As a seasoned researcher with a keen interest in cryptocurrencies and blockchain technology, I find the insights shared by CryptoQuant CEO Ki Young Ju particularly intriguing. The shift in the Realized Cap of Bitcoin whales, as highlighted by Young Ju, presents a compelling narrative about the evolving dynamics within the Bitcoin ecosystem.

The CEO of the on-chain analytics firm CryptoQuant has explained how the Bitcoin whales have been showing a shift in their Realized Cap recently.

New Bitcoin Whales Are About To Overtake Old Ones

In a new post on X, CryptoQuant CEO Ki Young Ju has discussed the recent trend in the Realized Caps of the new and old Bitcoin whales. The “Realized Cap” here is a model that calculates the total valuation of Bitcoin by assuming that each coin’s ‘true’ value in circulation is the price at which it was last transferred or sold on the blockchain.

In simpler terms, whenever a Bitcoin (BTC) is transferred for the last time, that’s when it changes hands, and the price at that moment can be considered its current cost basis. Consequently, the Realized Capital measure calculates the total investment made by investors in BTC, meaning it tracks the overall capital invested into Bitcoin.

In the given conversation, we’re focusing on specific types of ‘Realized Cap’ – these are found in only two sections of the market: the newly-arrived and established ‘whales’.

short-term holders (or new whales) and long-term holders (or old whales). The distinction is made based on age, where those who have acquired their coins within the last five months fall under the short-term holder category, while those who have held for longer periods are known as long-term holders.

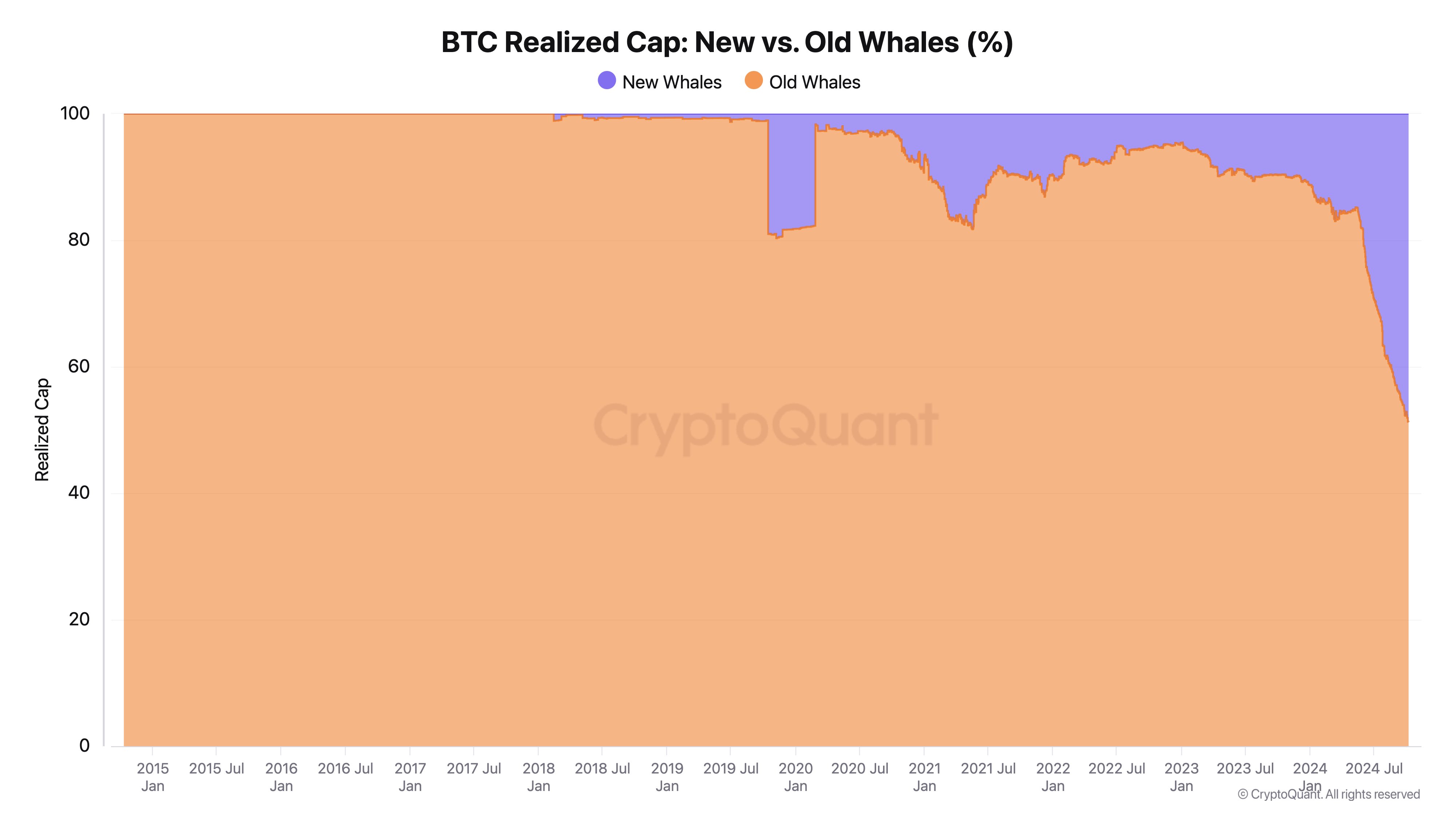

Here’s a graph illustrating the changing proportions of Realized Capital contributions from these two Bitcoin communities over time.

According to the graph, the total amount of Bitcoin held by new ‘whale’ investors (those with significant holdings) wasn’t substantial before 2018, suggesting that experienced capital had a dominant role in the network. However, since 2018, the influence of this group has been growing steadily, as shown by an increase in their percentage control over the network.

This year, the Realized Cap of this group has significantly increased, reaching a staggering $108 billion. Interestingly, the measure stands at $113 billion for the older investors, indicating that the gap between the two is nearly negligible.

According to Young Ju’s observation, there appears to be a significant change in the ownership of large amounts of Bitcoin among generations, with the emerging generation of whales expected to hold more Bitcoin than their predecessors in the near future.

It seems that the rapid increase in the total value held by new cryptocurrency whales might be due to a decrease in investments flowing into spot exchange-traded funds (ETFs).

BTC Price

At the time of writing, Bitcoin is trading at around $62,200, down more than 2% over the past week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-09 16:16