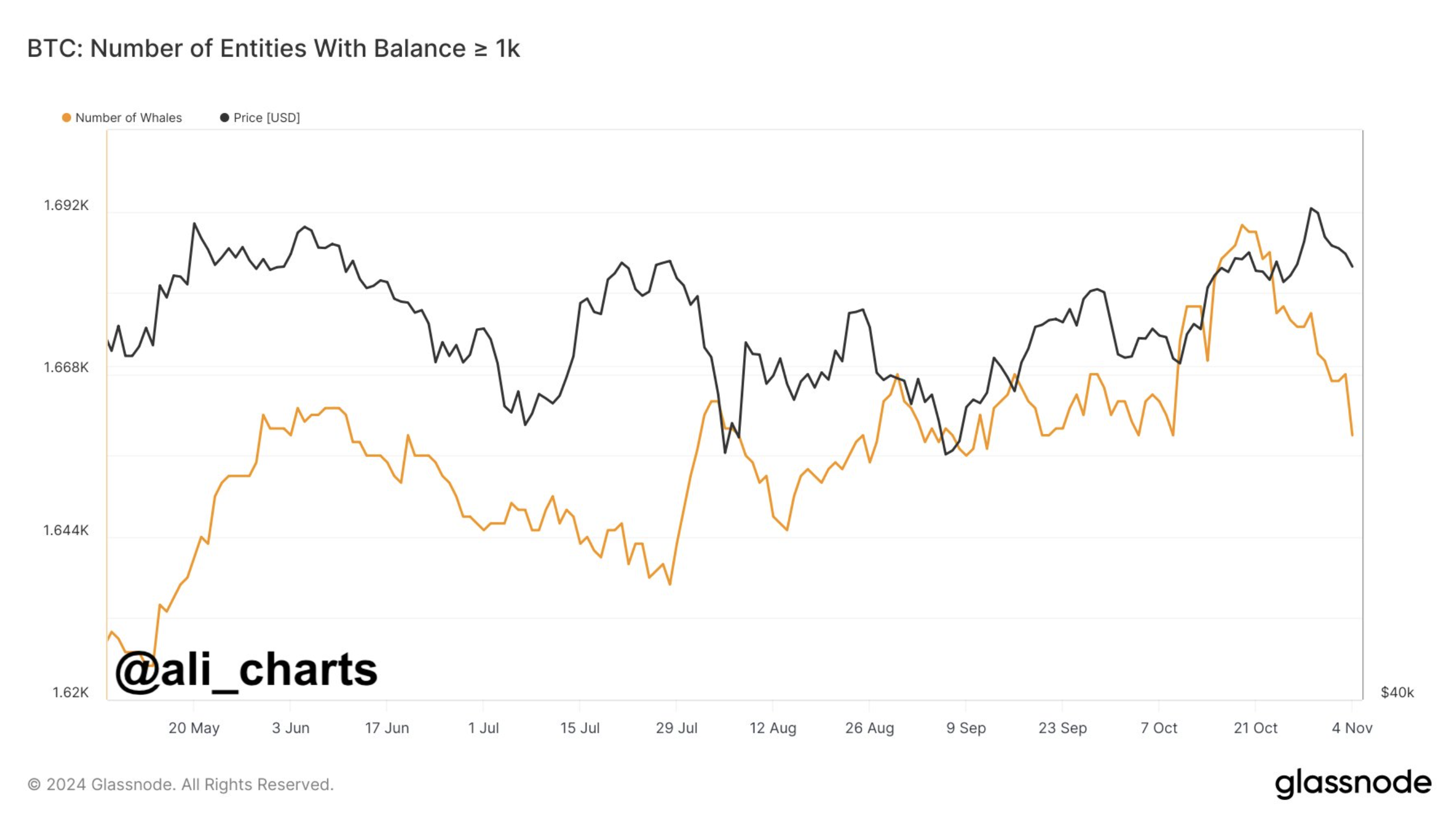

2% Fall In BTC Held By Whale Addresses

On platform X, cryptocurrency expert Ali Martinez posted an update stating that large Bitcoin holders (referred to as “whales”) are reducing their investment in Bitcoin prior to the upcoming tight US presidential race.

Based on the analysis, we’ve seen a reduction of around 2% in the count of Bitcoin wallets that have at least 1,000 BTC.

Significantly, from May up until mid-October, the count of significant Bitcoin holders (referred to as “Bitcoin whales”) reached a peak. This peak coincided with the time when Republican presidential candidate Donald Trump was considered most likely to win.

Currently, as we speak, the decentralized forecasting platform Polymarket indicates that Donald Trump stands approximately a 62.7% likelihood of being elected the next U.S. President, whereas Kamala Harris holds a roughly 37.4% chance in the race for the presidency.

Bitcoin’s large investors (often referred to as ‘whales’) dumping some of their Bitcoin might suggest a prudent strategy, aiming to reduce risk connected with the upcoming U.S. elections and any possible market fluctuations they could cause.

Bitcoin Whales Expecting Price Volatility?

The significant drop in Bitcoin’s price could indicate that major investors (Bitcoin whales) anticipate stricter regulations for digital assets after the elections, given the Biden administration’s allegations of a tough approach towards the digital assets sector. This apprehension may not be unwarranted.

Instead, throughout his campaign, Trump frequently pledged that if elected, he would strive to establish the U.S. as a global leader in cryptocurrency, dubbing it the “crypto capital of the world.

Beyond the recent whale-sized Bitcoin sales, it seems that long-term investors are offloading their assets. As per the latest reports, over 177,000 Bitcoins have been disposed of by these long-term holders within the past week.

Another scenario worth considering is that any further decline in whale addresses’ BTC holdings without a corresponding drop in price could indicate that retail investors are stepping up to buy the digital asset.

Significantly, there’s been a continuous increase in interest for Bitcoin among individual investors since September 2024. As per a recent study, the demand for Bitcoin by retail investors has climbed up by 13% over the past month, suggesting a change in the market’s risk tolerance from cautious to aggressive.

As an analyst, I’d like to highlight my observation regarding Bitcoin’s (BTC) Trend Directional (TD) sequential on the 12-hour chart. It appears to be indicating a potential buy signal at this time.

To put it simply, for those new to this concept, TD Sequential is a tool employed in market analysis that helps pinpoint possible moments when prices might be nearing an end, as well as potential shifts from one trend direction to another within financial markets.

That said, a Trump victory might not be the silver bullet for Bitcoin’s tumbling price, as it is critical for the top digital asset to hold the $68,000 support level to avoid slipping to $63,000. At press time, BTC trades at $69,595, up 1.3% in the past 24 hours.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

2024-11-06 15:04