As a seasoned crypto investor with a decade of experience under my belt, I find the current Bitcoin market dynamics intriguing. The revelation by Ki Young Ju that Bitcoin whales are holding back on taking profits suggests a unique perspective in this cycle compared to previous ones.

Ki Young Ju, founder of CryptoQuant’s on-chain analytics platform, disclosed an unusual behavior by Bitcoin whales regarding profit-taking. It appears that these large investors may think the bull market is still not at its end, explaining why they haven’t cashed out as much profit as they have in past bull markets.

Bitcoin Whales Have Taken Lesser Profits In This Market Cycle Than Past Ones

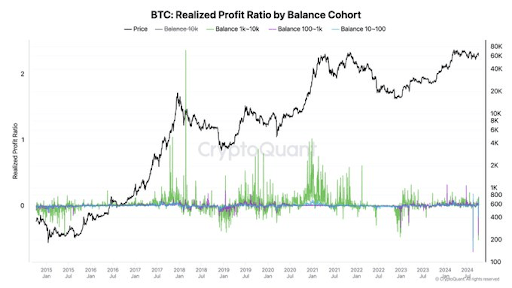

Ki Young Ju mentioned in an X post that if the Bitcoin bull cycle were to end here, it would mean that Bitcoin whales have just set the record for the least profit-taking across all cycles ever. Crypto analyst Ali Martinez tried to counter Ki Young Ju’s point by highlighting how these whales have been distributing their BTC across different addresses, leading to a drop in the number of addresses holding between 1,000 and 10,000 BTC.

In a recent assertion, the founder of CryptoQuant argued that this cycle’s return rate remains the lowest among all cycles, regardless of how much the large investors (whales) have sold through various wallets. Moreover, he hinted that these current sellers are likely new whales with less experienced hands, as they seem to be selling at a loss.

In summary, Ki Young Ju pointed out that not every transaction mentioned by Martinez can necessarily be classified as a sale. Instead, he emphasized the importance of examining broader, accumulated data over time, such as past realized profits, for a more comprehensive understanding, rather than focusing solely on individual transactions.

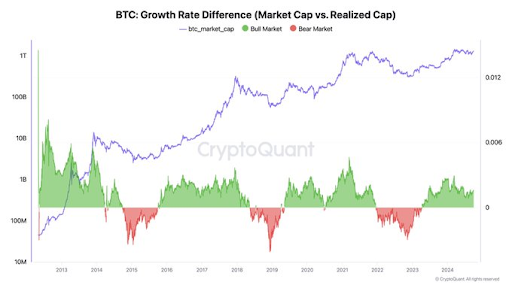

It seems that these whales might not be cashing out their profits just now, as the prolonged bullish trend in the cryptocurrency market appears to still be ongoing. Previously, the CEO of CryptoQuant had suggested that Bitcoin was still in the midst of a bull run, using the market cap to realized cap ratio as an indicator.

Rather than cashing out their Bitcoin, these major investors (Bitcoin whales) continue to amass even more BTC, preparing for an anticipated further escalation in the bull run. CryptoQuant has highlighted a significant increase in withdrawals from exchanges, the highest since November 2022. Furthermore, Ki Young Ju pointed out that the rate at which new whales are accumulating is unprecedented, as the market has never seen such rapid growth before.

When Is This Market Cycle Expected To Peak?

Bitcoin market experts such as Rekt Capital forecast that the peak of the market might take place around mid-September or mid-October in the year 2025. Conversely, a recent report by CoinMarketCap suggests a possible alternate viewpoint, predicting that the cycle top could instead occur between mid-May and mid-June 2025.

The system observed that Bitcoin has surpassed past patterns, significantly so because it reached a fresh record high (peak) prior to the Halving event. CoinMarketCap suggests that this market phase is speeding up by approximately 100 days, implying that the next maximum could appear earlier than anticipated.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-05 20:46